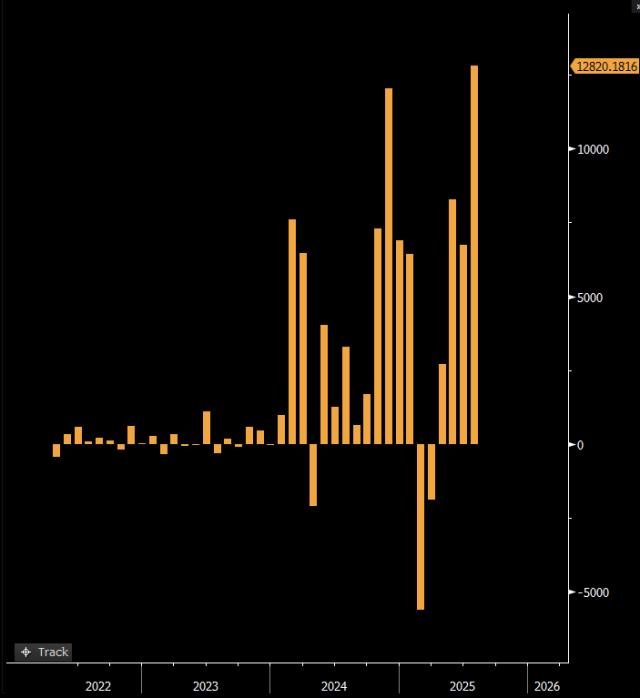

Ethereum Classic has experienced periods of extremely high liquidations, where substantial amounts of leverage are unloaded at the same time. Liquidations occur when leveraged traders cannot withstand price movements against them and get washed out in a manner that might add periodic downward pressure on price as large sums of ETC are sold over short timescales. This gives the liquidations a very significant effect on the price of ETC, making it much more volatile and, at times, pushing its price to unexpected lows.

Given such a high volume of liquidations, ETC faces an immediate price drop from the pressure of selling enforced by the liquidation. The further effect is additional liquidations on over-leveraged traders, forming a vicious cycle of lowering prices. This ripple effect is more noticeable in times of uncertainty with the market or even any extraneous factors that come as regulatory changes and increase the selling pressure.

Nevertheless, liquidations are not necessarily a bad long-term occurrence. For fearful investors, these troughs could be a time to buy because the selling pressure dries up after the first wave of liquidation. New buyers could be attracted at these lower prices that may nurse ETC back to greater health if the underlying fundamental reasons for Ethereum Classic holding its own remain in place and sentiment improves.

For those into Ethereum Classic predictions, this is important because market sentiment and other external factors which may result in mass liquidations need to be monitored. On the whole, the investor can better enjoy these turbulent periods with a higher sense of awareness of the general market condition and wise leverage management. Thus, knowledge of the dynamics behind the liquidation goes a long way in explaining the price movement of ETC in relation to the investor decisions being made.

Tracing expert analysis will provide additional information about the predictions around Ethereum Classic and how it is priced in the market.