Bitcoin [BTC] and Ethereum [ETH] have performed well recently, with the former reaching a new all-time high. While these two top currencies remain closely watched, BTC and ETH have set their sights on new targets - $100,000 and $4,000, respectively.

But which cryptocurrency has a brighter future?

Bitcoin takes the lead!

As mentioned, Bitcoin reached an ATH in November 2024. In contrast, ETH's ATH was set during the cryptocurrency bull market in November 2021.

Although many expected the ETH 2.0 upgrade to turn the tide, this has not been the case. Nevertheless, ETH appears poised to set a new all-time high in the coming months.

With BTC reaching a new high recently, more BTC investors have profited. According to IntoTheBlock data, 98% of Bitcoin addresses are "in the money," while this figure is 88% for ETH addresses.

Another aspect of Bitcoin's clear advantage is its dominance. AMBCrypto found that although BTC has declined, its dominance remains far higher than ETH.

Specifically, while Bitcoin's dominance has remained above 56%, ETH's dominance has slightly declined in the past 24 hours, standing at 12.8%.

Which indicators suggest...

Looking ahead, both cryptocurrencies face challenges. For example, Bitcoin's NVT ratio has risen. A similar uptrend has appeared on ETH's chart. This suggests that both cryptocurrencies are overvalued, implying a potential correction in the short term.

However, a favorable indicator for BTC is exchange balances. While ETH's balances have increased, Bitcoin's balances on exchanges have declined.

This means investors are still considering buying BTC, while ETH investors are selling. Generally, increased selling pressure leads to price corrections.

Given the rising selling pressure on Ethereum, a significant correction that pushes the Altcoin king to the $3.38 support level would not be surprising.

On the other hand, the rising buying pressure on BTC has pushed the token above the $96,000 resistance level. This suggests the king token may soon begin a rally towards $100,000, setting a new high.

Nevertheless, ETH investors should not lose hope, as ETH may surpass BTC by 2025. As the market gains a bullish momentum, some speculate a new Altcoin season in the coming weeks or months.

If this occurs, ETH may generate more profits for investors than BTC.

Bitcoin ETF and Ethereum ETF

When comparing these two cryptocurrencies, discussing their respective ETFs becomes crucial, as they are one of the most closely watched topics in 2024.

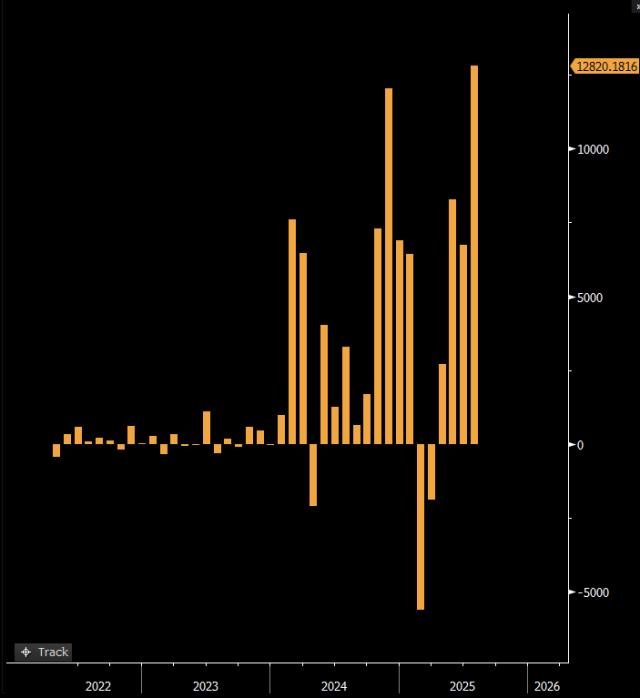

Interestingly, both cryptocurrencies have performed well in this regard. During the significant price increases in BTC and ETH, their ETF inflows have reached new highs. Specifically, on November 7th, the Bitcoin ETF inflow surpassed $1.3 billion.

Similarly, the Ethereum ETF inflow soared to a record high of $295 million on November 11th.

While these two cryptocurrencies have different use cases, they both possess strong market capitalizations. Time will tell which cryptocurrency outperforms the other in terms of market capitalization or profitability.