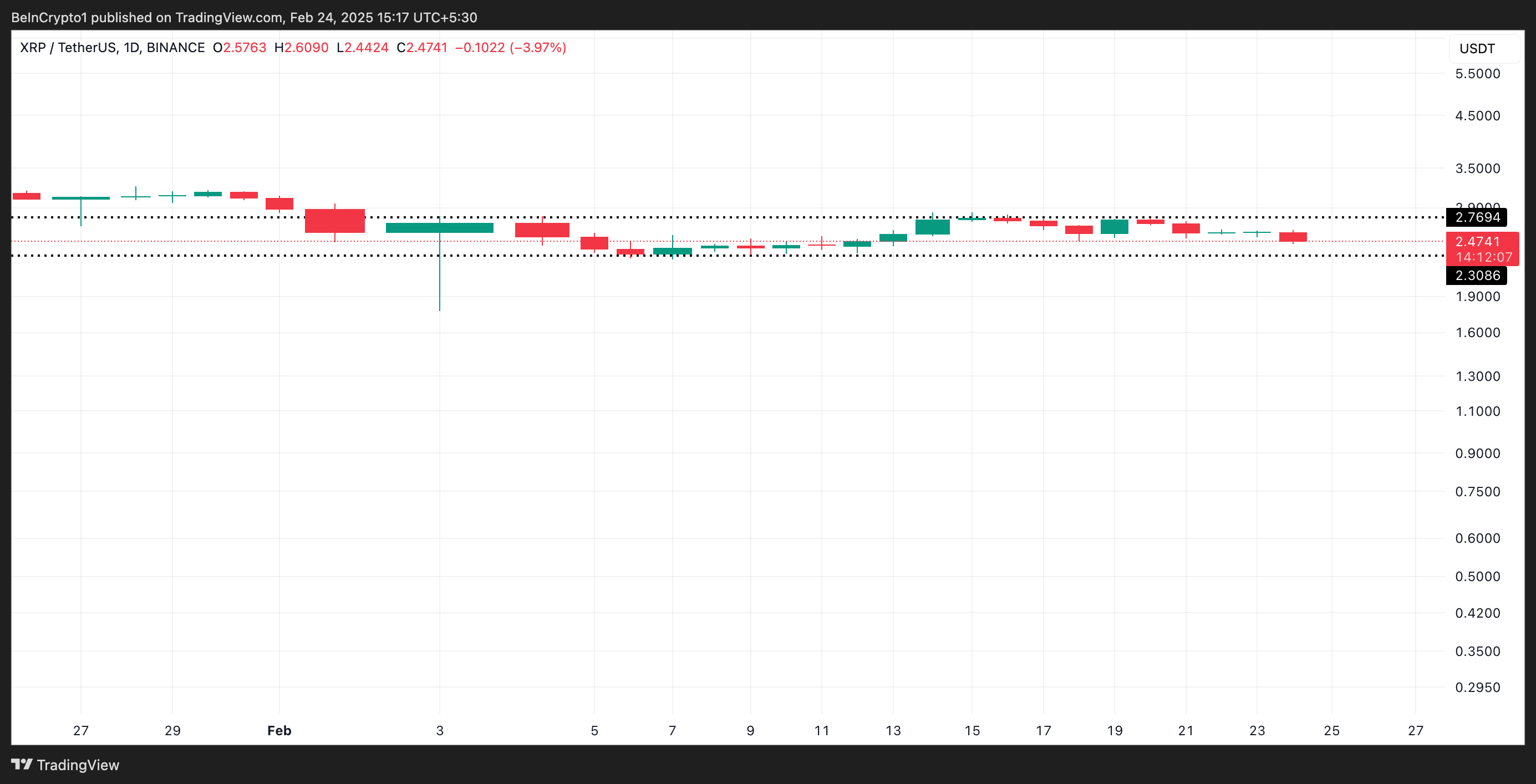

Since the beginning of February, the relative balance between buying and selling pressure has kept XRP within a narrow price range. It received strong resistance at $2.76 and support for the uptrend at $2.30.

However, technical indicators now suggest that this balance is likely to tilt in favor of the bears soon, setting the stage for a potential price decline.

XRP Struggles to Maintain Amid Selling Pressure

According to BeInCrypto's XRP/USD daily chart analysis, the token's price fluctuated between $2.76 and $2.30 from February 3rd. When an asset trades within such a range, the price moves between the established support and resistance levels, without breaking out in either direction, indicating a balance between buying and selling pressure.

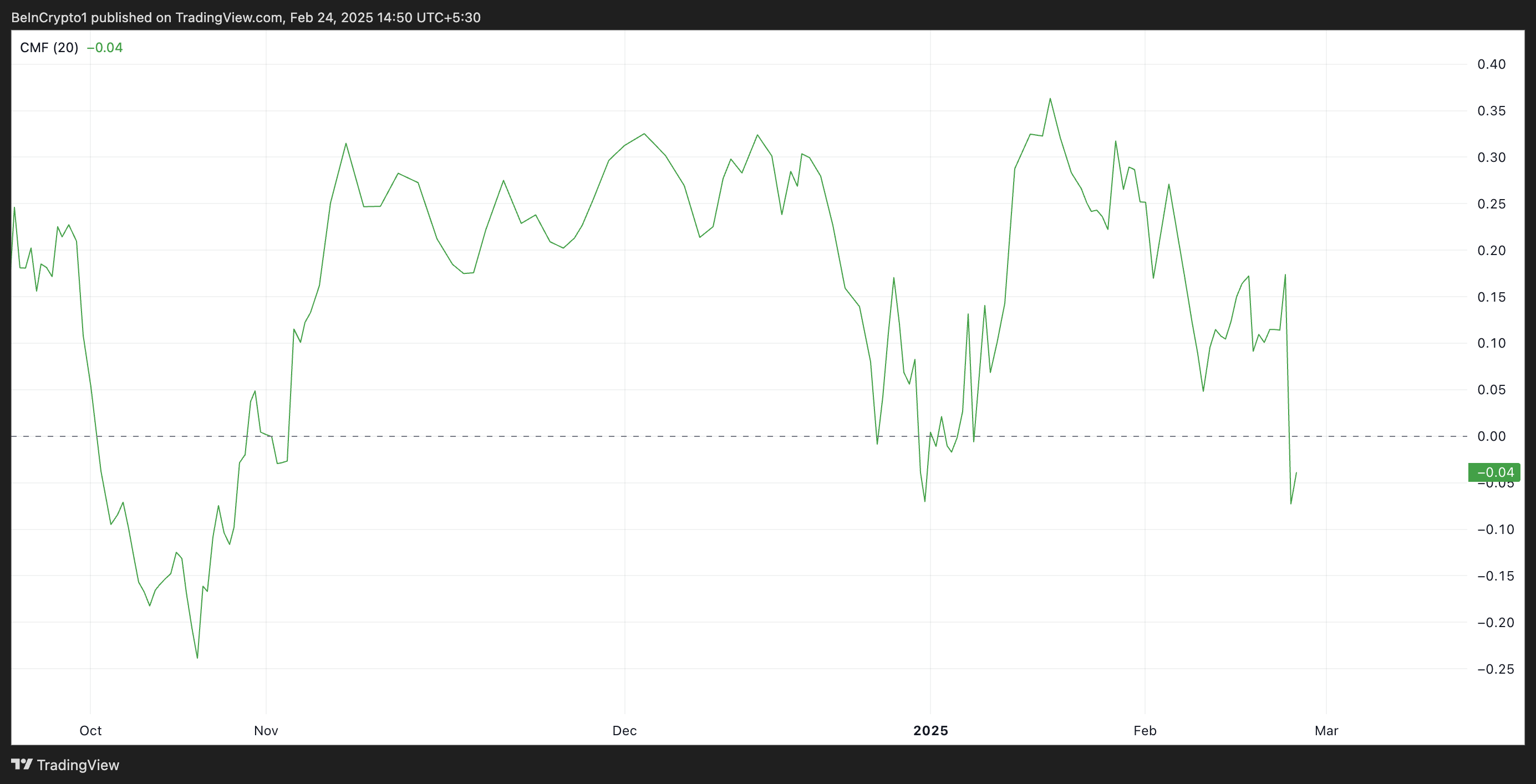

However, as the bearish bias on XRP strengthens, the $2.30 support level is likely to be breached in the near term. As highlighted by XRP's Chaikin Money Flow (CMF), the selling pressure is increasing. At the time of reporting, this indicator was at -0.04, below the zero line.

The CMF indicator analyzes the trading volume and price movement over a certain period to measure the inflow and outflow of capital into the asset. A declining CMF suggests that buying pressure is weakening, and capital is being withdrawn from the asset.

Similar to XRP, when an asset's price is in a range-bound movement and the CMF is negative, it indicates that the selling pressure is dominant, despite the sideways action. This means that traders are distributing the asset rather than accumulating it, even though the price has not yet declined.

This setup signals a potential bearish breakout, with the likelihood of a downward move increasing once the consolidation is over, due to the lack of strong buying interest.

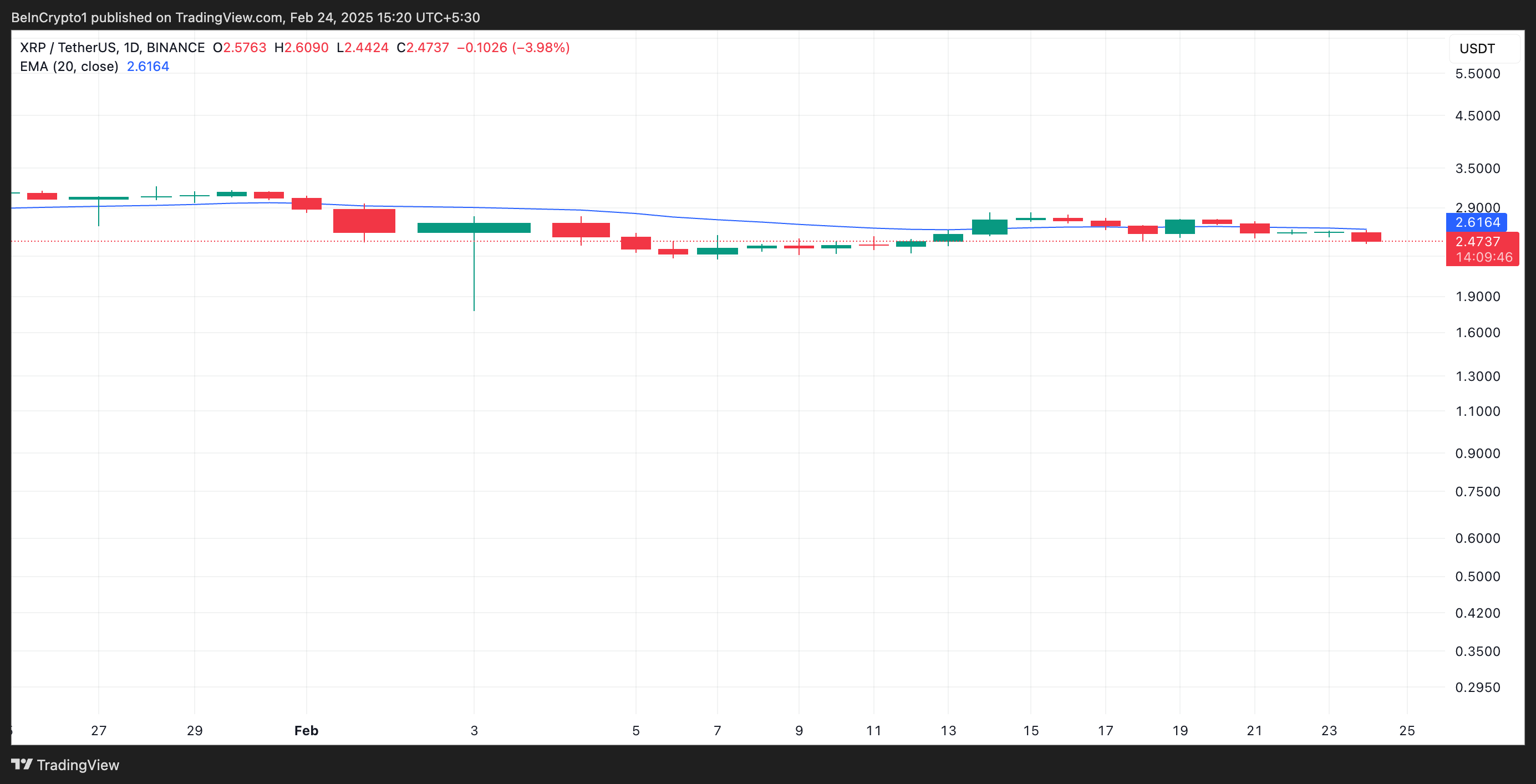

Moreover, this altcoin is currently trading below the 20-day Exponential Moving Average (EMA), confirming the increasing selling pressure in the XRP market.

This key indicator measures the average price of the asset over the past 20 trading days, with more weight given to recent price movements. When the price falls below the EMA, it indicates that the selling pressure is intensifying, signaling a potential shift to a downtrend. This suggests that the value of XRP may decline further.

Increasing Selling Pressure on XRP...Potential Decline to $1.48

A breakout below the $2.30 support level could lead to further downside for XRP. If the buying pressure fails to defend this level, the value of XRP could plummet to $2.13. If the selling pressure strengthens at this level, the decline could extend up to $1.48.

However, a strong resurgence in XRP demand could invalidate this bearish outlook. In that case, the token could break above the $2.76 resistance and target its all-time high of $3.41.