Crypto.com outflows reached $508 million last week. This represents the second negative flow in 2025. The outflows over the past 2 weeks have amounted to $925 million.

The outflows indicate that investor sentiment has shifted as they consider US economic events, trade tariffs, inflation, and uncertainty around monetary policy, following an 18-week rally.

Bitcoin hit hard... Altcoins rise

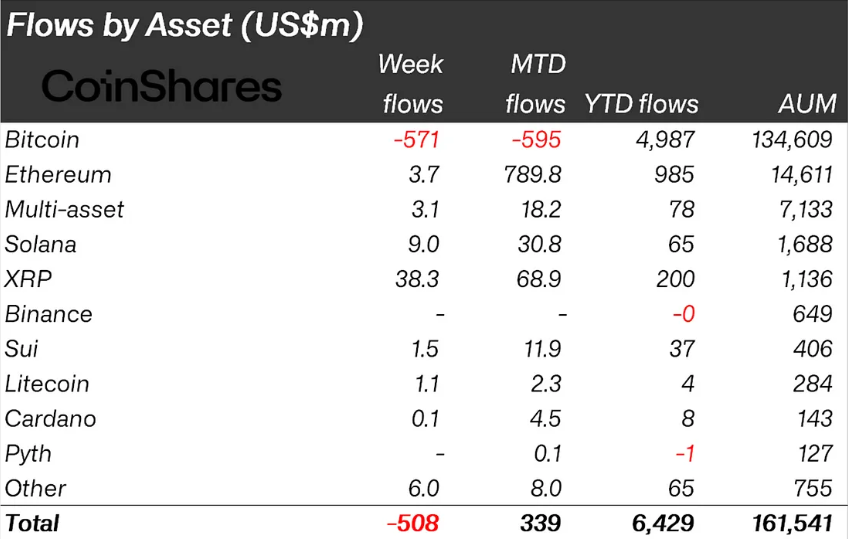

According to the latest CoinShares report, Bitcoin (BTC) saw $571 million in outflows as investors' attention waned. Additionally, some traders chose to increase their short positions, leading to $28 million in inflows into short-Bitcoin products.

This follows a similar trend to the previous week, where hawkish Federal Reserve comments and CPI data contributed to the first crypto outflows in 2025. CoinShares states that the recent outflow trend occurred as investors remained cautious amid continued digestion of US economic data.

"We believe investors are becoming more cautious in the wake of President Trump's trade tariffs, inflation, and uncertainty around monetary policy since his inauguration. This is clearly evident in trading volumes, which have declined significantly from $22 billion two weeks ago to $13 billion last week," an excerpt from the report read.

Geographically, the US accounted for the majority of the outflows, losing $560 million, emphasizing concerns over the country's economic policies.

Interestingly, while Bitcoin struggled, altcoins continued to show positive momentum. XRP led the way with $38 million in inflows, bringing its total to $819 million since mid-November 2025.

XRP's strong performance came amid growing expectations for a SEC decision on a XRP ETF. The SEC has started the deadline to approve or reject certain ETF applications. Investors are hopeful that XRP will gain regulatory clarity.

If approved, a XRP ETF could attract additional institutional investment and bolster the resilience of altcoins amid broader market uncertainty. However, XRP's surge also reflects investors' optimistic expectations that the US SEC will drop its lawsuit against Ripple.

Recent developments include the SEC's acknowledgment of Bitwise's XRP ETF application and the launch of an XRP ETF through HashDex in Brazil, which have fueled additional speculation.

Other altcoins also saw inflows, with Solana receiving $9 million, Ethereum $3.7 million, and Sui $1.5 million. This suggests that investor focus may be shifting from Bitcoin's digital gold narrative to altcoins with strong technical fundamentals and growth potential.

Meanwhile, this week's US economic data could have additional impact on this volatile market sentiment. As reported by BeInCrypto, Thursday's GDP and Friday's PCE inflation data could provide key insights into the Federal Reserve's policy direction.

As Bitcoin's sensitivity to macroeconomic uncertainty amplifies, unfavorable reports later in the week could exacerbate selling pressure. Altcoins appear to be benefiting from speculative interest and potential diversification strategies.

The divergence in investor sentiment between Bitcoin and altcoins suggests potential shifts in market structure, with some analysts already visualizing an altcoin season.