In February, the Libra scandal involving Argentine President Javier Milei shook the cryptocurrency sector. This incident enraged many Web3 members who claim that meme coins hinder the growth of the ecosystem and unfairly target small investors.

BeInCrypto spoke with Ray Chan, the CEO and founder of Meme.land, to discuss recent events surrounding the launch of meme coins and the future of the sector at Consensus Hong Kong.

From Libra Token to Meme Coin

The Libra meme coin scandal was unique in several ways. An anonymous group created a website for the "Viva la Libertad" project, inspired by a slogan frequently used by Argentine President Javier Milei.

This website is still active and has a mission to revitalize the Argentine economy by supporting small projects and local businesses. The Libra Token was launched as part of the project's strategy to raise funds.

According to the token distribution diagram, 50% of the tokens were intended to be used to promote Argentina's growth.

Within hours of the website going live, Libra Tokens were created on the Solana blockchain. Half an hour after the token launch, Milei posted his first X post.

"Free Argentina is growing! This private project will be dedicated to promoting the growth of the Argentine economy and supporting small businesses and Argentine startups. The world wants to invest in Argentina," the post read.

In the same post, Milei included links to the Viva la Libertad project website and the contract number of Libra, allowing investors to easily find and trade the cryptocurrency.

Soon, people began to realize that Libra was more akin to a meme coin than a token.

Meme Coins Face Pump and Dump Lists

Milei's social media posts triggered a sharp rise in token prices, with the market capitalization exceeding $4 billion within hours. This surge allowed insiders to cash out over $100 million in profits.

However, the rally did not last long. The meme coin had no tokenomics, the website was created just hours before launch, and over $87 million was cashed out in the first 3 hours. The token's value soon plummeted, revealing it as a typical pump and dump scam.

The scam sparked criticism, and Milei attempted to delete and retract his posts. The president admitted that he did not fully understand the project and decided to withdraw his support after learning more.

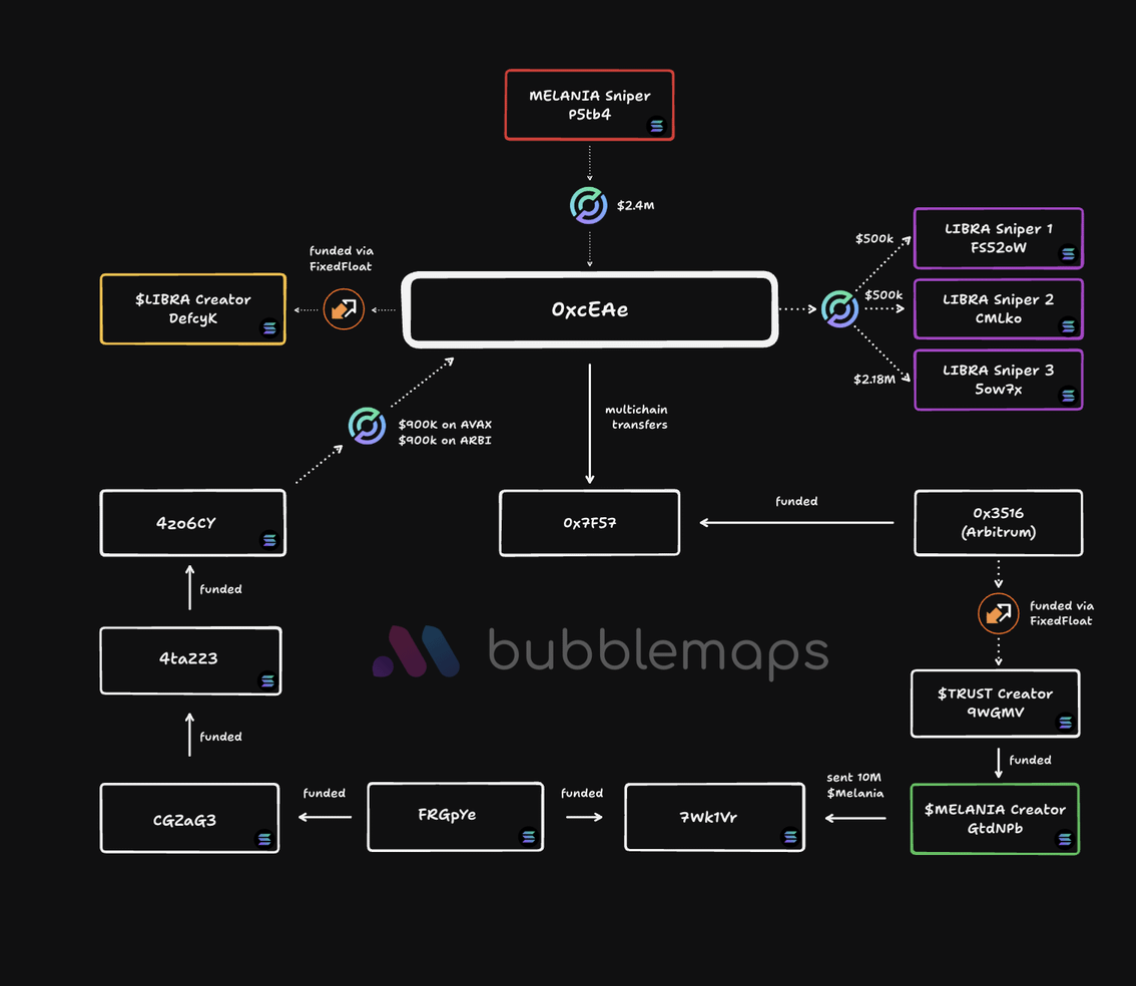

However, the damage was already done. A joint investigation by blockchain analytics firm Bubblemaps and on-chain researcher CoffeeZilla added salt to the wound.

The investigation uncovered evidence suggesting a connection between the Libra token launch team and the Melania Coin. Melania Coin was launched a day before Donald Trump took office as the US president.

The analysis confirmed allegations of insider trading and market manipulation in both cases. It also suggested that this group had led the launches of several other tokens, such as TRUST, KACY, VIBES, and HOOD, all of which ended in sniper scams and rug pulls.

Crypto Community Fatigued by Meme Coin Drama

In response to the scandal, members of the cryptocurrency community expressed their disappointment on social media. Some argued that meme coins benefit large insider traders while permanently alienating small retail investors from Web3.

"The crypto industry needs to engage in serious self-criticism if it doesn't want to end up as a meaningless circus. For years, the key players in the ecosystem have been creating narratives, inflating them, and then dumping tokens on retail investors to reap massive profits, pushing the masses away from this space. It's time to focus on creating value instead of constantly finding ways to quickly cash out at the expense of those trying to explore what this space is all about," said blockchain researcher Pablo Sabbatella.

For Meme.land founder Ray Chan, who has nearly 20 years of experience as a cryptocurrency expert in the meme coin industry, this incident needs to be analyzed from various perspectives.

It is well known that the meme coin industry is extractive. Many of these coins are primarily driven by community participation. Trading is generally speculative, and the market is inherently volatile.

"To me, it's very important to understand who is launching the token and what the token is for. If it's a meme coin, you should expect it to go to zero because, literally, I think most of these meme coins have no roadmap or utility mentioned. I think it's just for entertainment purposes. If you expect it to go to billions of dollars all the time, you're crazy. That's your responsibility," Chan told BeInCrypto.

However, the LIBRA scandal is different from insider events like the MELANIA Coin launch. When Milei shared his original X post, he said the funds would support small businesses and startups in Argentina.

Here is the English translation:"But at the same time, some Tokens, perhaps LIBRA, have mentioned that they are launching Tokens to support other companies and their goals. If they don't do that, I think it's a problem," he said.

When asked how to protect users from common practices in meme coin trading such as rug pulls, pump and dumps, insider activities, market manipulation, and snipping, Chan said these issues would become less frequent over time.

Meme Coin Industry in Early Stage

Meme coins have existed for just over 10 years. The "Doge" internet meme gained widespread popularity on social media in the mid-2010s.

Leveraging this trend, Jackson Palmer and Billy Markus created Dogecoin. It was launched as a cryptocurrency on the Bitcoin Talk forum in December of the same year. This event distinguished Dogecoin as the first cryptocurrency based on an internet meme.

According to Chan, since this industry is still in its early stages, investors must accept the natural volatility of the market before participating.

"Before participating, or whether you invest $10,000 or $100,000, you need to understand that this industry is very new, and new things are highly volatile. So it's very important to understand the risks before investing or gambling," he said.

Players with broad knowledge and experience in this field will inevitably gain an advantage.

Expanding the User Pool

Since the meme coin industry is so new, players already familiar with its mechanics are more likely to benefit from general market-related plans.

"I think this is part of growing pains. In any technology or sector, the most sophisticated people from the beginning will probably understand the loopholes. They will understand the opportunities and grab them, for better or worse, to make money," Chan told BeInCrypto.

As the market matures and the meme coin industry attracts new players, these plans will become less frequent.

"Ultimately, expanding the audience to include more builders who understand cryptocurrencies and blockchain will attract reputable individuals who want to maintain their goals and reputation. As more legitimate companies and builders enter this space, I expect the entire industry to grow in a healthier direction," he explained.

As a result, meme coins will become less dependent on prominent figures. They will focus more on supporting and conveying their message.

"I think the space will be better when the support for Tokens is driven by the team and their understanding of their work, not influencers. At that stage, it will be a healthier and more sustainable environment," Chan added.

He also emphasized that while inflating Token prices based on community engagement has negative aspects, it also has positive ones.

Positives in All Negatives

In the interview with BeInCrypto, Chan highlighted the key differences in building between Web2 and Web3.

"In Web2, companies heavily rely on venture capital and IPOs, with many constraints. But in Web3, if you can mobilize a community that understands and supports what you're building, VC funding becomes much less essential," Chan explained.

Furthermore, launching meme coins is one of the easiest processes in Web3. Anyone can do it, and this has become one of the most important drivers of success.

"The first is the ease of creation. I actually think Tokens are a kind of content. By lowering the barrier to creation, more so-called creators will participate, and they will create more content. I think meme coins are the lowest barrier in cryptocurrencies. This explains why so many new coins are launched every day," he said.

By using these fundamental aspects of meme coin launches for specific purposes and prioritizing substance over high interest, much more meaningful results can be achieved.

"You can actually turn your so-called consumers into supporters, even investors. I think understanding all these kinds of advancements and breakthroughs, I won't easily give up on cryptocurrencies and blockchain," Chan added.

Considering these unique aspects, Chan expects meme coins to have a bright future.

The Future of Meme Coins

Chan argues that the meme coin trend reflects the general trend of technological development. Science and technology are often invented to provide meaningful solutions to existing problems.

Scientists have developed vaccines to prevent deadly diseases like polio and influenza, and engineers have invented airplanes to connect the world more.

Satoshi Nakamoto developed Bitcoin to provide an alternative to the traditional financial system. Blockchain solves pressing issues related to data storage, user security, supply chain management, and voting systems.

However, not all technologies become popular.

"For example, if you look at social media, the most useful social media is LinkedIn, but the most popular social media is TikTok. This is because it's fun, easy to participate in, and immersive," - Chan

The meme coins of Web3 have a similar purpose to TikTok in Web2. In the long run, they may be able to drive more adoption.

"I think meme coins are the TikTok of cryptocurrencies. Many people say they're useless, but many people are participating. This is the biggest driver of mass adoption. As cryptocurrencies become more mainstream and blockchain is more adopted, the meme coin category will gain more market share," - Chan

Whether Chan's prediction materializes depends greatly on the sentiment in the cryptocurrency sector, particularly how newly onboarded users interact with meme coins.

The cryptocurrency industry's recent diverse plans may permanently alienate people, or the meme coin market may mature over time, which can only be known as time passes.