Solana (SOL) is currently trading at its lowest level in 4 months. Over the past 24 hours, the price of SOL has dropped by 5%, and it has seen a sharp 45% correction over the past 30 days.

This downtrend has pushed the market capitalization to $70 billion. The persistent downward trend is clearly visible in the Ichimoku Cloud and moving average indicators, suggesting further downside potential.

Solana Ichimoku Cloud Signals Strong Bearish Momentum

Solana's Ichimoku Cloud clearly shows a downward trend. The price is below the cloud, indicating strong bearish momentum. The upcoming red cloud reflects the bearish sentiment, and the Conversion Line (blue line) is below the Base Line (red line), reinforcing the downward pressure.

This suggests that the current negative momentum is likely to continue. The Lagging Span (green line) is also below the price movement, confirming the overall bearish sentiment.

There was a brief period of consolidation, but the SOL price failed to recover and has since declined further. The current price is stabilizing, but the bearish structure remains intact.

To signal a trend reversal, the price would need to break above the Conversion Line and Base Line and through the cloud. However, as long as the price remains below these key Ichimoku levels, the downtrend is likely to persist.

SOL Whales Attempt Recovery

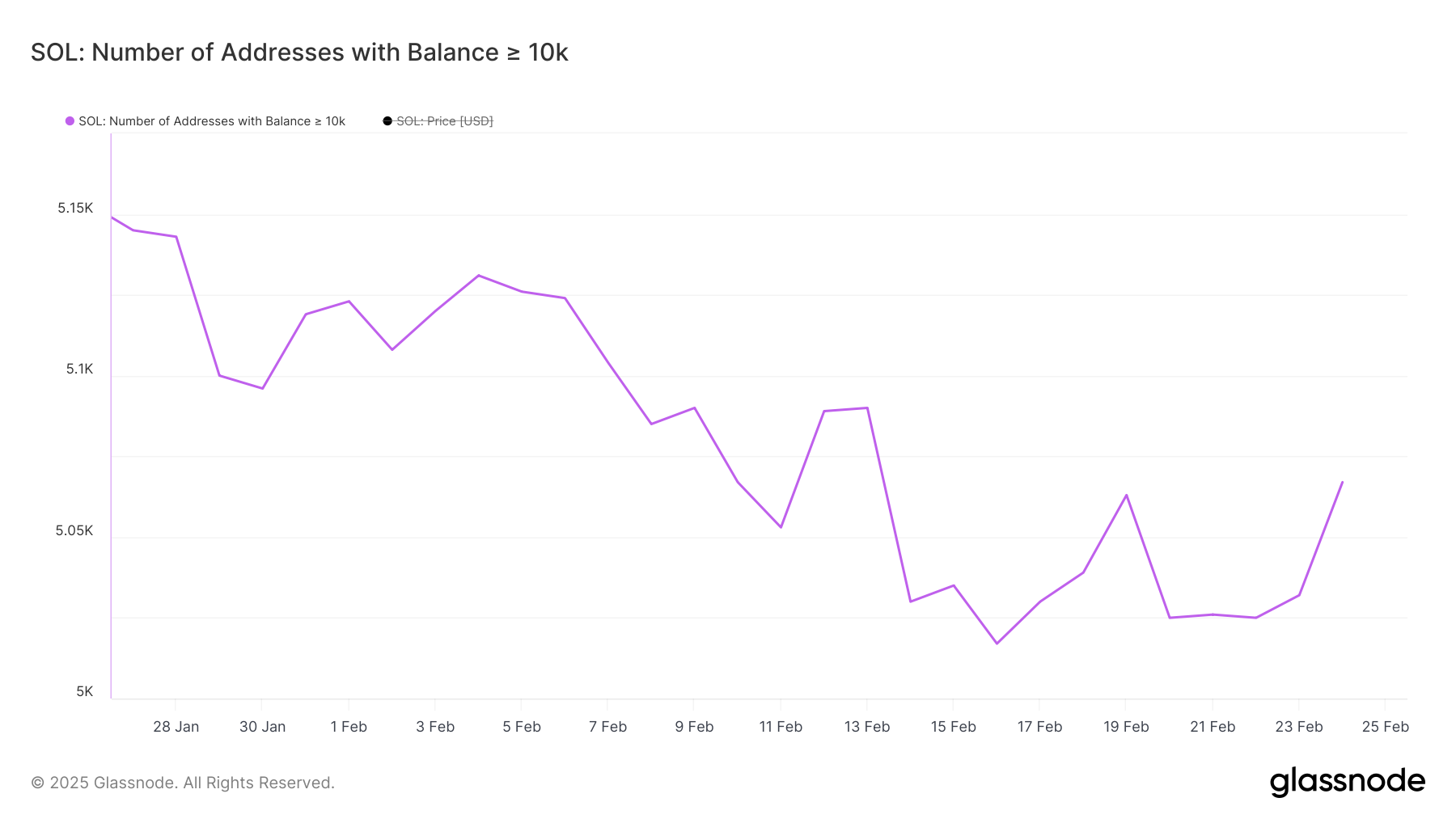

Solana whales – addresses holding at least 10,000 SOL – have steadily decreased in number over the past 30 days, reaching 5,017 on February 16th, the lowest level since December 2024.

This indicates that large holders are selling, contributing to the downward trend seen in the Ichimoku Cloud. As whales reduce their positions, the selling pressure increases, reinforcing the market's negative momentum.

This is in line with the overall bearish sentiment reflected in the cloud indicators.

Tracking whales is important, as they can significantly influence price movements. Their buying or selling activity can signal market trends, as they control a substantial portion of the supply.

Recently, the number of Solana whales has shown signs of recovery, reaching 5,067. While this is an improved figure, it is still lower than the past few months and relatively high historically.

This suggests cautious accumulation, but it is not enough to change the bearish outlook reflected in the Ichimoku Cloud.

Will Solana Reach a 6-Month Low?

Solana's moving averages are displaying a highly bearish configuration. The short-term moving averages are below the long-term ones, with a significant gap between them.

This indicates strong bearish momentum and suggests that selling pressure is dominant. If this downtrend continues, SOL could test the $133 support level. If this level breaks, the price could drop to $120 or $110, which would be the lowest point since August 2024.

The wide gap between the moving averages reinforces the strength of this downtrend, aligning with the negative sentiment seen in the Ichimoku Cloud.

Conversely, if the trend reverses, it could signal a potential change in momentum. If Solana's price manages to recover, it could first test the $152 resistance level.

If this resistance is breached, the next target could be $171, and a successful break above that level could see SOL rise back to $180. Investors are also closely watching the 19 billion SOL unlock scheduled for March 1st and its potential impact on the price.