The net outflow of the US spot Bitcoin ETF (exchange-traded fund) approached $1 billion on Tuesday. This indicates a continuation of such losses, with the weekly outflow approaching $1.5 billion.

The Bitcoin ETF outflow occurred amid a broader sell-off in the market, with macroeconomic concerns driven by the threat of tariffs by President Trump playing a major role.

Bitcoin ETF Net Outflow Approaches $1 Billion

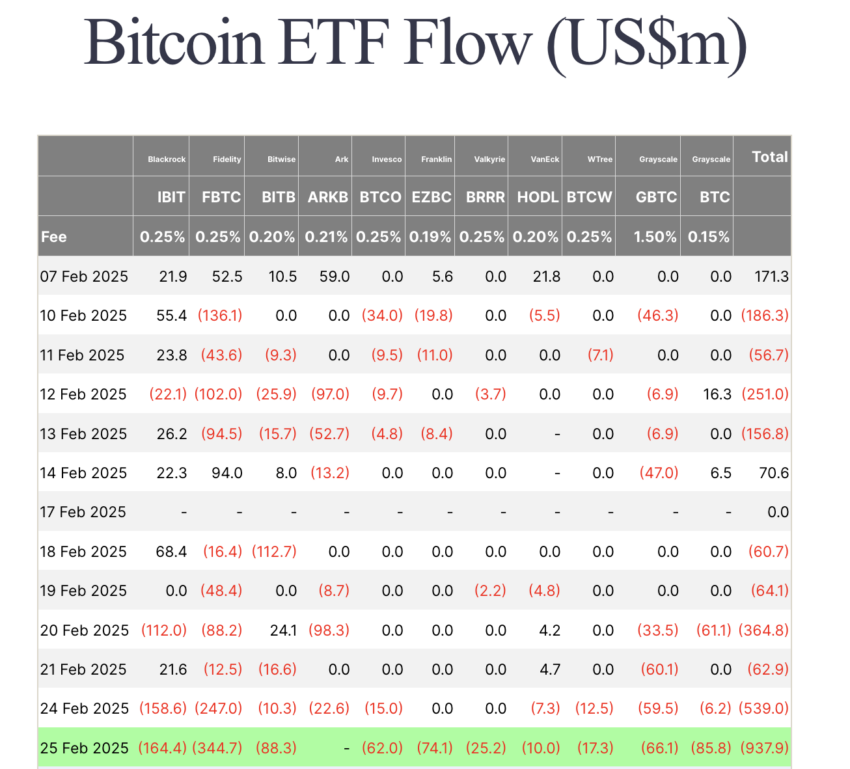

According to analysis by Farside Investors and Trader T, the net outflow of Bitcoin ETFs reached $937 million on Tuesday. Fidelity's FBTC led this outflow with $344 million, while BlackRock's IBIT recorded $164 million in redemptions.

Similarly, Bitwise's BITB and Grayscale's BTC recorded net outflows of $88 million and $85 million, respectively. Franklin Templeton's EZBC lost $74 million, and Grayscale's GBTC and Invesco's BTCO decreased by $66 million and $62 million, respectively.

Likewise, funds from Valkyrie, WisdomTree, and VanEck also reported net outflows, with BRRR, BTCW, and HODL recording $25 million, $17 million, and $10 million, respectively.

These outflows exceeded the threshold set on December 19, when the US spot Bitcoin ETF recorded nearly $672 million in withdrawals after Bitcoin fell below $97,000.

According to crypto investor Dissolve DC, this result suggests a broad panic on Wall Street. Specifically, the spot Bitcoin ETF financial product provides institutional investors with indirect exposure to BTC.

"We asked Wall Street to join the party, and this is what we got," the investor commented.

Experts attribute the panic to concerns over the confirmation of President Trump's tariffs. This triggered $1 billion in liquidations across the cryptocurrency market. According to BeInCrypto, President Trump has resumed discussions on tariffs on goods imported from Mexico and Canada, reigniting inflation concerns and pushing investors away from risk assets.

"We're on the tariffs, and it's moving along very quickly... We've been treated very badly, not only by Canada and Mexico, but by many countries. We've been taken advantage of," Reuters quoted Trump at the White House reporting.

As an immediate result, BTC lost the critical $91,000 support and traded down to $88,928. These concerns were also reflected in last week's outflows of digital asset investment products.

Bitcoin Price Outlook... Key Levels to Watch

On the daily timeframe, the BTC/USDT trading pair shows a change in market structure. This occurred after Bitcoin price fell below the key $93,700 reversal level (previous demand zone). This reversal adds to the pressure on BTC, with the $103,991 supply zone remaining a strong resistance level.

The price is approaching the 200-day moving average at $85,696, which provides crucial support. A break below this could accelerate the downtrend. If the 200-day MA fails, the next major support is in the $67,797 to $70,000 demand zone, where buyers may step in.

The RSI (Relative Strength Index) at 29.80 indicates an oversold condition for BTC, but there are no clear reversal signals yet. The MACD (Moving Average Convergence Divergence) shows a bearish crossover with deep negative histogram values, reinforcing the downtrend.

Similarly, there is a high-volume node (gray, bearish) around $91,000, acting as immediate resistance. The low-volume areas below the current price suggest the potential for a sharp decline.

Overall, Bitcoin is at a critical support level. If buyers (yellow bars, bullish) defend the 200-day moving average, there is a possibility of a rebound to $91,000. However, a breakdown could lead to $70,000 in the coming weeks.

The IntoTheBlock Global In/Out of the Money (GIOM) indicator supports this outlook. It shows that Bitcoin is facing immediate resistance (red). Any attempts to push the price higher will be met by the sell pressure of around 6.11 million addresses that purchased an average of 4.1 million BTC at $98,050.

Meanwhile, Bitcoin's initial strong support level is around $72,500, where 6.76 million addresses purchased approximately 2.65 million BTC at an average price of $65,304.