According to Matt Hougan, Chief Investment Officer of Bitwise, the high interest in meme coins will lead to a dramatic decline, which could mark the end of the meme coin era.

Hougan pointed to high-profile scams and illegal activities as a catalyst that could dampen the speculative fervor around meme coins.

Bitwise CIO Discusses the Demise of the Meme Coin Era

In a recent X (formerly Twitter) post, Hougan mentioned that the cryptocurrency market is dealing with the end of the meme coin frenzy. While the decline may not happen immediately, he predicts it could effectively end within 6 months.

The post read, "The combination of Melania, Libra, and Lazarus Group using meme coins to launder stolen ETH will kill it."

The MELANIA Token associated with the former First Lady and LIBRA promoted by Argentine President Javier Milei have been embroiled in controversy after insiders cashed out millions of dollars.

Meanwhile, the Lazarus Group is reported to have utilized platforms like Pump.fun, a recently hacked Solana (SOL)-based meme coin launchpad, to launder over $150 million in stolen funds from the massive Bybit exchange hack.

Hougan emphasized that the decrease in interest in meme coins could leave a void in the market's short-term enthusiasm. However, a new narrative is already poised to take its place, including the institutional adoption of Bitcoin (BTC) through ETFs and major corporate holdings.

Stablecoins are becoming increasingly important as major institutions are signaling increased adoption. Tokenization is unlocking the liquidity of real-world assets. Finally, Decentralized Finance (DeFi) is making a comeback, attracting retail and institutional users with new innovations.

However, not everyone shares Hougan's pessimism. Meme coins have thrived for a long time based on high interest and community belief rather than intrinsic value. As Kiwoom CEO Ki Young Ju pointed out, "If you can create something that people believe in, you can thrive as an entrepreneur in the cryptocurrency industry."

The CEO argued that meme coins leverage deep-seated human instincts and cultural patterns, reflecting the need for symbols and beliefs to unite people, much like religious or spiritual systems have in the past.

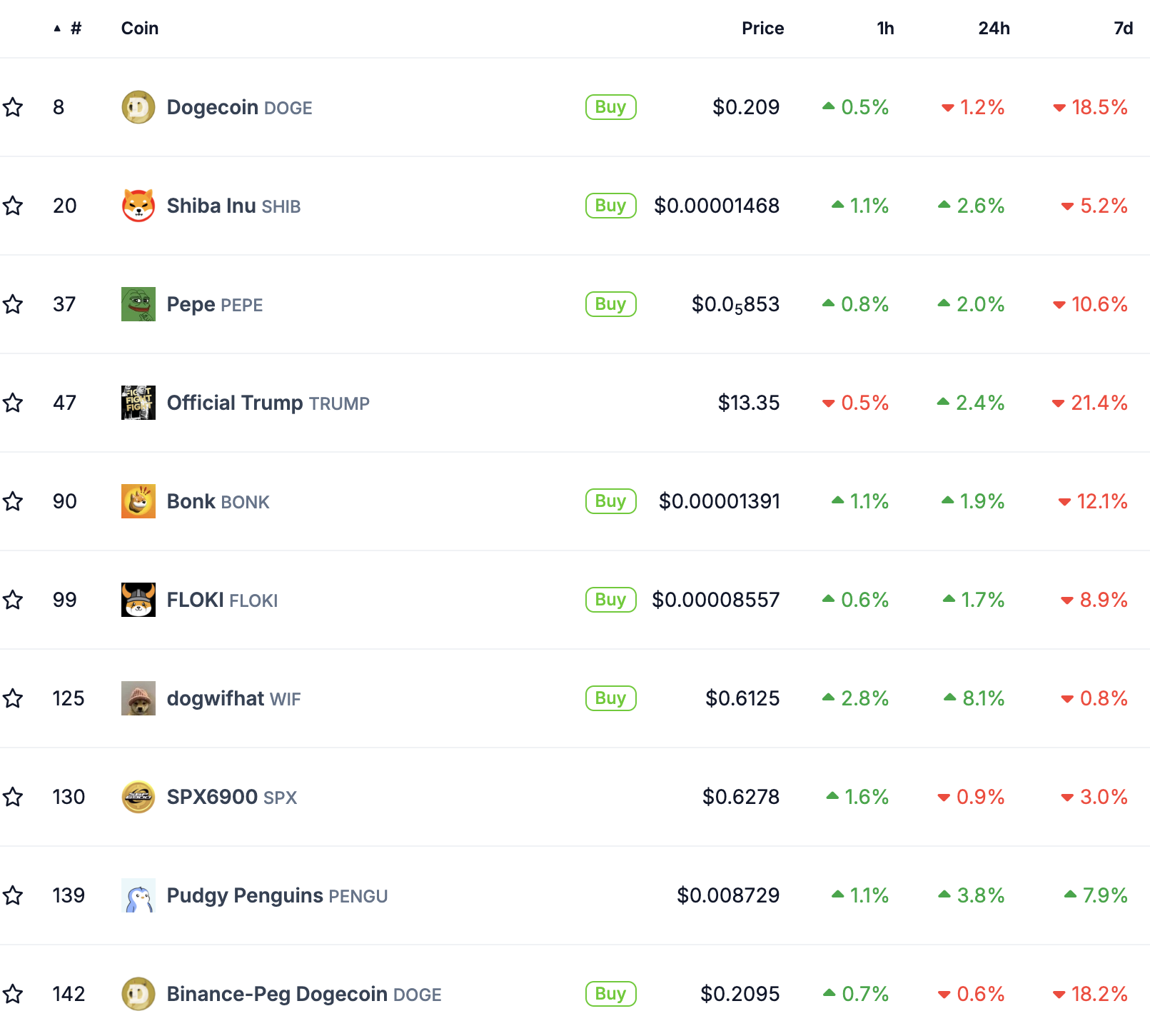

Despite Hougan's concerns, the meme sector still shows signs of vitality. At the time of reporting, the market capitalization stood at $64.2 billion, up 1.2% in the last 24 hours.

This growth contrasts with the broader cryptocurrency market, which lost $109 billion simultaneously. Notably, 7 out of the top 10 meme coins saw gains in the last 24 hours.

However, despite these recent gains, 90% of the top 10 meme coins recorded losses over the past week.