The trade war tariffs of Donald Trump have caused significant volatility in the cryptocurrency market this week, leading to a decline in the value of Ethereum. At the time of reporting, major altcoins are trading at $2,347, which is the lowest level recorded since November.

As the price has declined, ETH investors have been increasingly bearish and withdrawing capital from investment funds that support altcoins.

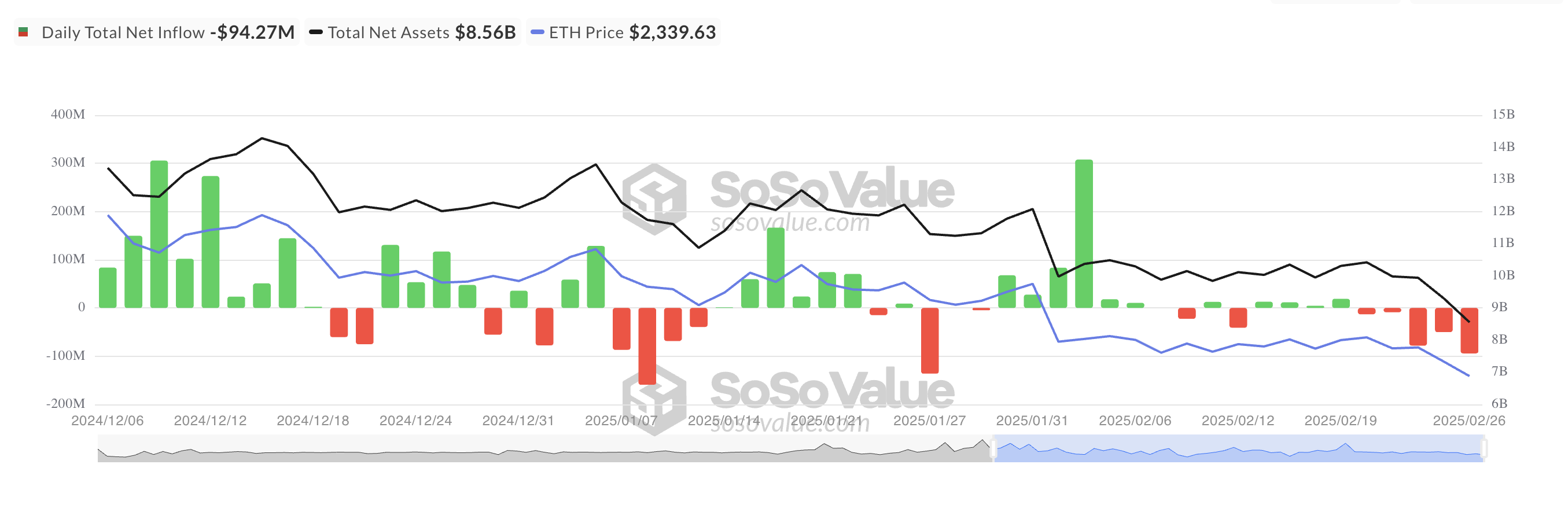

ETH Spot ETF Outflows Reach 30-Day High

According to SosoValue data, the net outflows from ETH spot ETFs reached a 30-day high of $942.7 million on February 26. This was the third-highest single-day net outflow since the start of the year, occurring after the price of the coin dropped to an intraday low of $2,251.

On Wednesday, the BlackRock ETF ETHA saw a single-day net outflow of $697.6 million, while the total net inflow into the fund since its launch is $4.33 billion. Fidelity's FETH recorded the second-largest net outflow that day, totaling $183.8 million, with a cumulative net inflow of $1.51 billion.

When ETH ETFs show such net outflows, investors are withdrawing more capital than they have invested, indicating a decrease in confidence or profit-taking. It's worth noting that ETH spot ETF investors have been steadily withdrawing capital since February 21. This persistent outflow suggests bearish sentiment and puts additional downward pressure on the price of ETH.

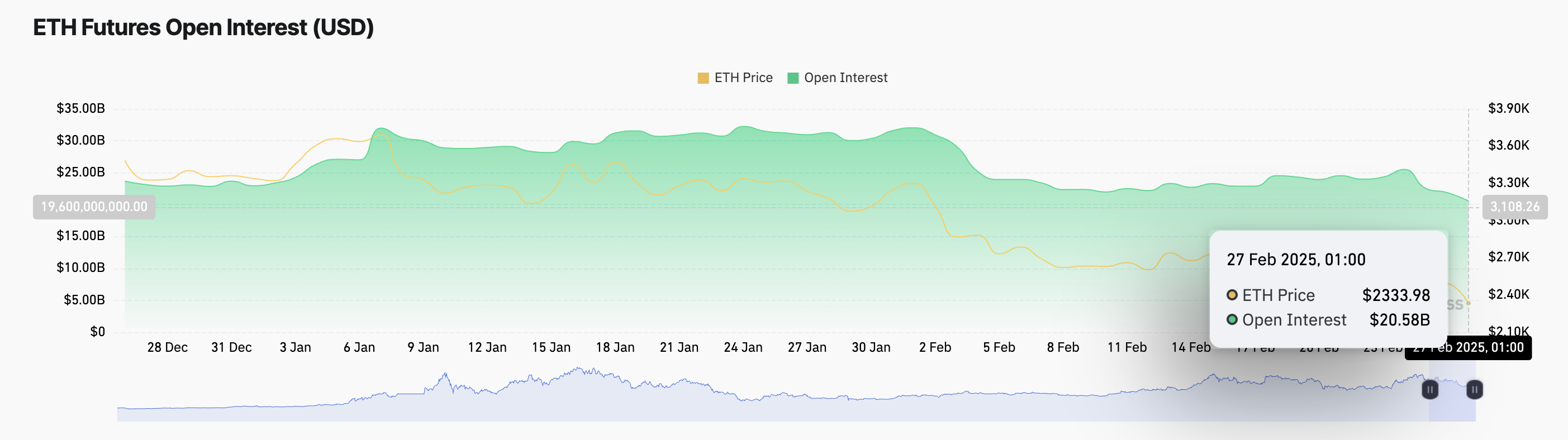

Specifically, the decrease in open interest in the futures market for ETH emphasizes the overall bearish bias in the market. At the time of reporting, this stands at $20.58 billion, a 20% decline since the start of the week. During the same period, the price of ETH has dropped by 17%.

Open interest in an asset measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When it decreases along with the asset's price, traders are closing existing positions rather than opening new ones.

This suggests that market interest in ETH is waning, and it implies the possibility of continued decline in value.

Key Support for ETH Breaks Down... Will Annual Low of $2,150 Be Breached?

On the daily chart, ETH is currently trading below the lower line of a horizontal channel that it has been in for most of February. This indicates a breakdown of a strong support level and suggests the potential for further downside. In this case, the price of ETH could revisit the annual low of $2,150.

Conversely, if market sentiment improves and new demand flows into the ETH market, its value could rise to $2,467. Breaching this resistance level could push the price of ETH up to $2,585.