Bit has dropped sharply in price this week, falling below $80,000 from $95,700. The recovery of the cryptocurrency king appears uncertain, and large wallet holders known as whales have taken advantage of the price decline to sell a substantial amount of BTC.

This selling pressure further exacerbates the situation for investors already suffering from the downtrend.

Bit holders are cashing out

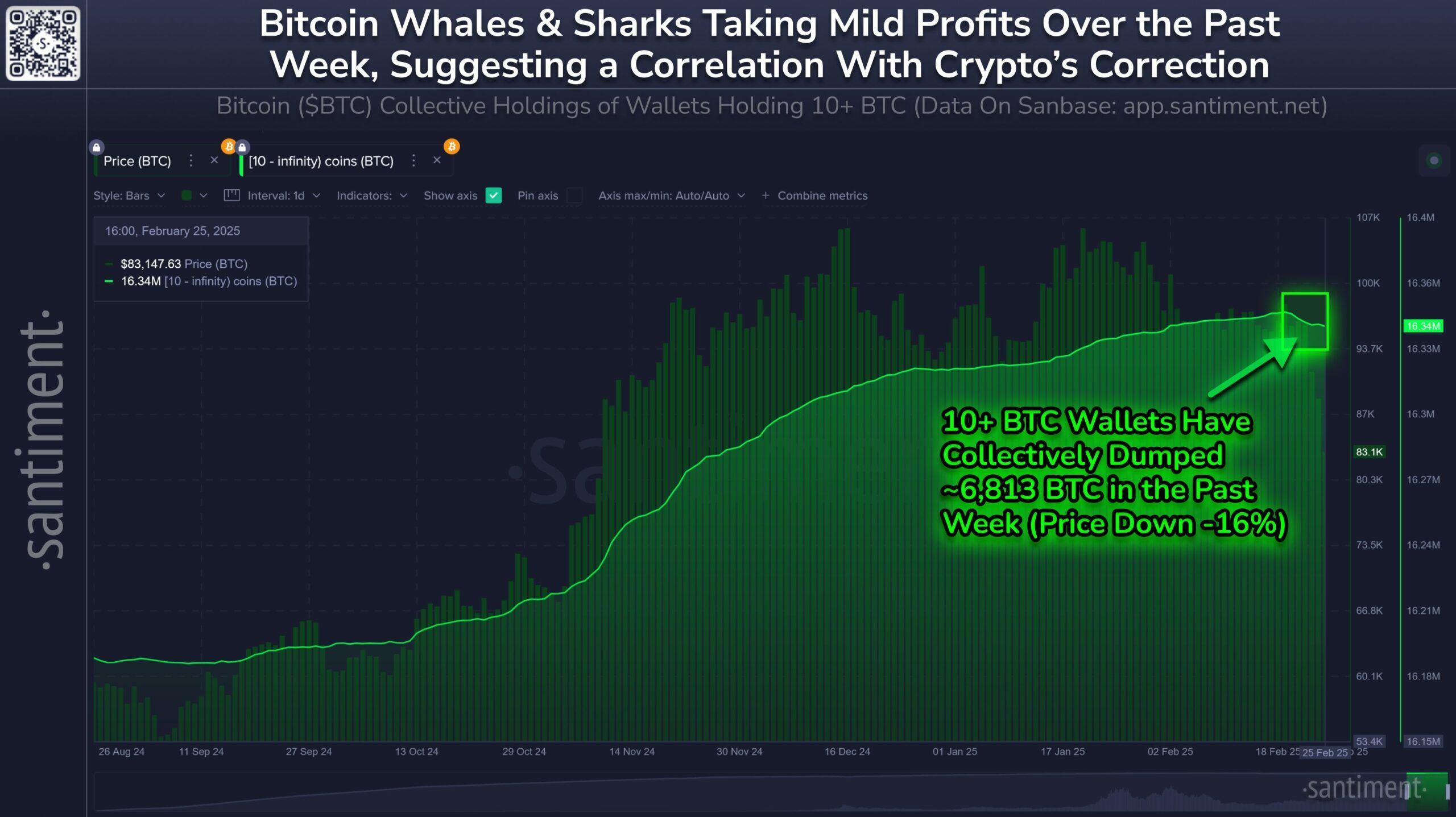

Whales and sharks, particularly wallets holding more than 10 BTC, have been actively trading in the market and have sold about 6,813 coins since last week. This is equivalent to about $540 million, the largest decline since July 2022. This serves as a bearish indicator, presaging further price declines.

Despite the selling pressure, the potential for these large holders to accumulate could signal a market reversal. Historically, these whales have had a significant impact on the market, so their actions should not be overlooked. Once the market stabilizes, they may start accumulating at lower levels.

The overall sentiment remains negative, but this behavior may suggest a change in strategy. If these large investors start re-accumulating BTC, it could indicate confidence in the long-term potential of Bit.

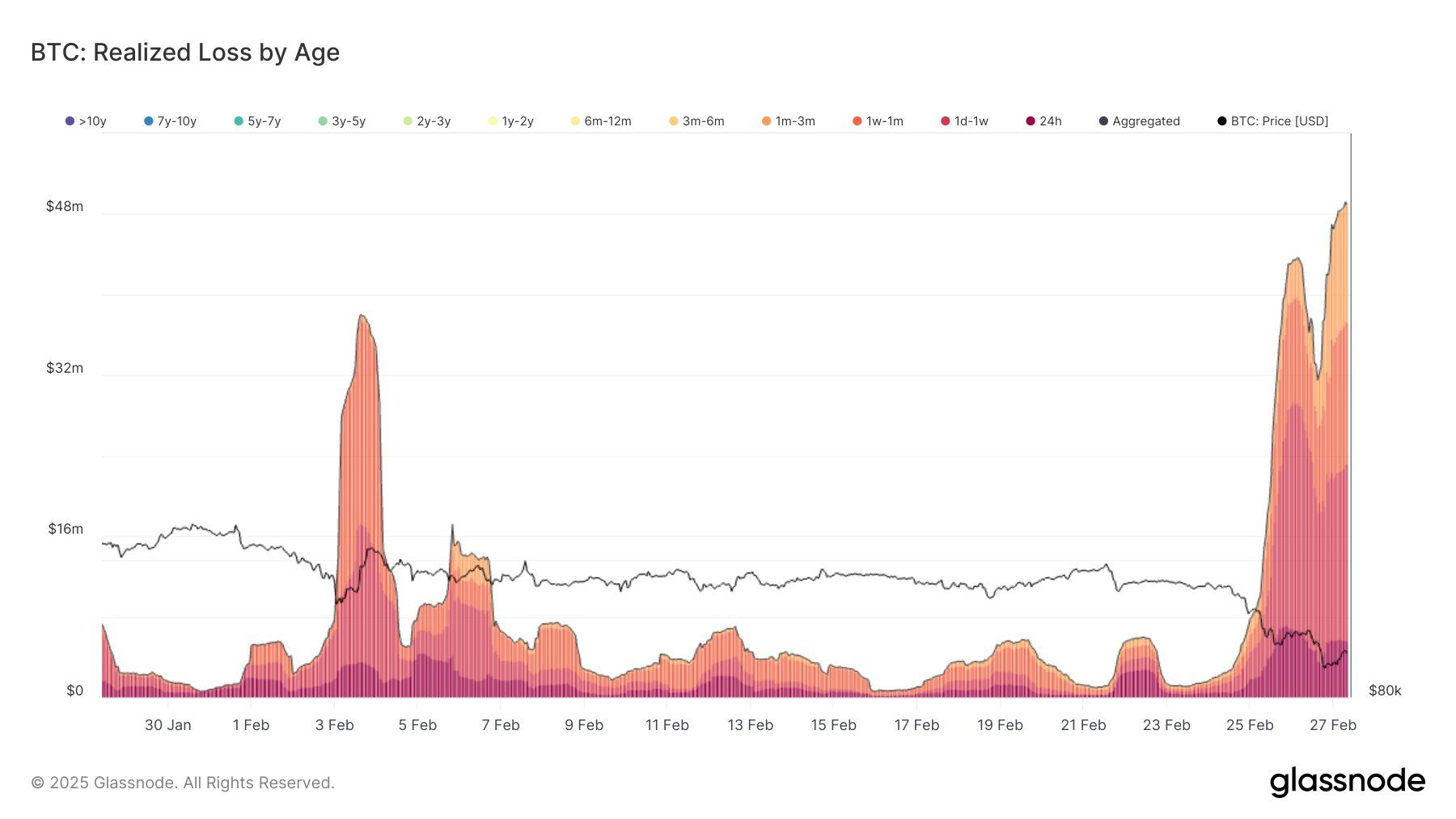

Looking at the broader market, the recent decline in Bit has been accompanied by significant realized losses. Over $2.16 billion in losses were realized from February 25th to 27th, primarily from newer market entrants.

Of these losses, about $927 million, or 42.85% of the total young cohort losses, occurred in a single day. This represents the largest single-day loss since August 2024. This large-scale selling by new investors is a concerning signal that could hinder market participation.

These losses reflect the severe frustration faced by new market participants and can reduce overall investor confidence. As long as this trend continues, it could pose a significant burden on the recovery of Bit prices. This could further exacerbate the market's bearish sentiment.

BTC price struggling

Bit is currently trading at $79,539, having already lost the $80,313 support. Considering the recent situation, BTC is likely to test the next support level of $76,741. This level has historically acted as a key reversal point, providing hope for a price rebound.

However, if the selling pressure continues and investor confidence further weakens, Bit could fall below $76,741 and approach the $71,529 support. A decline to this level would significantly expand losses and deepen the bearish outlook on cryptocurrencies.

To invalidate the bearish narrative and potentially trigger a recovery, Bit needs to reclaim the $80,313 support and return to $85,000. If this occurs, it could signal the start of a reversal and the possibility of a recovery.