Bit has risen 8% in the last 24 hours, recovering from last month's losses. It is currently trading at $93,202, and is trying to set $93,625 as a support level. This sharp rebound has rekindled the uptrend, but caution is needed.

While Bit is showing strength, traders and market trends are showing divergent behavior, increasing volatility risk.

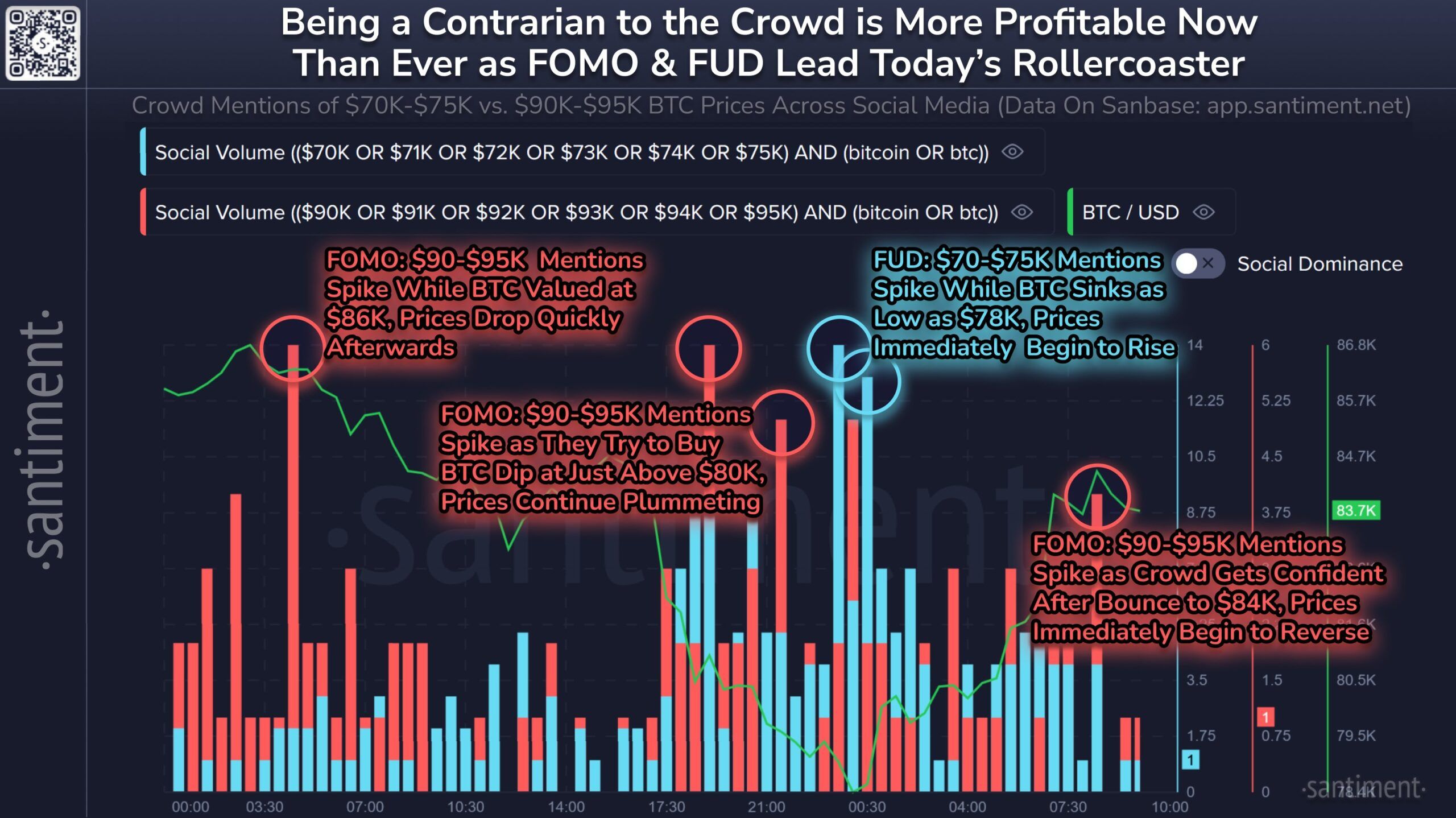

Bit sentiment-based trading is risky

Data from the cryptocurrency online data platform Sentiment highlights recurring patterns. Traders often misjudge Bit's price movements. When traders expect an increase, the market tends to decline. Conversely, when a decline is expected, Bit often surprises with an uptrend. This pattern suggests that market unpredictability remains high, and sentiment-based trading is risky.

Investors should closely monitor Bit's attempts to break through $100,000. Historically, a contrarian strategy has been more effective than following trader sentiment. In the face of ongoing uncertainty, market participants may consider acting against the prevailing opinion to effectively navigate the current situation.

Bit's dominance is 60.74%, forming a fractal similar to 2020-2021, when Bit surged and then declined. A similar trend is emerging, suggesting the historical pattern may repeat. Bit's price has shown signs of recovery during periods of declining dominance, but the strength and sustainability of these movements depend on broader market conditions.

As altcoins gain attention with declining dominance, Bit often ends up profiting in the long run. The current market structure is in a transitional phase, and BTC may see further upside. If this fractal is maintained, the recent sharp rise in Bit's price could continue, reinforcing positive momentum.

BTC price needs to secure support

The 8% rise in Bit has pushed the price to $93,202. If BTC can maintain $93,625 as a support level, it could see further upside to $97,696. Securing this level would strengthen the upward momentum and support Bit's recovery.

Transitioning the 50-day moving average to a support level is crucial for sustaining gains. This move will erase the losses from February and lay the groundwork for further upside. Maintaining this trajectory could position Bit to retest higher resistance areas.

However, if it fails to hold above $95,761, the upward momentum will be invalidated, and it could drop to $92,005. Losing this critical level could trigger further declines and weaken Bit's upward trajectory.