There are several major events scheduled in the cryptocurrency market this week that could impact the portfolios of traders and investors. Key news includes the White House Cryptocurrency Summit, a large-scale ecosystem-specific token unlock, and TRON blockchain recently fulfilling its recent promises.

The following headlines are poised to influence investor sentiment, and traders will need to adjust their strategies to capitalize on the volatility.

White House Cryptocurrency Summit

The White House Cryptocurrency Summit scheduled for Friday, March 7th, with U.S. President Donald Trump, is the highlight of this week's cryptocurrency news. This heightened interest comes after the President's executive order delegated a cryptocurrency reserve that includes assets such as Solana (SOL), Cardano (ADA), and the XRP Token of Ripple.

This reserve also includes Bitcoin (BTC) and Ethereum (ETH), each holding significance as the pioneering cryptocurrency and altcoin, respectively.

"...and, of course, BTC and ETH will be the centerpiece of the reserve as other valuable cryptocurrencies. I love Bitcoin and Ethereum," read a post on Trump's Truth Social, according to the post.

Analysts at Greeks.live mention the potential impact of the Cryptocurrency Summit on Bitcoin. They also mention the potential of Trump's tariffs on Mexico and Canada, scheduled to be implemented on Tuesday, March 4th. Amid the expected volatility, the analysts see opportunities for investors.

"The most notable event this week is the Cryptocurrency Summit in the U.S. on March 7th...Trump's every move has a significant impact on the cryptocurrency market...Trump's tariff policy on Mexico and Canada going into effect on Tuesday, and other important economic events on other days, the event provides rare trading opportunities," they wrote in their report.

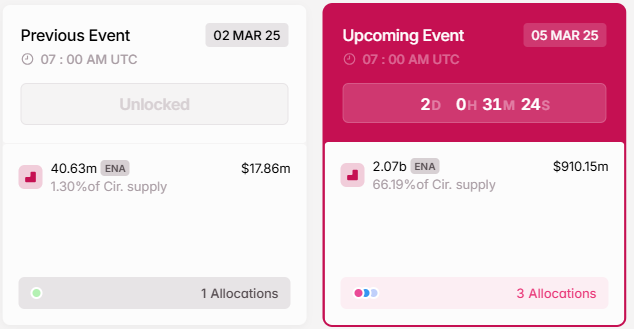

Ethena (ENA) Unlock

Another major cryptocurrency news this week is the scheduled Ethena token unlock on March 5th. On Wednesday, the Ethena network is set to unlock 2.07 billion ENA tokens, accounting for 66.19% of the circulating supply and currently valued at $910.15 million at current prices.

Considering the general market response to such events impacting asset prices, this event could introduce volatility to ENA. BeInCrypto recently reported that 90% token unlocks tend to drive prices down. Citing Keyrock Research, the report explained that larger events lead to more abrupt declines.

This suggests the Ethena token unlock could significantly drive down the price of ENA, especially if recipients quickly cash out their initial gains. Other notable token unlocks include Portal (PORTAL), Altlayer (ALT), and NFPrompt (NFP).

Fei Protocol Upgrade, Sepolia Testnet Debut

Ethereum's Fei Protocol upgrade is scheduled to debut on the Sepolia testnet on March 5th. This upgrade features eight major improvements, including wallet and staking enhancements. This testnet deployment follows testing on the Holeski testnet on February 24th.

These testnet deployments ensure stability before the mainnet implementation in April. Particularly, the April launch has been delayed from earlier reports that had anticipated a March release. This delay is due to the need for thorough testing and coordination for a smooth transition.

"Parithosh Jayanthi, a DevOps Engineer at the Ethereum Foundation, shared an update on the status of Fei Protocol Devnet 6. He confirmed that the devnet is 'progressing well' and the validator participation rate is nearly perfect," as cited in a recent report.

In addition to the Fei Protocol upgrade, the Ethereum Foundation is also planning Pusaka, which is expected to bring significant improvements to the Ethereum Virtual Machine (EVM) and increase block capacity.

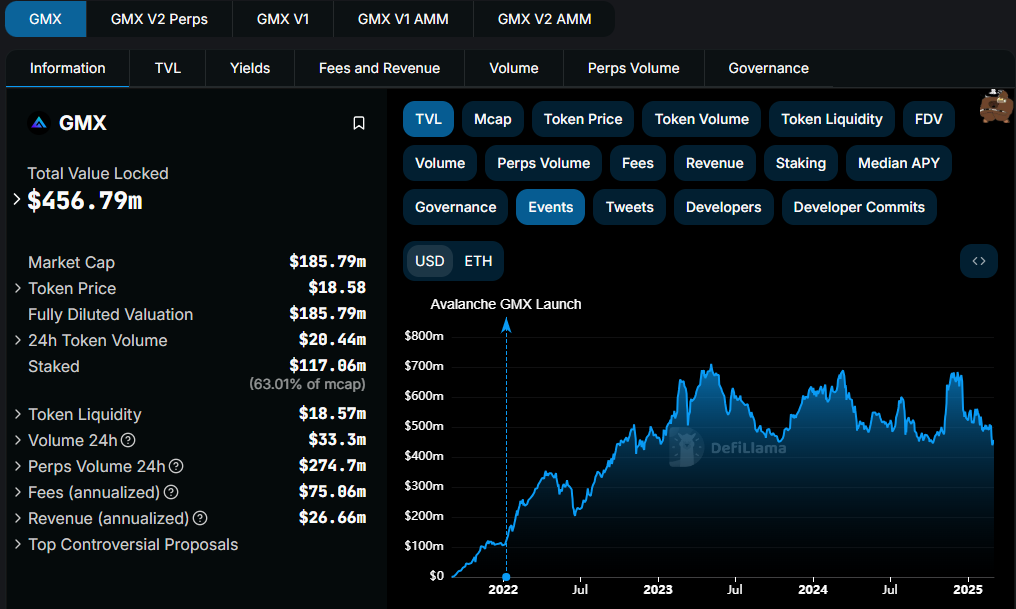

GMX Perpetual DEX Debuts on Sonic

The cryptocurrency market is also anticipating the launch of the GMX perpetual DEX (decentralized exchange) on Sonic. GMX boasts over $243 billion in historical trading volume and can now launch a new Layer-1 (L1) blockchain on Sonic, which touts 10,000 TPS in the Phantom lineage.

Currently, GMX can leverage Sonic's speed on Arbitrum and Avalanche to enable faster and cheaper trades. This can allow it to enter a new ecosystem after a $1 million hackathon. This could bring GMX's $456 million TVL (Total Value Locked) to compete with rivals like Hyperliquid's $642 million.

The GMX token is currently trading at $18.03, and the Sonic's S token could also see speculative gains. However, this rumor is yet to be confirmed.

Launch of the MegaETH Testnet

Additionally, MegaETH is an Ethereum Layer-2 network, aiming to redefine blockchain performance with 100,000 TPS and block times under 10ms. This targets blockchain games and real-time use cases like high-frequency trading.

Backed by $30 million from Vitalik Buterin, Dragonfly Capital, and others, MegaETH's EVM-compatible platform promises seamless app integration. The testnet will launch in two days, and according to X posts, while there are no incentives, it's an opportunity to preview the technology. Imagine Netflix-like speeds on the chain.

"MegaETH has announced that the testnet will have no incentives." – X user statement.

The mainnet is scheduled for late 2025, and while no confirmed token launch announcement has been made, there is speculation around cryptocurrency airdrops. MegaETH could strengthen the Ethereum ecosystem for the market, and a surge in adoption could buoy ETH. However, the centralized sequencer raises concerns about decentralization.

TRON Starts USDT Transactions with No Gas Fees

Another highlight this week is TRON blockchain's plan for gas-free transactions on the USDT stablecoin. Praised for cheap USDT transfers, TRON saw its fees skyrocket from $3.20 to $6.50 per TRC-20 USDT transaction, exceeding the $0.40 ERC-20 fee on Ethereum.

This change weakened the cost advantage, and founder Justin Sun announced the "gas-free" feature within February 25th.

"TRON's gas-free feature will support USDT gas payment without TRX, and it will be launched within next week." – Sun statement.

This means users can send USDT without needing TRX for fees, simplifying the process. TRON processes over $600 billion in USDT, 51% of its supply. This is significant, as it aims to regain cost-efficiency, drive adoption, and facilitate enterprise stablecoin usage. With fees spiking to $9 by the end of 2024, this could revive TRON's appeal.