Bit (BTC) is hovering around an important price level, and cryptocurrency investors are focused on the week of U.S. economic data releases that could shake market sentiment.

From employment figures to insights from Federal Reserve Chair Jerome Powell, these macroeconomic indicators are poised to influence the trajectory of Bit (BTC).

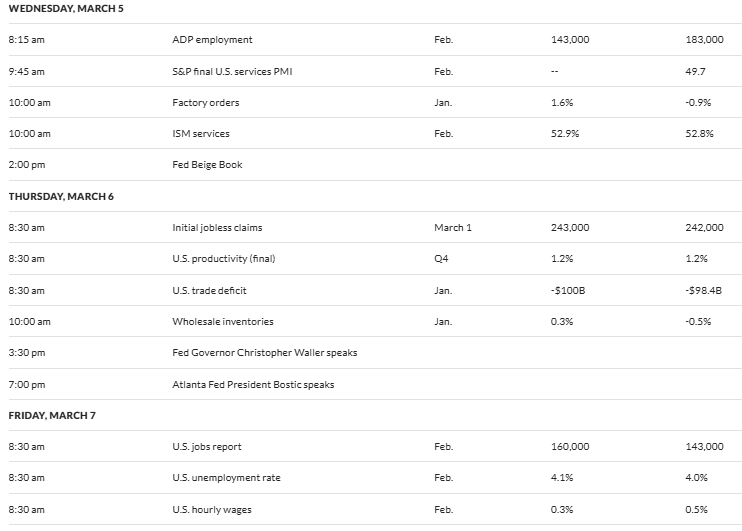

Key U.S. Macroeconomic Data to Watch This Week

Crypto market participants, traders, and investors have several U.S. economic events to keep an eye on this week. This comes after a weekend shift in sentiment due to the move by U.S. President Donald Trump to establish a Crypto Assets Working Group.

The crypto market's reaction to the presidential executive order reflects Bit (BTC)'s growing importance in the U.S. macroeconomic landscape. Here are five key data points that could impact major global cryptocurrencies and their potential implications.

ADP Employment Report

The week starts on Wednesday with the release of the ADP National Employment Report. This U.S. economic data is a key indicator of private sector job growth. From the previous 183,000, economists expect the February job data to slow to around 143,000. This reflects a cautious employment environment, even as President Trump's economic policies remain a focus.

A stronger-than-expected report could signal resilience in the labor market, which could strengthen the dollar and pressure Bit (BTC) as investors shift to traditional assets. Conversely, weak figures could stoke expectations of Federal Reserve rate cuts, potentially boosting Bit (BTC) as a risk asset.

"The focus this week is on employment data, with ADP expected at 143,000 on March 5 and nonfarm payrolls at 160,000 on March 7. If these numbers hit or exceed expectations, there is a good chance of a 1-2% rally in risk assets due to tech sector optimism and belief in a soft landing," one user commented.

However, the outcome is uncertain, and historical trends show a mixed crypto market reaction to ADP surprises.

Initial Jobless Claims

Thursday's Initial Jobless Claims report will provide a real-time snapshot of the health of the U.S. labor market. The previous week's figure rose to 242,000, exceeding the consensus of 225,000 and suggesting an economic slowdown.

According to MarketWatch data, analysts expect a slight increase to around 243,000 for the week ending March 1. Lower claim numbers could bolster confidence in the economy, potentially reducing the appeal of Bit (BTC) as a hedge against uncertainty.

However, higher claim numbers could stoke fears of an economic downturn, leading investors to seek Bit (BTC) as a safe-haven alternative.

U.S. Unemployment Rate

The U.S. Employment Report on Friday, particularly the unemployment rate, will be a key market event. February job growth is expected to be 160,000, up from 143,000 in January. The unemployment rate is forecast to rise to 4.1% from the previous 4.0%.

Strong job growth could weaken hopes for monetary easing, making yield-generating assets more attractive and putting pressure on Bit (BTC) as interest rates rise. Conversely, a disappointing report could strengthen the narrative of Bit (BTC) as a hedge against economic weakness.

Jerome Powell Speech

An upcoming speech by Federal Reserve Chair Jerome Powell is also a variable that could impact crypto sentiment this week. His remarks could set the tone for monetary policy expectations.

Scheduled for Friday, his speech will be closely analyzed for clues on the Fed's latest rate decision and potential signals for rate cuts in 2025. Dovish hints could weaken the dollar and boost risk appetite, lifting Bit (BTC). Hawkish stances emphasizing inflation control could increase borrowing costs and pressure Bit (BTC).

Notably, Powell recently told the Senate Banking Committee that he would not rush to cut rates, maintaining a cautious economic approach. However, the growing concerns among U.S. policymakers about President Trump's policies cannot be ignored.

"Many participants cited various factors that would call for a patient approach to monetary policy decisions in the coming quarters," the Fed's previous meeting minutes stated.

Consumer Credit

Friday's Consumer Credit data will round out the week by shedding light on U.S. borrowing trends. After a sharp $40.85 billion increase in December, rapid growth could signal strong consumer confidence, potentially reducing the appeal of Bit (BTC) as disposable income flows elsewhere.

A slowdown in credit growth could suggest economic caution, potentially driving investors to choose Bit (BTC) as a store of value amid uncertainty. However, MarketWatch data points to a modest $12 billion median forecast.

At the time of writing, Bit (BTC) is trading at $92,811, up over 8% since the start of the Monday session. With these five data points on the horizon, volatility is almost certain.

Meanwhile, traders and investors are anticipating the cryptocurrency summit to be held at the White House on Friday. President Trump is seeking to position the United States at the forefront of the growing digital asset industry.

"I expected a pro-US cryptocurrency asset reserve focused on the US Blockchain, but did not trade the news. This is a beta trade. Consider holding some of the tokens that have not been added before the summit on Friday. Trump hinted that there will be more additions, but the ones that are not selected are likely to be heavily backlashed, so it's quite a speculative trade." - A X user mentioned.