The upcoming White House Cryptocurrency Summit on March 7 could have a significant impact on the market. Discussions on regulation and innovation are scheduled. Five major assets, including Hedera (HBAR), Chainlink (LINK), TRUMP, MELANIA, and Uniswap (UNI), are attracting attention. There is increasing speculation that they may be included in the U.S. cryptocurrency reserve.

HBAR and LINK hold strong positions in their respective fields. TRUMP and MELANIA may gain attention due to their association with the summit. Meanwhile, UNI is seeing active discussions about its long-term role in the DeFi ecosystem following its regulatory victory over the SEC.

Hedera (HBAR)

Hedera is one of the top 5 cryptocurrencies created in the U.S. by market capitalization. It is very close to XRP, Solana, and USDC. XRP and Solana are already included in the U.S. cryptocurrency reserve, and USDC is a stablecoin. There is growing speculation that HBAR may be the next to be included.

This movement can generate significant upward momentum as investors expect increased institutional adoption and government recognition.

Despite a 7% drop in the last 24 hours, HBAR rose over 13% last week. Its market capitalization is around $10.3 billion, reflecting ongoing interest in the asset.

If HBAR is added to the U.S. cryptocurrency reserve, its price could surge, testing the key resistance levels of $0.29 and $0.32.

A stronger rally could push it to $0.37, and if the upward momentum continues, HBAR could reach $0.40, a level it has not achieved since November 2021.

However, if the recent price correction intensifies and HBAR loses the $0.22 support, $0.20 and $0.17 could emerge as the next major support levels.

Chainlink (LINK)

Chainlink is a major player in the oracle space and is expanding its influence in the real-world assets (RWA) sector. Its roles in these two industries further strengthen the possibility of it being included in the U.S. cryptocurrency strategic reserve, alongside XRP and Solana.

LINK has remained one of the most relevant U.S.-made cryptocurrencies since its launch in 2018, with a market capitalization similar to Hedera. Adding it to the strategic reserve could increase demand and drive up its price.

The inclusion possibility could allow LINK to test $17.6, and further breakthroughs could lead to $19.7 and $22.3. If the momentum is strongly maintained, it could even reach $26.4 for the first time since mid-December 2024.

However, a market downturn could test LINK's $15.7 support, and further declines could lead to $14 or even $13.45.

Official Trump (TRUMP)

Trump's cryptocurrency summit could have a significant impact on his meme coin, Official Trump (TRUMP). This coin has been struggling below $20 for over two weeks. The event could reignite interest in the coin and reverse its recent downtrend.

TRUMP was one of the most highly sought-after meme coins. On its first day, it reached a market capitalization of $15 billion, making it the third-largest meme coin. However, it has since lost 80% of its value, and its current market capitalization is around $2.9 billion.

If momentum increases, TRUMP could test the resistance levels of $17, $20, and $24.5, and a strong rally could push it back to $30 for the first time since January.

However, if the correction continues, TRUMP could test the $12.1 or $11 support. Falling below $11 would mark a new all-time low since its launch.

Melania Meme (MELANIA)

Similar to TRUMP, MELANIA could also see an upswing due to Trump's cryptocurrency summit. Launched on January 19, MELANIA quickly surged to a market capitalization of $2 billion, but then plummeted, losing $50 over the past 30 days without finding support.

MELANIA has been trading below $1 for nearly a week and is currently near its all-time low. A strong rebound could push it back to $1.29 and $1.39, and it has the potential to surge to $1.61 for the first time since February 6.

However, if the momentum fails to recover, MELANIA could continue to decline below $0.80 and $0.70, setting new all-time lows.

The outcome of the summit will play a crucial role in MELANIA's price movements. If high interest returns, it could regain its lost position, but if market sentiment remains weak, further declines are expected.

Uniswap (UNI)

Uniswap remains one of the most important DeFi applications, even though it sometimes loses the lead to competitors like Raydium, Hyperliquid, and Pumpfun.

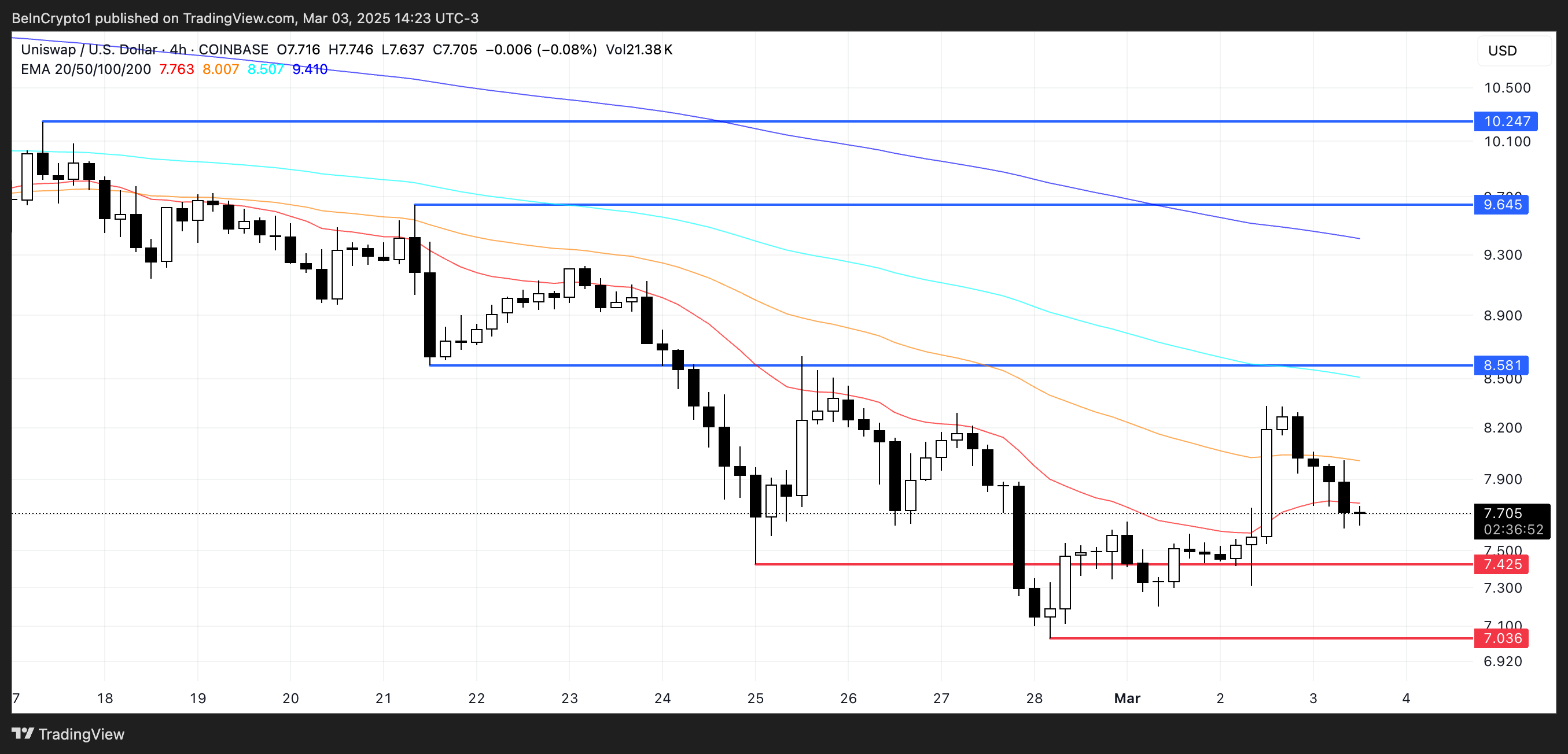

With the SEC's investigation into Uniswap being dropped, speculation is growing that UNI could be included in the U.S. strategic cryptocurrency reserve. If that happens, UNI could test the $8.5 resistance and potentially rise above $9.64 and even $10, a level not seen since mid-February.

However, UNI has declined 33% over the past 30 days, and the correction may continue if buyers hesitate.

If further declines occur, the UNI price could test the $7.42 support. If that level breaks, it could fall below $7 for the first time since January 2024.