Bit (BTC) surged nearly 8% on Wednesday, recovering above $90,000 after briefly falling below $80,000 five days ago. This sharp recovery indicates new bullish momentum as investors react to speculation about Trump's U.S. cryptocurrency preparedness plan.

Key technical indicators like the DMI and Ichimoku Cloud suggest buyers have regained control. Whether BTC can maintain this momentum and move towards $100,000, or if volatility increases again, largely depends on future market developments, including the upcoming White House cryptocurrency summit.

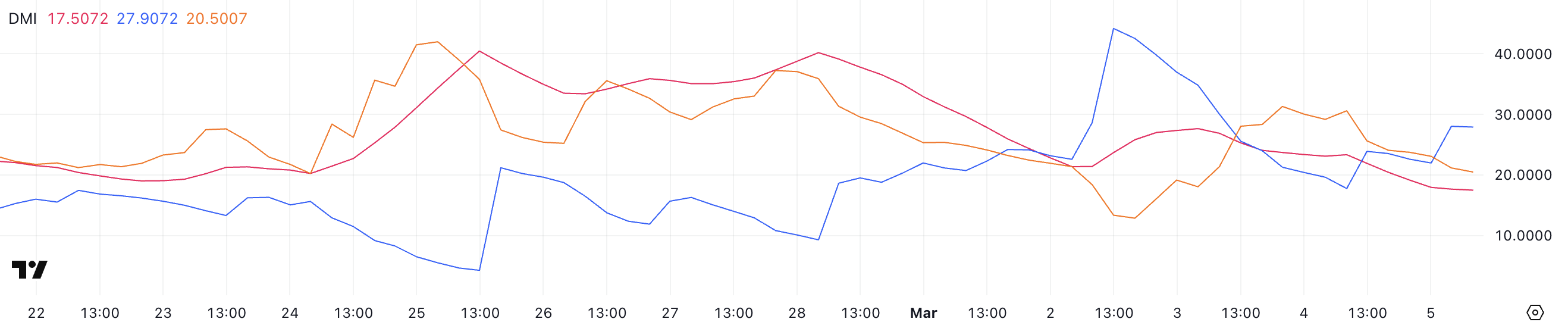

Bit (BTC) DMI, Buyers Regain Control

Bit's (BTC) Directional Movement Index (DMI) has seen the ADX drop to 17.5, down significantly from 27.6 two days ago. The decline in ADX indicates the trend strength has weakened, meaning the previous downtrend has lost momentum.

Simultaneously, +DI has risen from 17.7 to 27.9 yesterday, while -DI has fallen from 30.5 to 20.5. These changes suggest increasing bullish momentum and decreasing selling pressure.

Bit (BTC) is currently attempting to transition from a downtrend to an uptrend, and the movement of the DMI lines indicates buyers are starting to regain control.

The ADX, or Average Directional Index, measures trend strength rather than direction. Values above 25 indicate a strong trend, while values below 20 suggest a weak or uncertain market.

With the current ADX at 17.5, the current price movement of Bit (BTC) lacks a strong trend confirmation, making the next move important.

However, the rising +DI and falling -DI suggest increasing bullish pressure. If the ADX rises again and the gap between +DI and -DI widens in favor of buyers, Bit (BTC) could establish a new uptrend.

Conversely, if the ADX remains low, the price action may lack the necessary strength for a decisive breakout, leading to high volatility.

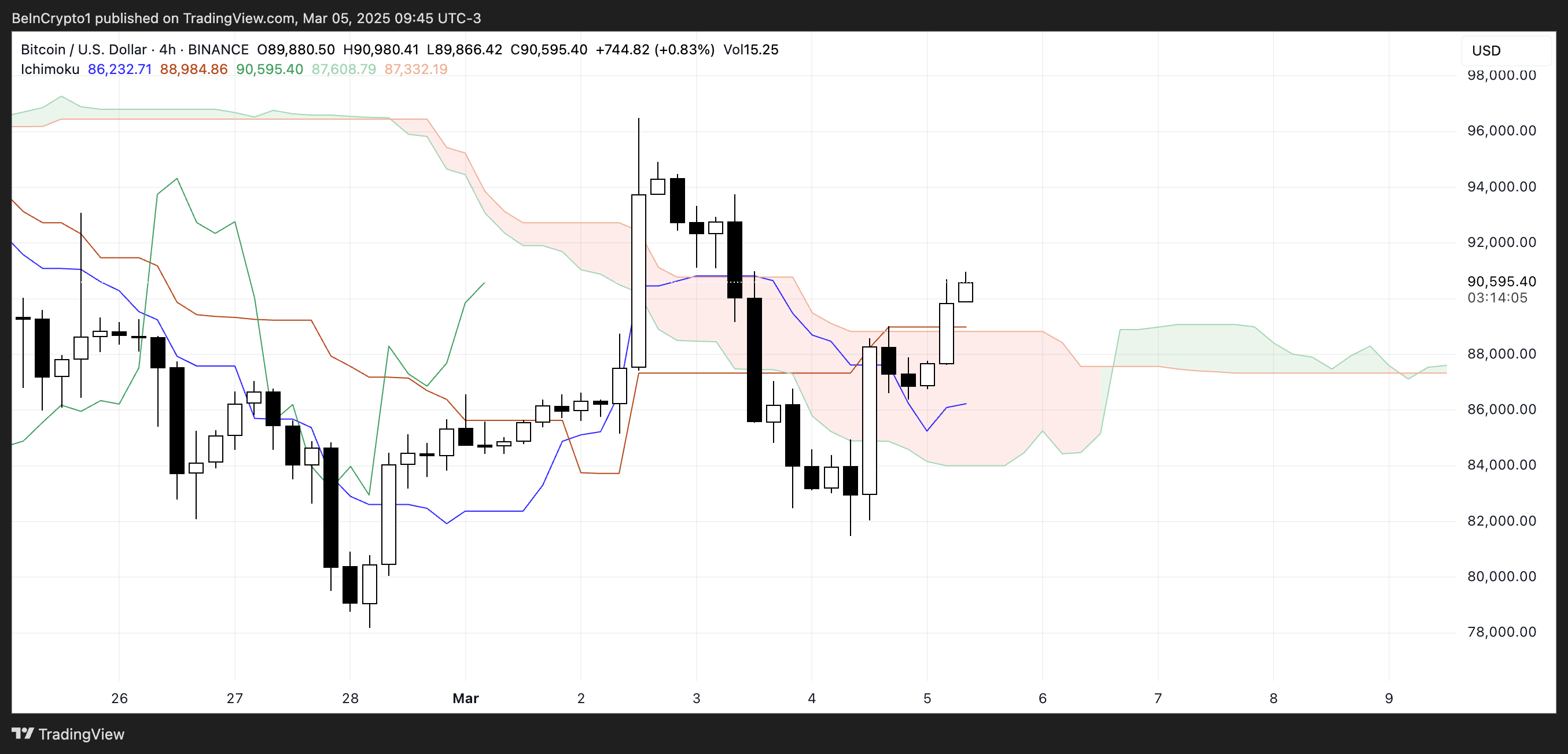

Bit (BTC) Ichimoku Cloud, Potential Momentum Shift

The Ichimoku Cloud structure for Bit (BTC) suggests a potential shift in momentum as the price has crossed above key levels. The price has recently crossed above the red baseline, indicating increasing bullish pressure. However, it is still interacting with the cloud, which represents an area of uncertainty where the trend is often tested.

The green leading Span A has started to slope upwards, while the orange leading Span B has remained relatively flat, suggesting the upcoming cloud may turn into a potential support area.

Additionally, the lagging span (green line) is approaching the 26-period price movement, implying Bit (BTC) is determining if this breakout has enough strength to continue.

The Ichimoku Cloud is a dynamic indicator that highlights trend direction, momentum, and key support and resistance areas. A decisive move above the cloud could confirm a stronger bullish trend, allowing Bit (BTC) to establish a clearer uptrend.

However, if the price fails to maintain above the red baseline and re-enters the cloud, it may signal a correction or a retest of lower levels.

The current setup suggests Bit (BTC) is at an important juncture. If the momentum continues, it could lead to a breakout, but hesitation around the cloud could result in a consolidation phase before a clear trend emerges.

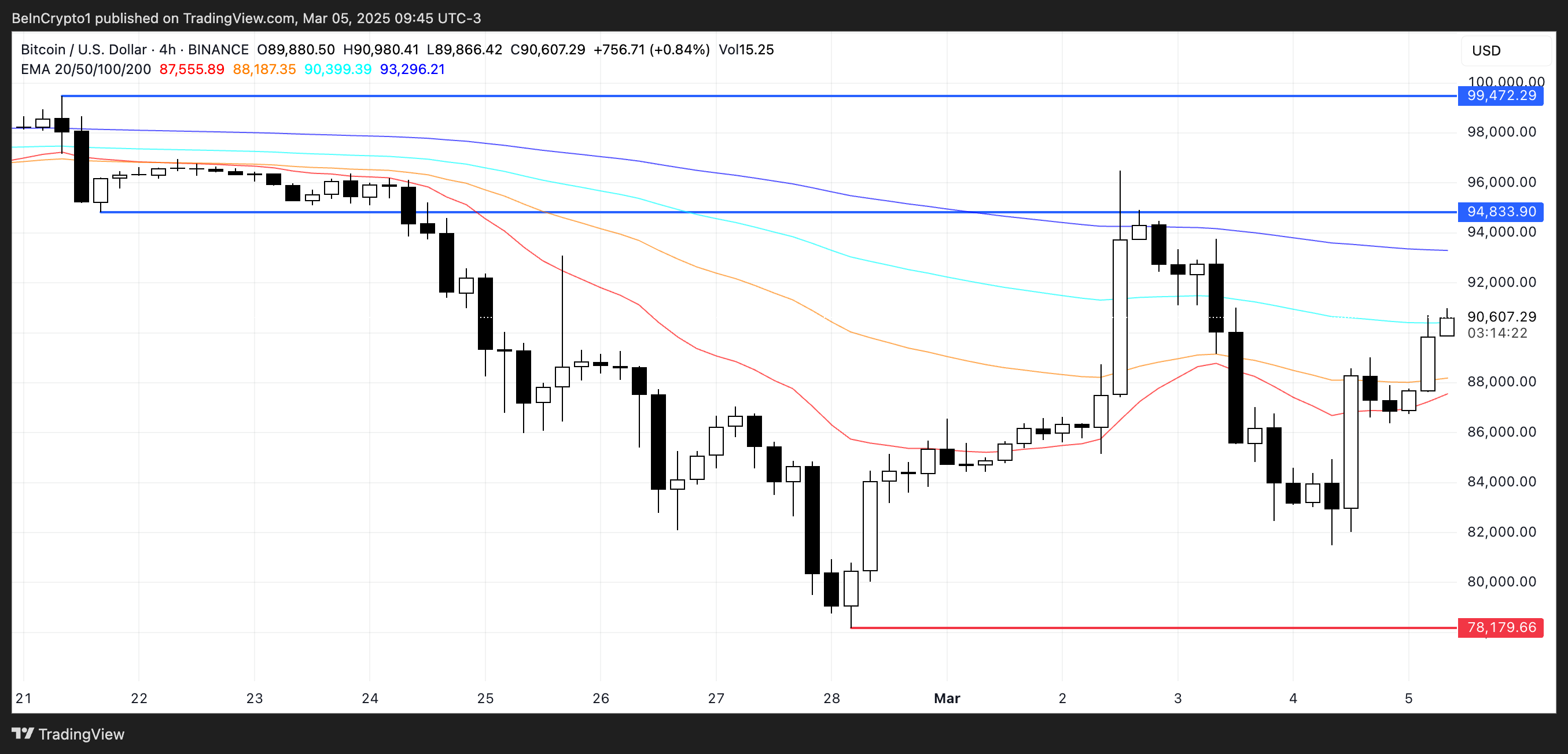

Bit (BTC) Reaction After the White House Cryptocurrency Summit

Bit (BTC) has recovered to the $90,000 level as speculation about potential special treatment for Bit (BTC) in Trump's proposed U.S. cryptocurrency preparedness plan has increased.

This new bullish momentum puts BTC in a position to test the key $94,833 resistance. A breakout above this level could lead to a rally towards $94,472.

If the bullish sentiment continues to build, Bit (BTC) could surpass $100,000 for the first time since February 3rd, which would be a significant milestone.

The overall trend depends on whether the buying pressure is strong enough to maintain the current momentum and overcome these critical levels.

However, Bit's (BTC) recent price action has been highly volatile, with strong bidirectional swings over the past few weeks.

The market uncertainty surrounding the upcoming White House cryptocurrency summit adds additional risk on March 7th. If the developments fail to meet investor expectations, a downtrend could resume.

If the bearish pressure strengthens, Bit (BTC) could experience a sharp decline, potentially falling as low as $78,179.