Donald Trump signed an executive order to keep his promise and establish a separate U.S. digital asset stockpile and a strategic Bit reserve.

Some industry figures praised the order, but others are skeptical. They argue that this initiative is merely a rebranding of existing government-held assets and lacks a substantive new strategy.

Donald Trump Orders Bit Reserve Strategy

The order directs the U.S. Treasury to fund the strategic Bit reserve initially with BTC seized through criminal and civil asset forfeitures. The administration has promised not to sell these assets.

"Bit, as the original cryptocurrency, is referred to as 'digital gold' due to its scarcity and security. With a fixed supply of 21 million coins, being one of the first countries to establish a strategic Bit reserve provides a strategic advantage." – the order

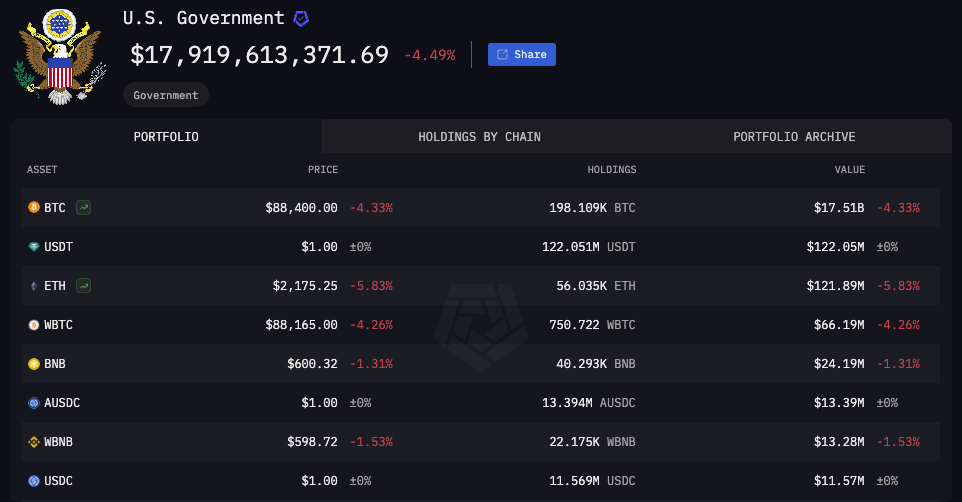

According to Acam Intelligence data, the U.S. government holds 198,109 BTC in public wallets, worth around $17.5 billion at current market prices.

Despite this substantial holding, David Sacks, the White House AI and Crypto Czar, noted that a comprehensive audit of the government's digital assets has never been conducted. The new executive order mandates this accounting.

"U.S. taxpayers have already lost over $1.7 billion in value due to early Bit sales. Now the federal government will have a strategy to maximize the value of its held assets." – he wrote.

It also allows for the possibility of further acquiring Bit through budget-neutral strategies. However, critics argue that the reserve will not have a substantive impact.

Industry Experts Divided on Bit Strategic Reserve

Jacob Kinge, the founder of Whaleswire, dismissed the recent attention on the reserve.

"In reality, this has existed for over a decade. They are just putting a fancy title on it to appease Bit supporters." – he mentioned.

Kinge also pointed out that the reserve will not include new Bit purchases. Therefore, he believes this move is not significantly important in the big picture of the market.

Peter Schiff, a vocal Bit critic, also weighed in on the order. According to Schiff, this move was made under pressure from cabinet members conflicting with donors.

He described the order as a "fake" attempt by the government to profit from the Bit it already holds.

"If they seize more Bit, they can hold that too. But they can no longer buy any, because buying requires payment by definition." – Schiff posted.

Despite the criticism, some industry leaders see this order as an important step in legitimizing Bit on the global stage.

"The ultimate goal was not for the U.S. government to buy all the Bit in the world." – Ryan Rasmussen, Head of Research at Bitwise, he said.

Rasmussen explained that this move could spur other countries to purchase Bit. He also expects it to pressure asset managers, financial institutions, pensions, and endowments to adopt cryptocurrencies.

Rasmussen said this reserve could allay concerns about the government selling its held assets and open the door for future additional acquisitions. He added that this move could increase the likelihood of U.S. states adopting Bit.

Matt Hougan, the CIO of Bitwise, agreed. He pointed out that this order could significantly reduce the possibility of future Bit bans. Hougan added that this reserve could,

"accelerate the pace at which other countries consider strategic Bit reserves. This creates a short-term window where they can get ahead of potential additional U.S. purchases."

Analyst Nick Carter also praised the decision, evaluating it as a successful execution of a major campaign promise. He emphasized that Bit has received official U.S. government endorsement that is not granted to other cryptocurrencies. Carter stressed that this initiative was shielded from backlash by not using taxpayer funds.

"The announcement couldn't have been better," he argued.

The executive order signing came a day before the White House Crypto Summit. Initially, Trump was expected to sign the Bit reserve order at the summit, which had boosted Bit prices. However, the actual signing led to a decline in the value of cryptocurrencies.

After briefly recovering that level on March 5th, Bit has fallen back below $90,000. At the time of reporting, Bit is trading at $87,469, down 4.5% in the last 24 hours.