The Bit price fell below $85,000 during early Asian trading on Friday. This is a market reaction to the latest executive order by US President Donald Trump for strategic Bit stockpiling.

This announcement was intended to strengthen the role of Bit in the national economy, but it has triggered volatility. Liquidations exceeded $250 million over the past 24 hours.

Trump's Bit move triggers liquidations

On Thursday, President Trump signed an executive order for strategic Bit stockpiling. However, contrary to expectations, the market reaction was not bullish. Traders hastily sold their held assets, triggering a drop in the value of Bit.

During early Asian trading on Friday, Bit plummeted to $84,667. The price has rebounded slightly, but it is still down 5% over the past 24 hours.

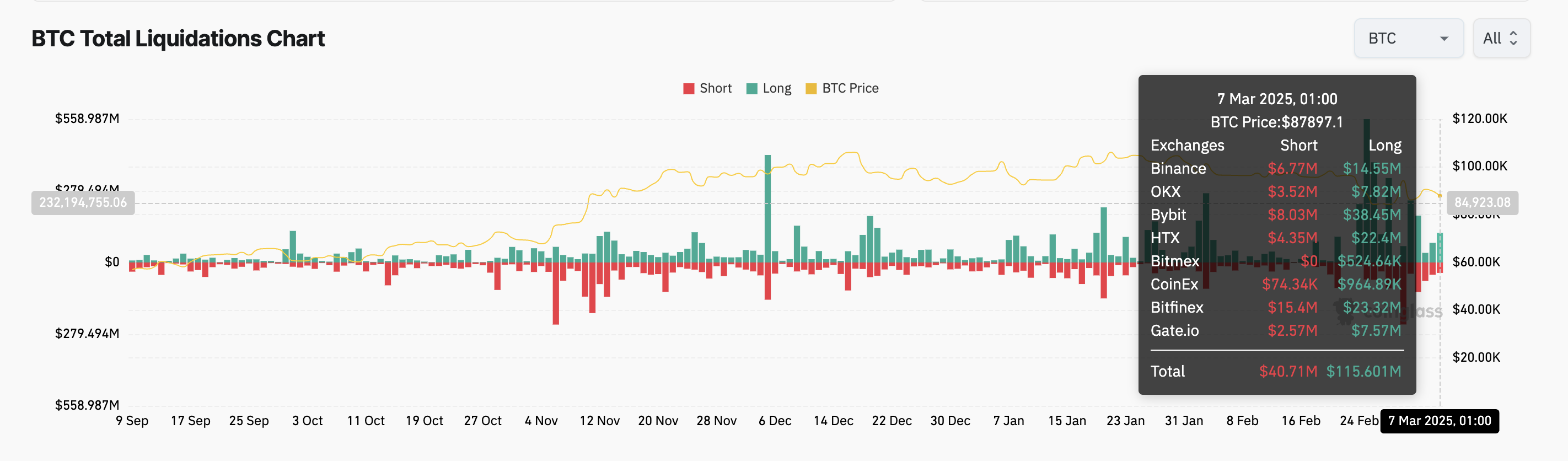

This price decline has triggered a wave of liquidations in the Bit futures market. According to CoinGlass data, a total of $261 million was liquidated over the past 24 hours.

On-chain data shows that most of the losses occurred in long positions, indicating that traders who had anticipated a price increase were caught off guard by the sudden drop. According to CoinGlass, Bit long liquidations currently stand at $115.6 million, the highest in 3 days.

Long liquidations occur when traders with long positions are forced to sell their assets at lower prices to cover their losses as the price declines. This typically happens when the asset price falls below a certain critical threshold.

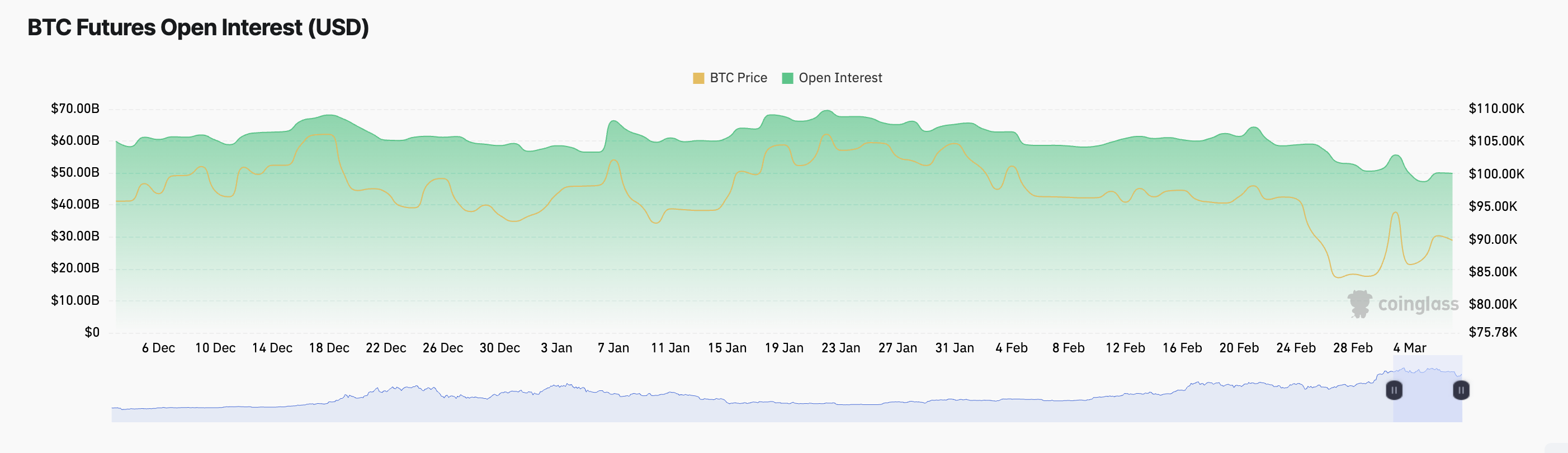

Furthermore, the decrease in Bit's open interest emphasizes that trading activity has declined since Trump's executive order. It is currently at $50 billion, a 5% drop over the past 24 hours.

An asset's open interest measures the total number of outstanding derivative contracts. When it decreases along with the price decline, traders are closing their existing positions rather than opening new ones. This suggests a weakening of market confidence among Bit holders and implies the possibility of a long-term downtrend.

BTC declines ahead of Crypto.com Summit

The drop in Bit occurred just hours before the scheduled Crypto.com Summit today. If demand remains stagnant and the downtrend continues, the coin's price may test the support level formed at $85,357.

If the bulls fail to defend this level, the coin may continue its downward trend over the next few days, potentially reaching $80,580.

However, if the bulls regain strength, this bearish forecast will be invalidated. With new demand entering the market, the BTC price could bounce back above $90,000 and trade around $92,247.