The price of Solana has experienced significant volatility in the past week due to recent market issues. This seems to have dampened the sentiment in the futures market, with leveraged traders appearing reluctant to take long positions.

This lack of confidence is increasing the risk of further price declines, and SOL is showing signs of potentially dropping below $130 in the short term.

SOL Perpetual Futures Struggle as Traders Depart

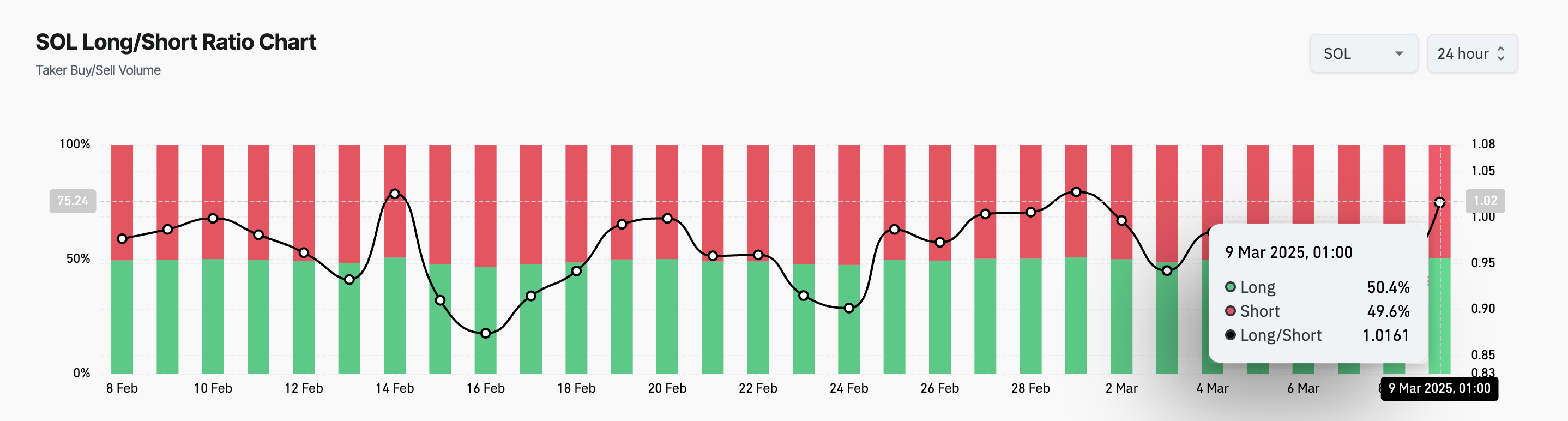

The negative funding rate of SOL indicates a weakening of the bullish bias among futures traders.

According to Coinglass data, the SOL perpetual futures have maintained a negative funding rate over the past 3 days, suggesting that short sellers are paying a cost to maintain their positions. The current rate is -0.0060%.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts, used to align the contract price with the spot market.

In the case of SOL, a negative rate indicates that short sellers are paying a fee to long traders, reflecting a bearish sentiment in the market.

This suggests that more traders are positioning for a price decline, adding downward pressure on the coin's price.

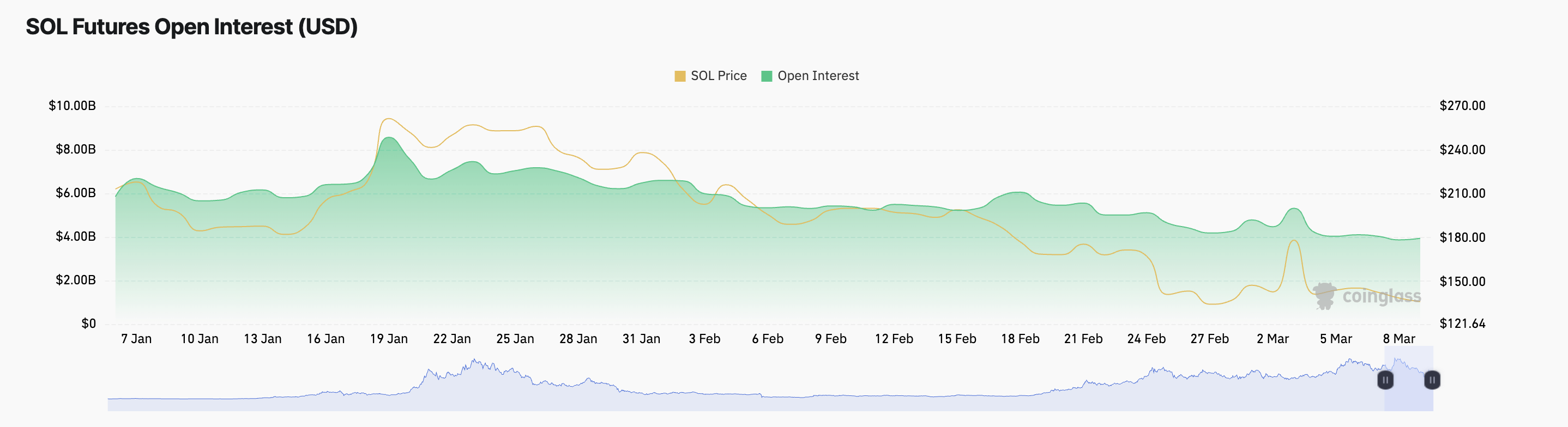

Moreover, the lack of confidence among SOL futures traders is reflected in the plummeting open interest. The current figure stands at $3.94 billion, a 19% drop since early March.

The open interest of an asset tracks the total number of active futures contracts that have not yet been settled.

A decline in this metric, especially during periods of price decline, suggests that traders are closing their existing positions rather than opening new ones, indicating a waning confidence in SOL's short-term price recovery among futures traders.

Solana Bullishness Wanes... Could it Drop Below $130?

Currently, SOL is trading at $137.70, just above the $136.62 support level. As the bullish sentiment weakens, this level is at risk of turning into a resistance area.

In this case, the price of SOL could drop below $130, potentially reaching $120.72.

However, if the SOL market regains bullish momentum, this bearish forecast would be invalidated. In this scenario, new demand could push the coin's price up to $182.31.