Solana has experienced a sharp decline, falling to its lowest level in months amid broader market weakness. The persistent downtrend in altcoins has been exacerbated by recent technical indicators, making a recovery uncertain.

Solana's future price movement will largely depend on Bitcoin's performance. If Bitcoin rebounds, it could support the recovery of SOL.

Solana's long-term holder sentiment is quite uneasy

Solana's long-term holder net unrealized profit/loss (LTH NUPL) has entered the fear zone, indicating increasing market unease. Currently at a 16-month low, this metric reflects the impact of the broader market downturn on SOL investors. As long-term holders incur increasing losses, there is a possibility of significant selling pressure, which could lead to further downside risks.

The sentiment among these investors could also affect retail traders if fear spreads. Widespread selling could amplify the downward pressure and make it difficult for SOL to recover. Unless Bitcoin stabilizes and the market situation improves, investor confidence in Solana is likely to remain bearish in the short term.

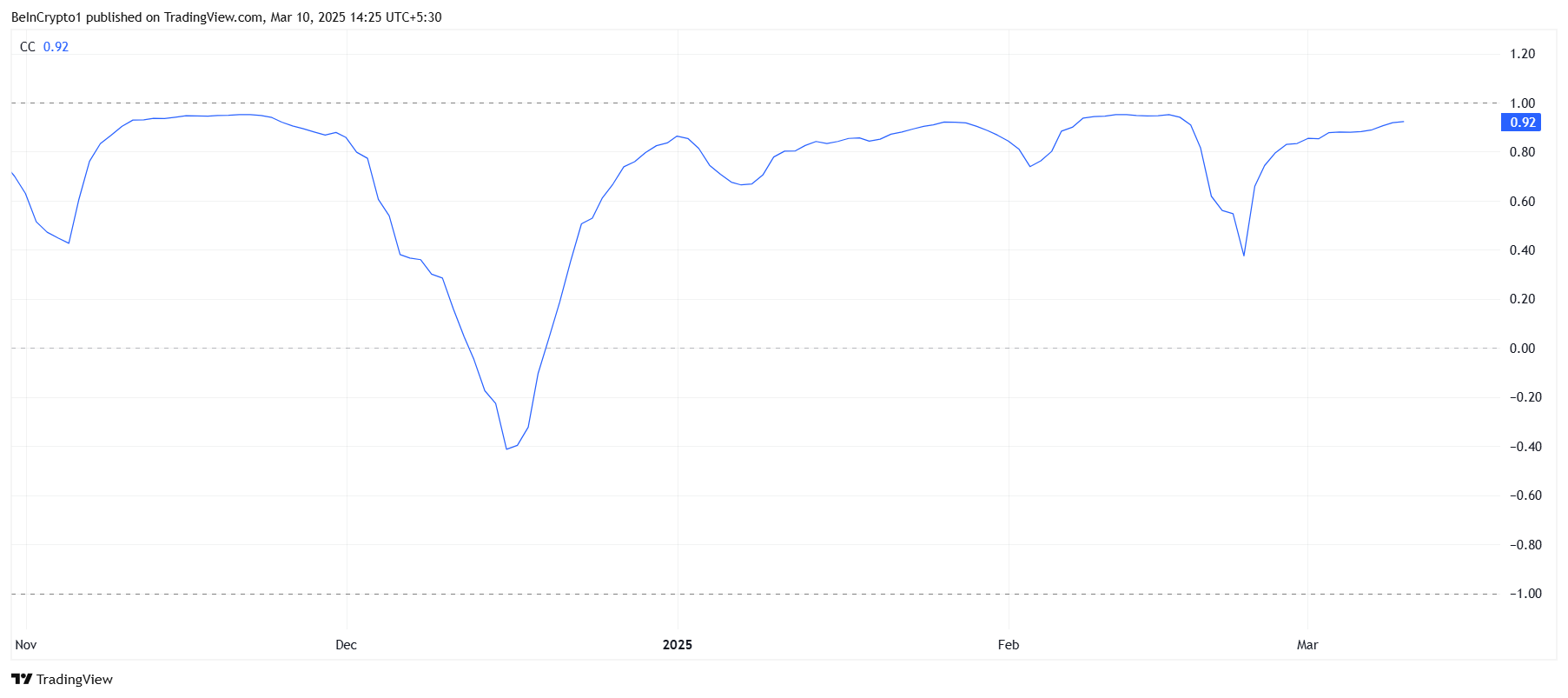

Solana maintains a strong correlation with Bitcoin, currently at 0.92. While high correlation generally indicates an uptrend, in the case of SOL, it reflects the downtrend. As Bitcoin struggles to maintain above $80,000, further weakness in Bitcoin could also pull down Solana.

If Bitcoin fails to regain momentum, Solana's price may experience additional losses. The altcoin's dependence on Bitcoin's stability adds to its vulnerability. Until Bitcoin recovers its key support levels, SOL's macroeconomic momentum is likely to remain bearish, with the downtrend continuing.

SOL price decline, hoping for a reversal on Bitcoin's rise

Solana's price has dropped 28% in the last 24 hours, trading at $128. The decline stems from the overall market weakness and the formation of a death cross on the SOL chart last week. This technical pattern suggests the downtrend may continue unless strong buying pressure emerges.

Currently, SOL is attempting to stabilize above $120. However, if the market conditions do not improve, the altcoin risks breaching the crucial support at $128. Failure to maintain this level could accelerate losses, leading to deeper corrections.

Conversely, if investors capitalize on the low prices and start buying, SOL could recover to the $137 support level. Successfully breaking above this level could open the door to a potential rally towards $155, invalidating the bearish outlook. Market sentiment and the path of Bitcoin remain crucial for Solana's recovery.