The price of Ethereum fell by 13% last week. During early Asian hours on Monday, major altcoins plunged to $1,997, the lowest level since December 2023.

As the downtrend intensifies, cryptocurrencies may soon dip below the crucial $2,000 support level.

Surge in ETH Selling... 50% of Holders at a Loss

An analysis of the ETH/USD chart shows the altcoin trading below the Ichimoku Cloud, a trend that has persisted since January 25.

At the time of reporting, the leading Span A (green) and B (red) are forming dynamic resistance above the altcoin's price at $2,346 and $2,742, respectively.

The Ichimoku Cloud tracks the market momentum of an asset and identifies potential support/resistance levels. When the price trades above this cloud, the market is in an uptrend.

Conversely, when the asset's price falls below the cloud, the market is in a downtrend. In this case, the cloud is acting as a dynamic resistance zone above ETH's price. If the coin's price remains below it, the downtrend is likely to continue.

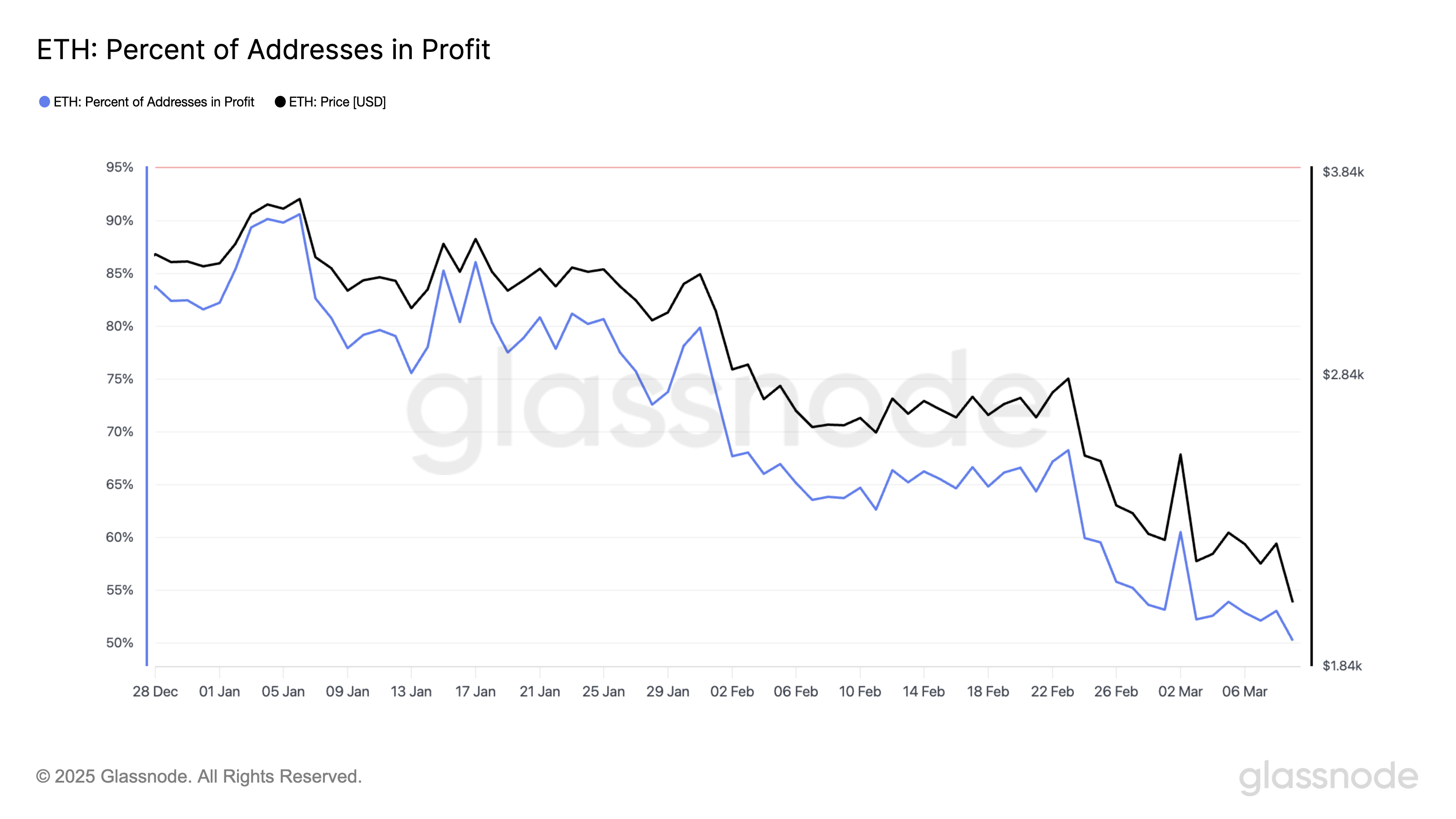

Furthermore, ETH's declining price has pushed many holders into losses. According to Glassnode, the percentage of ETH wallet addresses with an average purchase price below the current price has dropped to a yearly low of 50%.

ETH Percent of Addresses in Profit. Source: Glassnode

This means that only 50% of all addresses holding ETH are currently in profit. For context, this figure was 82% at the start of the year. This trend could exacerbate selling pressure among ETH traders, as many seek to minimize their losses by offloading their holdings.

Increased selling could further drive down the price of ETH. This could reinforce the downtrend and trigger more stop-loss selling.

Ethereum's Next Move: $1,924 Breakdown or $2,500 Breakout?

The $2,000 support for ETH may not hold if the selling pressure persists, leading to further losses. Readings from the Fibonacci retracement tool suggest that if demand weakens further, the coin's price could drop to $1,924.

However, this bearish forecast could be invalidated if market sentiment turns positive. If ETH witnesses a resurgence of new demand, it could propel the price to $2,224. If the coin can establish this level as support, it could then push ETH's price into the $2,500 region.