BTC Whales, Predicted BTC Decline Following FOMC Rate Freeze

BTC 4,442, Betting on 40x Leverage Short Position

Expert: "Must Maintain $81,000 After Rate Announcement"

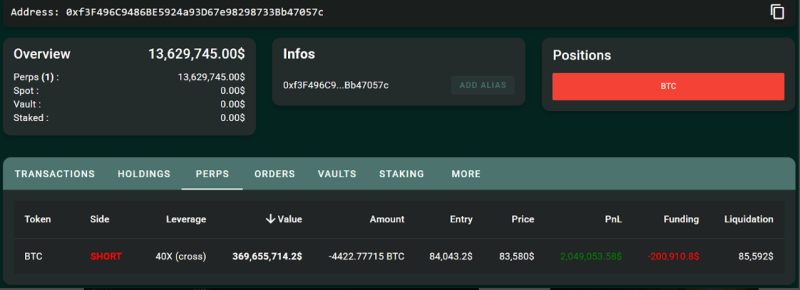

According to data from on-chain transaction tracker Hyperscan on the 16th, a 'BTC whale wallet' holding a large amount of BTC has bet on a 40x short (decline) position of about 4,442 BTC. The price of BTC that the BTC whale has bet on the short position is about $36.8 million (about 535.3 billion won).

The Fed has previously hinted at keeping interest rates unchanged this month through multiple interviews after the FOMC rate announcement last month. Based on the prediction that the Fed will announce the interest rate freeze at the FOMC meeting on the 19th, the BTC whale has taken a bold bet on the BTC decline.

According to the betting contract of the BTC whale wallet, if the price of BTC exceeds $85,592, the BTC in the wallet's bet will be liquidated.

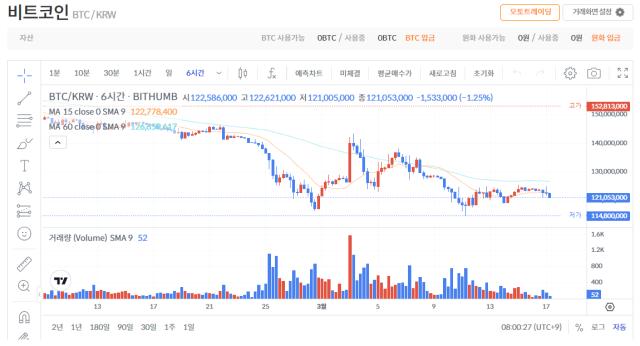

Meanwhile, as large volatility in the cryptocurrency market, including BTC, is expected due to the FOMC rate announcement, experts predict that BTC must defend the $81,000 level.

Ryan Ree, chief research officer at Bitget Research Team, said, "To avoid a large-scale decline after the FOMC meeting, the weekly closing price of BTC must be above $81,000. When analyzing the weekly chart of BTC, if BTC defends the $81,000 level, there is resilience, but if it is below, BTC could fall below $76,000 due to short-term selling pressure."

Reporter Kwon Seung-won ksw@blockstreet.co.kr