According to Chainalysis' 2025 Crypto Crime Report, dark net market (DNM) vendors are adapting their money laundering tactics. Centralized exchanges (CEXs) remain the primary cash-out method, but there has been a noticeable shift towards decentralized finance (DeFi) protocols.

In 2024, DeFi played an increasingly important role in storing, transferring, and obfuscating illicit cryptocurrency proceeds.

Dark Net Market Vendors Shift to DeFi

The increased use of DeFi occurred amid stricter regulations on centralized exchanges. Tighter know-your-customer (KYC) and anti-money laundering (AML) measures have made it more difficult for illicit actors to cash out. Additionally, law enforcement agencies have intensified their efforts and disrupted major money laundering networks, seizing assets.

In response, dark net market vendors are increasingly shifting their financial activities to decentralized platforms.

"Last year, DNM vendors sent far more funds to DeFi than they have historically," the report read.

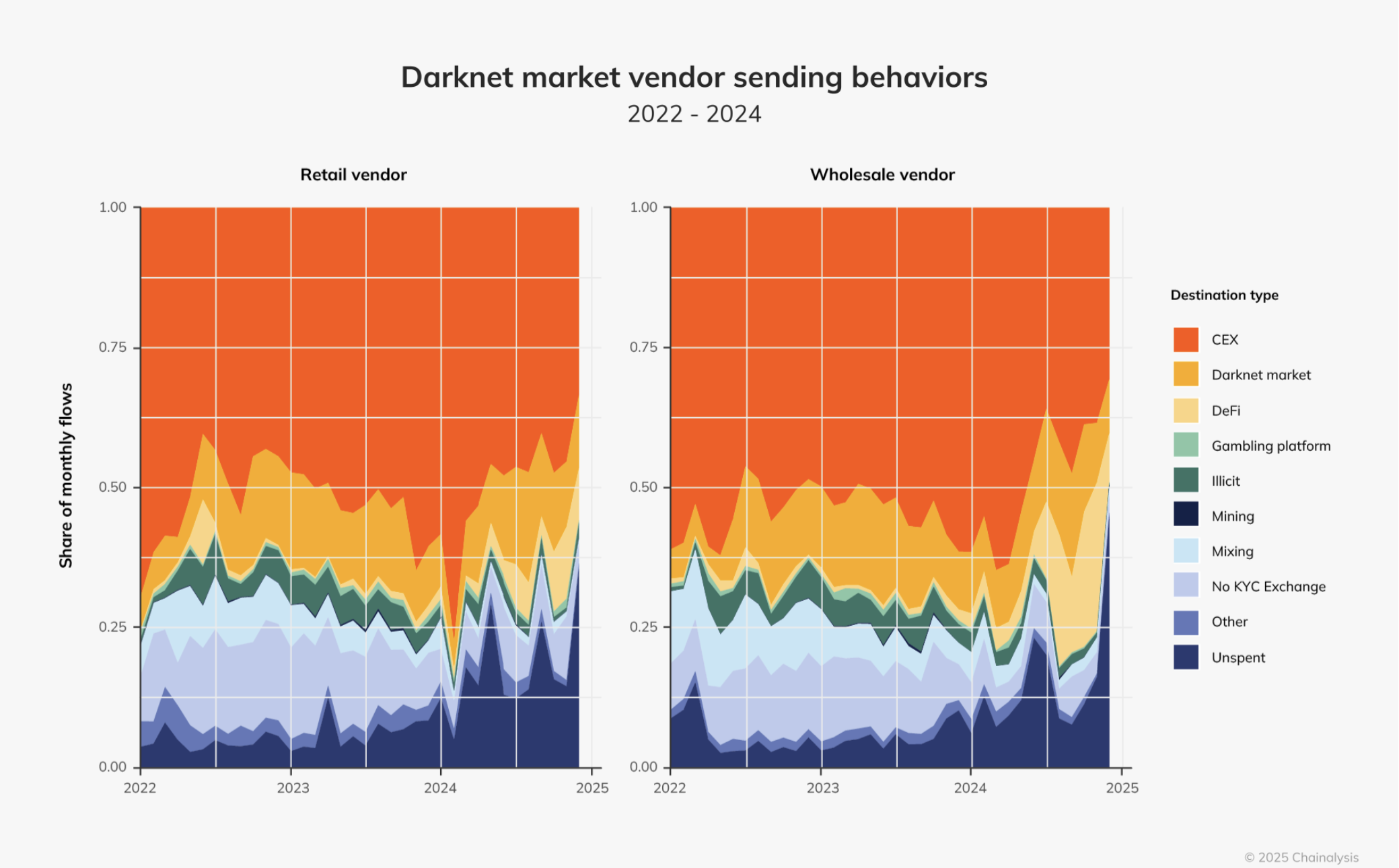

The change in vendor behavior is primarily driven by wholesale vendors. Meanwhile, smaller-scale retail vendors are holding more illicit proceeds in personal wallets and delaying conversion to fiat to evade detection.

Dark net market vendor fund allocation. Source: Chainalysis

This shift is not limited to dark net markets. Fraud proceeds are also increasingly moving through decentralized protocols.

"As fraud has increased across more blockchains, including Ethereum, TRON, and Solana, the use of DeFi protocols has also grown," the report noted.

While DeFi adoption is increasing among dark net vendors, it has not replaced centralized exchanges as the primary money laundering method. However, the trend is clear. Illicit actors are expanding their strategies, and enforcement agencies must evolve their tracing methods to keep up with increasingly sophisticated laundering techniques.

Another interesting trend is the shift in the assets used. As law enforcement has improved its ability to track BTC transactions, dark net market operators and vendors have been gravitating towards Monero (XMR), a privacy-focused cryptocurrency.

"As international authorities have disrupted large and small DNMs over the past few years, cybercriminals and drug dealers have directly experienced the consequences of operating DNMs that accept BTC. Many operators have since started accepting only Monero (XMR)," Chainalysis added.

Unlike BTC, which relies on a transparent public ledger, Monero offers built-in privacy features like ring signatures, stealth addresses, and confidential transactions, making it nearly impossible to trace the identities of senders and receivers.

The report also revealed that while the total cryptocurrency crime proceeds are on track to reach a record high, inflows to dark net markets and scam shops decreased in 2024. Total dark net market revenues fell from $2.3 billion in 2023 to $2 billion in 2024.