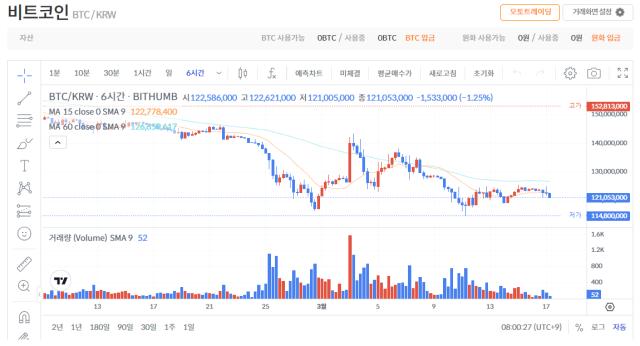

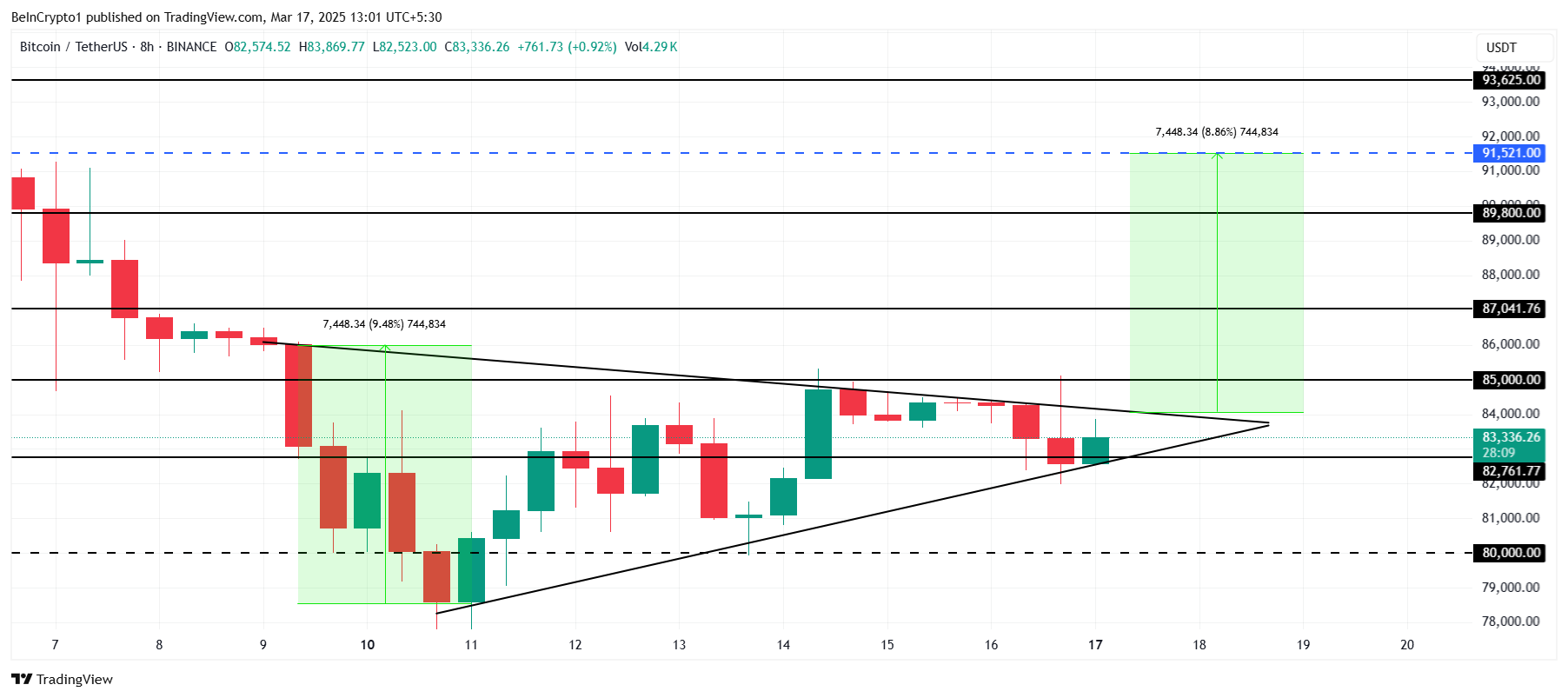

Bit is preparing a potential Longing that can pull the price above $91,000. Major cryptocurrencies are currently trading within a symmetric triangle, which suggests an upward potential.

However, this upward momentum is facing challenges as short-term holders adjust their positions and long-term holders apply selling pressure.

Bit holders, stable

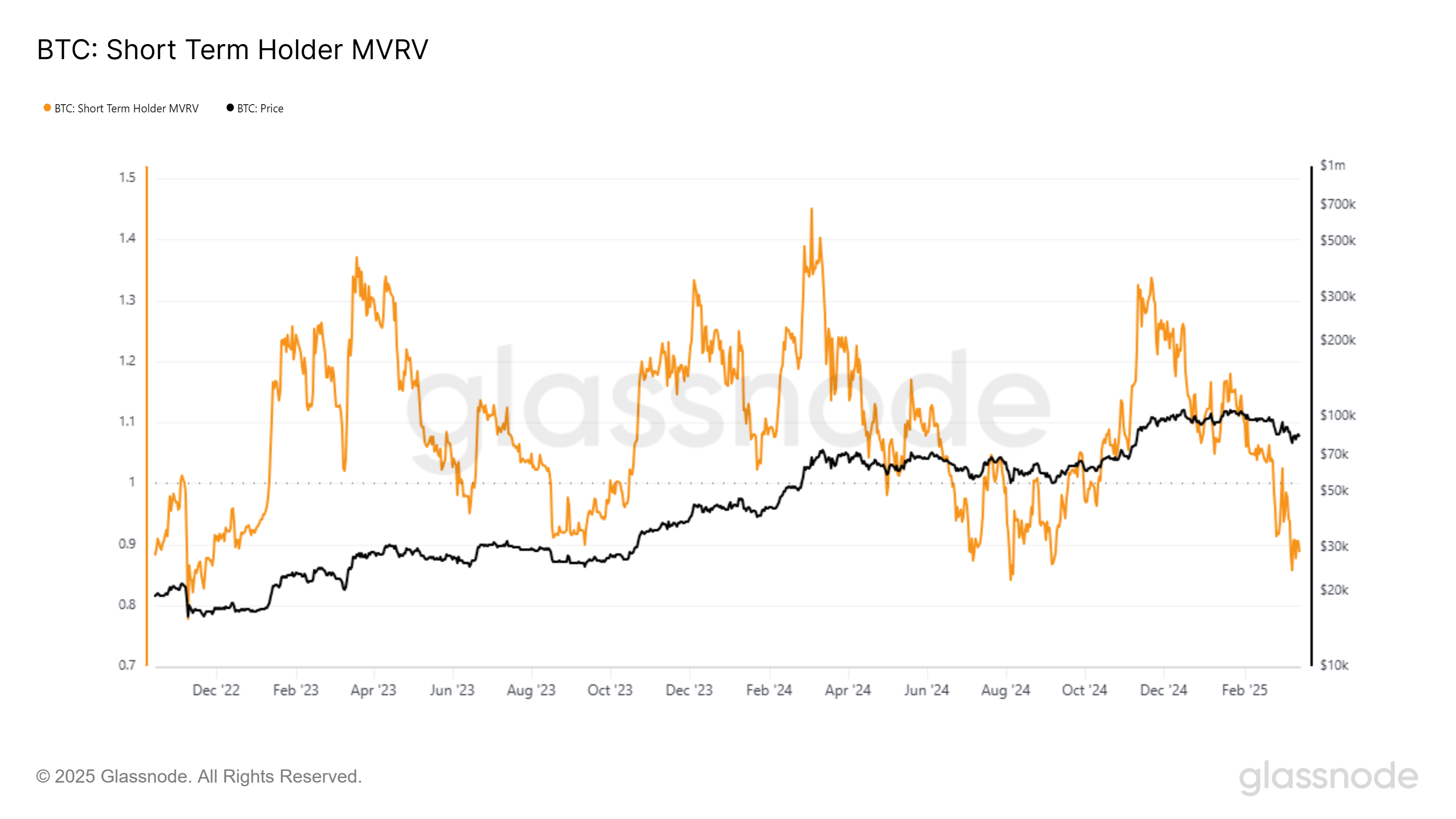

The short-term MVRV has fallen below 0.9, which is historically associated with the saturation point of short-term holder selling. This indicator often signals the end of the selling phase and a potential price reversal. If history repeats itself, Bit could soon see a resurgence of buying pressure, laying the foundation for a recovery.

Bit has shown a pattern of price rebounds when the short-term MVRV has dropped to such levels in the past. If the same trend continues, BTC could gain short-term upward momentum.

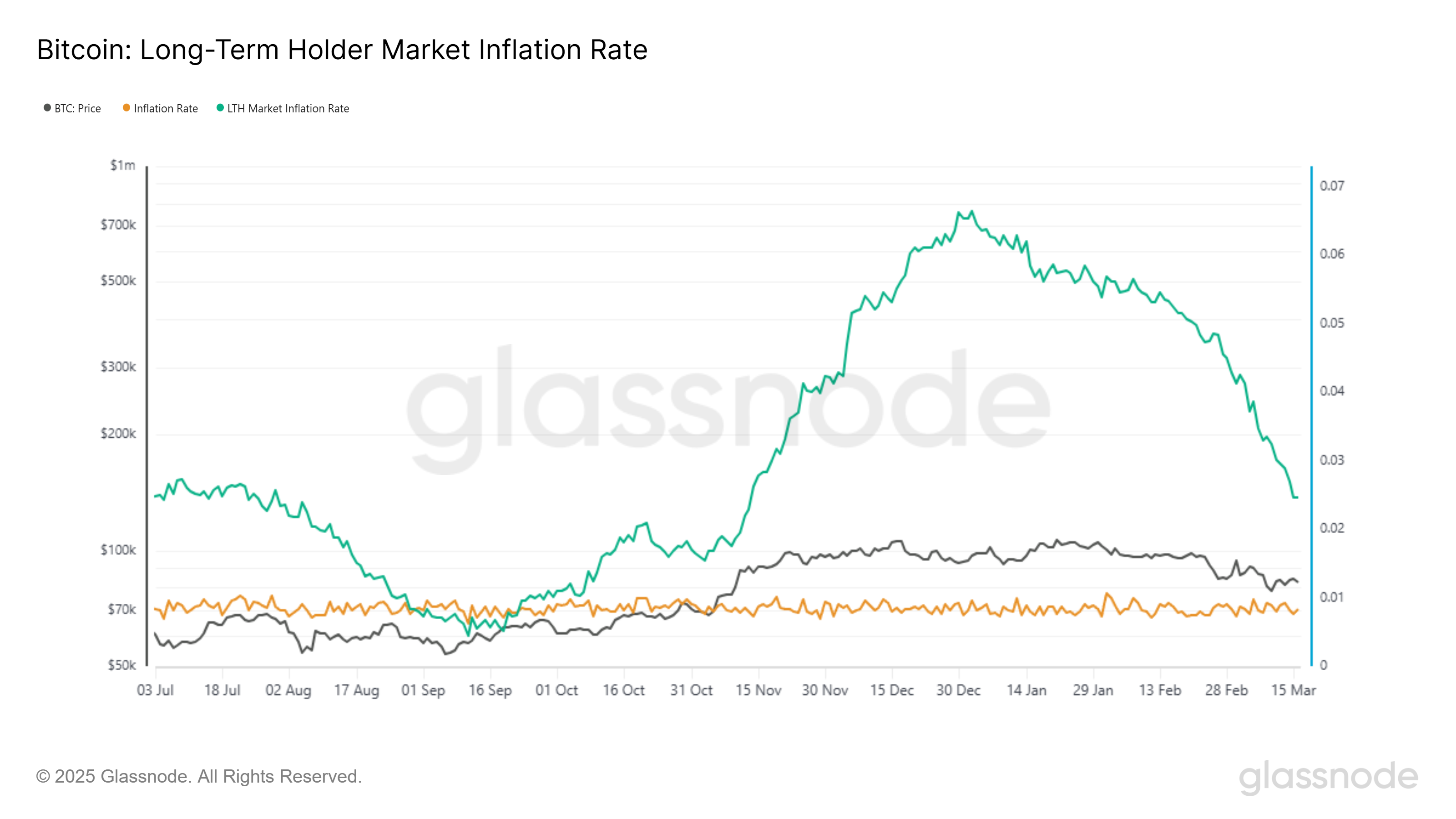

The Long-term holder market inflation rate measures the annual net accumulation or distribution rate of LTHs compared to the miner issuance. The current value of 0.025 indicates that LTHs are still applying selling pressure. This indicator is showing a downward trend, but it still influences the price movement of Bit.

If the Long-term holder market inflation rate falls below the miner issuance level (inflation rate of 0.008), the pressure on Bit's price will be alleviated. This change will increase the likelihood of BTC breaking through resistance, and allow the market to escape the volatility driven by LTH selling activity.

BTC price breakout imminent

Bit is currently trading at $83,336 and is above the crucial $82,761 support level. The symmetric triangle pattern suggests a potential 8.8% breakout, indicating that BTC could move higher in the coming days.

The breakout target of $91,521 is achievable if Bit can break above $85,000 and establish $87,041 as a support level. Achieving these milestones will bring Bit closer to recovering its recent losses and strengthen the positive outlook for cryptocurrencies.

However, if Bit fails to break above $85,000, it could retreat back to $82,761 or even drop to $80,000. This scenario would invalidate the upward pattern and introduce additional downside risk, delaying the short-term recovery.