The price of gold has reached a record high of $3,004 per ounce. This was triggered by heightened geopolitical tensions, rising inflation concerns, and a surge in demand for safe-haven assets.

This milestone has reignited speculation about whether Bit could experience a similar surge in global uncertainty.

Gold vs Bit, will Bit follow the historic rally of gold?

Gold broke through $3,000 for the first time on Friday, marking its 13th record high of the year. This rally has pushed the total market capitalization of precious metals beyond $20 trillion, according to CompaniesMarketCap.

Meanwhile, Bit has taken a different path. As macroeconomic conditions continue to weigh, its value has declined significantly.

Major cryptocurrencies are currently trading 23.3% below their all-time highs. Last month, they fell 14.5%. At the time of reporting, BTC was valued at $83,643, down 0.8% in the past 24 hours.

Despite Bit's short-term difficulties, analysts suggest it could follow a similar path to gold's historic rise.

In a recent X (formerly Twitter) post, an analyst compared the launch of the gold exchange-traded fund (ETF) in November 2004 to the expected launch of a Bit ETF in January 2024. He proposed that Bit could follow a similar price trajectory to gold after the ETF introduction.

The launch of the gold ETF made it easier for institutional and retail investors to gain exposure to gold. Over time, gold experienced periodic peaks and corrections, but maintained an overall upward trend.

According to the analysis, Bit appears to be following a similar pattern. If this trend continues, the Bit ETF could serve as a catalyst for institutional adoption and sustained price appreciation, allowing Bit to see a multi-year growth trajectory akin to gold.

Another market analyst agreed with this view, noting that gold and Bit are following a five-stage parabolic model. He predicted that Bit could soon experience a major breakout similar to gold's past performance.

"The future of Bit is written in gold! Gold followed this pattern before its breakout. Now Bit is following that movement," Merlijn wrote on X.

According to his forecast, Bit has completed the "fake-out" stage and is approaching a new all-time high. What is his bold prediction? A surge to $150,000 is "loading".

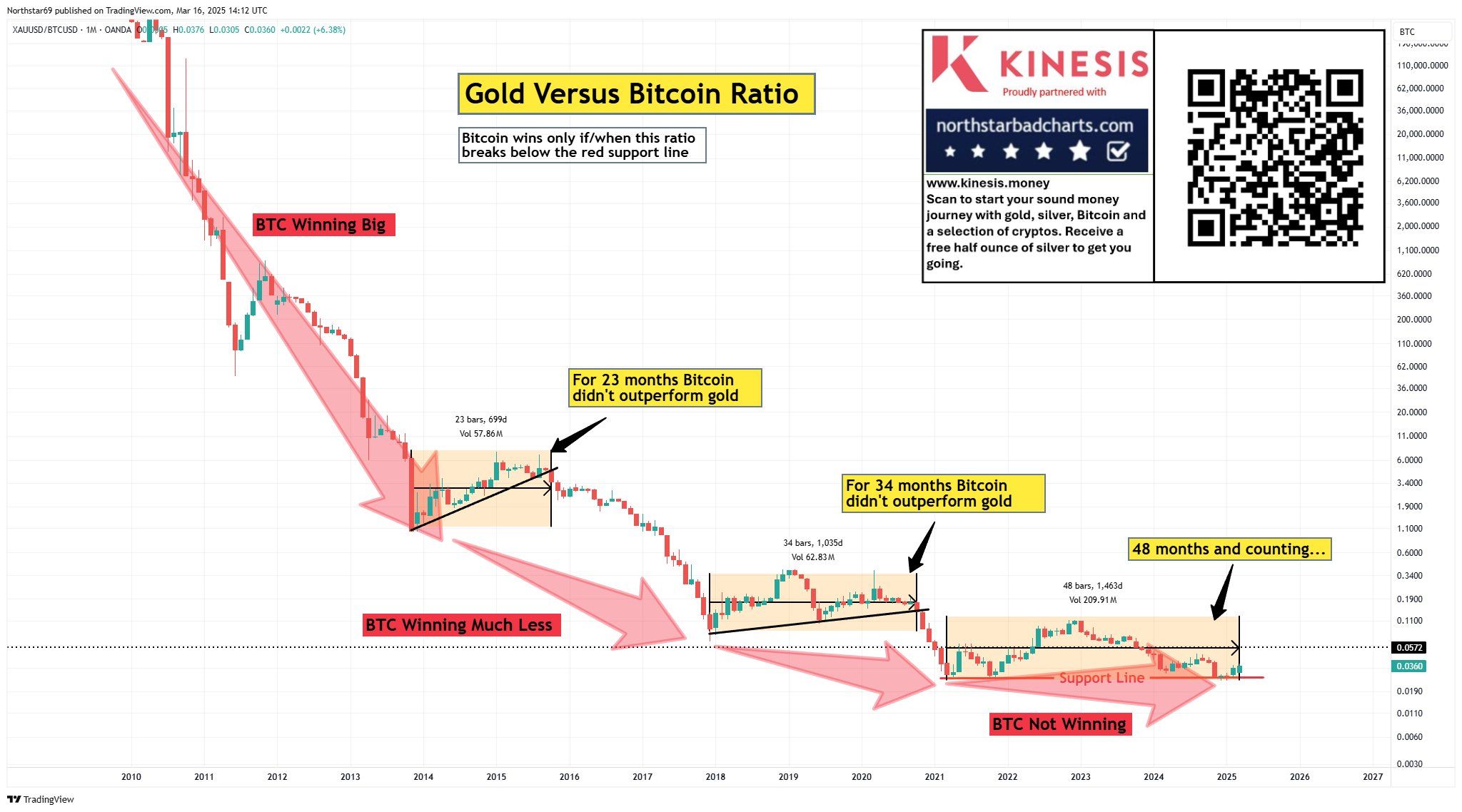

However, not all experts are convinced. Market analyst Northstar pointed to concerning trends in the gold/Bit ratio, which has been in a long-term downtrend. In fact, Bit has failed to outperform gold for four years, the longest period on record.

He warned that gold's breakout is not just about price appreciation, but also what it signals.

"Historically, when gold breaks out against stocks, it starts a capital rotation event that typically takes the NASDAQ down by around 80%. Unfortunately, Bit tracks the NASDAQ," the analyst noted.

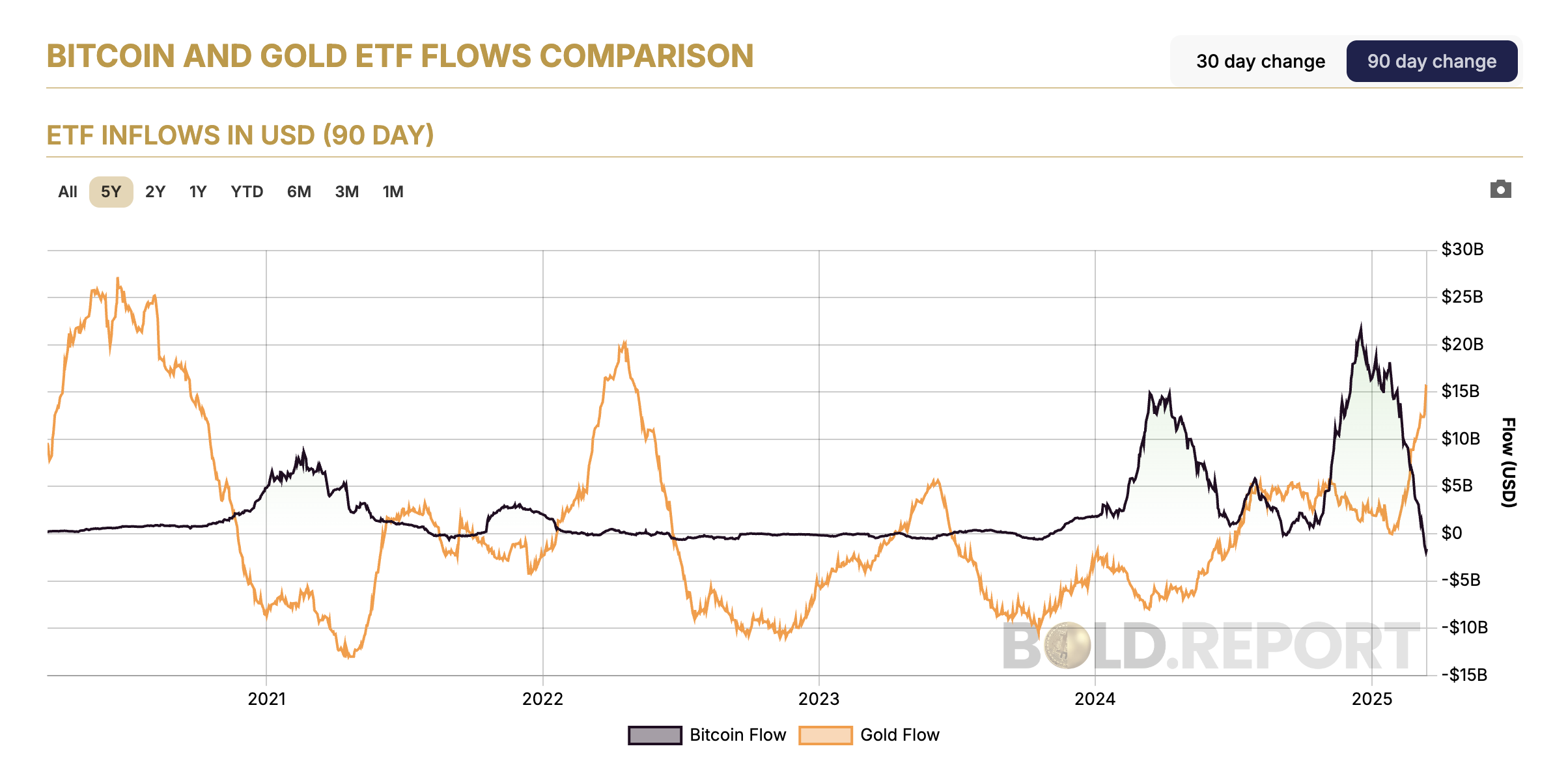

Adding to the skepticism, financial analyst Charlie Morris pointed out the difference in ETF flows. While gold-based funds have seen inflows amid the recent price surge, Bit ETFs have experienced significant outflows.

Bit is currently trading around $80,000. The next few months will be crucial in determining whether it will follow gold's trajectory or continue to underperform. The debate continues as to whether Bit will establish itself as a long-term store of value, or if gold's enduring appeal will continue to outshine the potential of digital assets.