XRP by Ripple rose nearly 10% last week. This was in line with the broader market uptrend. The fourth-largest cryptocurrency by market capitalization is currently trading at $2.33.

However, on-chain indicators suggest the token may be overvalued. This raises concerns about a potential price correction as traders look to realize their gains.

Overvaluation, Profit-Taking...Potential Downside

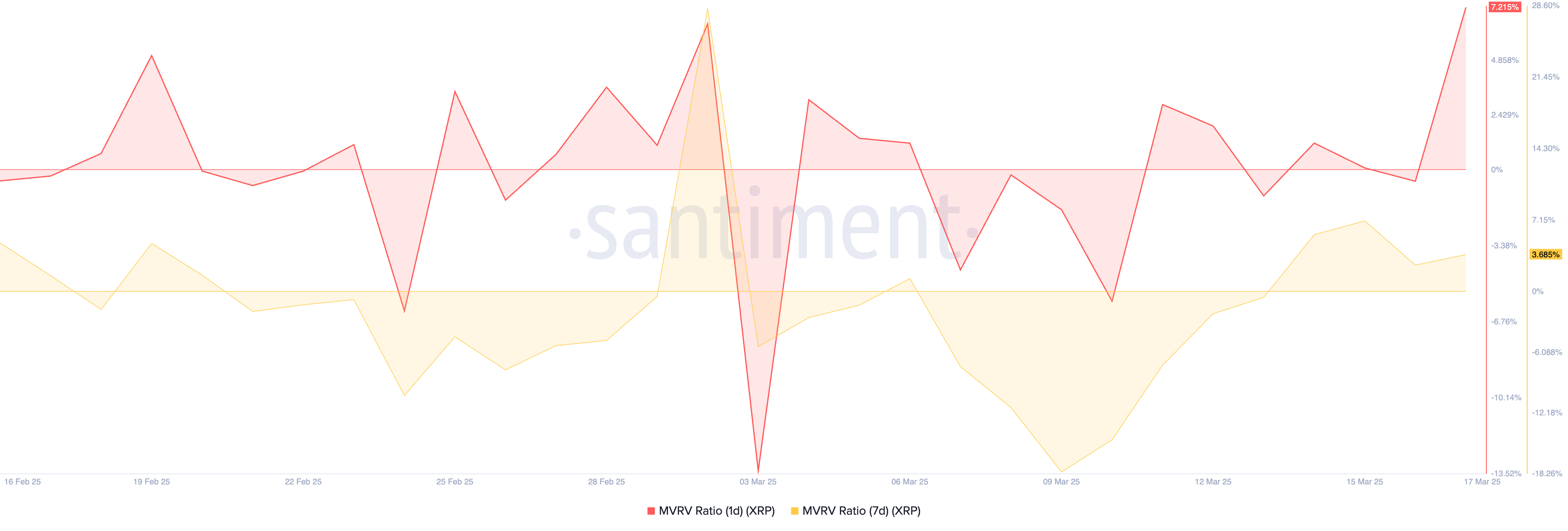

One of the key indicators flashing warning signals is XRP's market value to realized value (MVRV) ratio. This metric is measured using the 1-day and 7-day moving averages, which currently stand at 7.21% and 3.68% respectively.

The MVRV ratio measures the relationship between an asset's market value and its realized value. This helps identify whether an asset is overvalued or undervalued.

When an asset's MVRV ratio is negative, its market value is lower than its realized value. This suggests the coin is undervalued compared to the price people originally paid.

Conversely, when positive like XRP, the asset's market value is higher than its realized value. This implies it is overvalued.

This presents an opportunity for profit-taking for XRP investors who bought in at lower prices. They may see it as a chance to cash out before a potential correction, increasing selling pressure in the market. The more holders sell, the more XRP supply exceeds demand, putting downward pressure on the price.

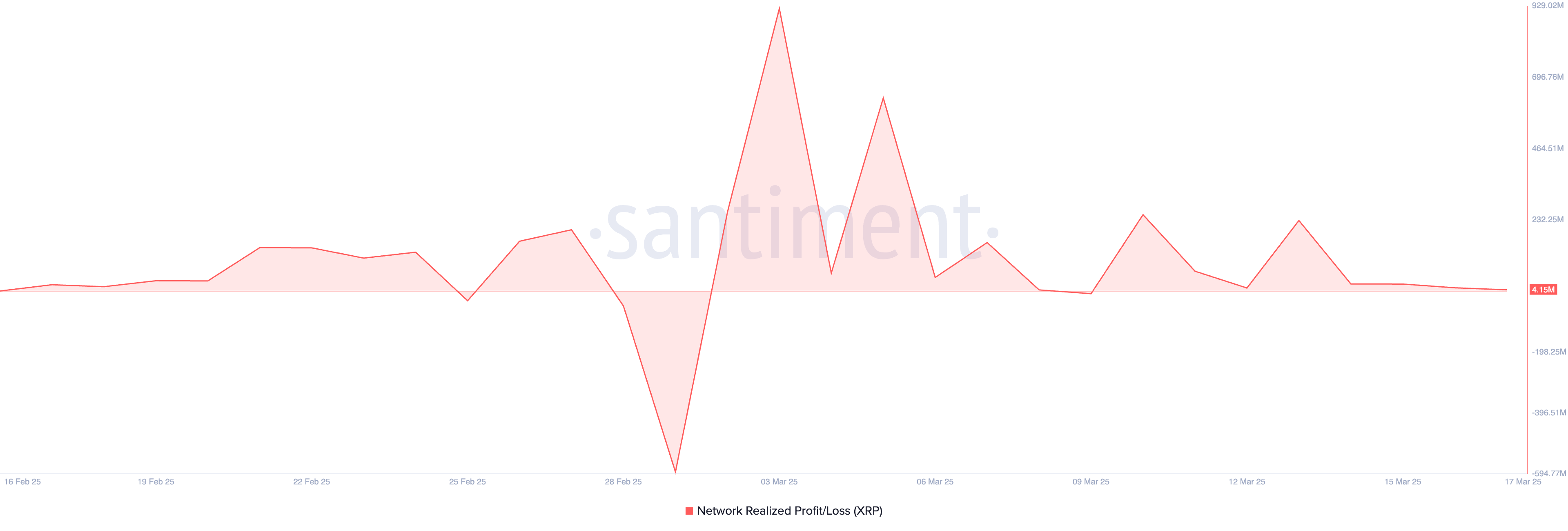

Additionally, the positive figures in the token's network realized profit/loss (NPL) lend support to this bearish outlook. At the time of reporting, this stood at $4.15 million.

NPL measures the difference between the price at which an asset was last moved or sold and its current market price. This tracks the profits or losses "realized" by coin holders.

When an asset's NPL is positive, it indicates more investors are selling at a profit. This trend can increase the supply of XRP in the market, and if demand fails to keep up with the selling, the asset's price could decline.

XRP Faces Selling Pressure...Further Downside?

XRP is trading at $2.30 at the time of reporting, recording a 3% price drop over the past day. As more traders take note of this sell signal and distribute their holdings for profits, the downward pressure on XRP will likely intensify.

In this case, the price could drop to $2.13. If buy-side support fails to defend this support, XRP could extend its decline to $1.47.

However, if profit-taking slows down, the altcoin could resume its uptrend and rise to $2.61.