The FOMC is scheduled to hold meetings tomorrow and the day after, which could have a significant impact on the cryptocurrency market. The market is on the verge of a bearish trend, and an interest rate cut could spur further growth.

However, Federal Reserve Chairman Jerome Powell is not interested in such interest rate cuts. This is particularly due to issues such as inflation and tariffs. President Trump's personal intervention could be the best hope for interest rate cuts and a positive narrative.

Will the FOMC Decide the Fate of Cryptocurrencies?

The U.S. Federal Open Market Committee (FOMC) is scheduled to meet from March 18 to 19, which could have a significant impact on U.S. policy and the cryptocurrency market. Through this committee, the Federal Reserve will make major decisions regarding the U.S. economy, including whether to cut interest rates. Interest rate cuts are very positive for cryptocurrencies.

Earlier this year, Fed Chair Jerome Powell signaled that he has no plans to cut interest rates, which led to a cryptocurrency selloff. However, the FOMC is concerned about all sectors of the U.S. economy. Interest rate cuts are also related to inflation, and the threat of tariffs has already led some community members to believe that Powell will not budge.

However, the market is in a worrying state. The market was recently in a state of extreme fear, which has somewhat subsided. Despite an increase in consumer confidence, the cryptocurrency industry lacks a clear narrative to attract the average consumer. Avoiding disaster is not enough for the market to continue growing. However, a good narrative has not yet emerged.

In conclusion, the FOMC could be the biggest hope for cryptocurrencies. The cryptocurrency market experienced a major rally after Trump's election. However, this has stalled, and those gains have since disappeared. Cryptocurrencies are intertwined with the traditional market, and a bearish period could trigger a recession. The industry needs to find a way to regain investor confidence.

Will Trump's Intervention Change the Situation?

In other words, the FOMC could provide a crucial lifeline for the cryptocurrency industry. A recent U.S. CPI report revealed that inflation was lower than expected, which boosted the cryptocurrency market. This data could convince Powell that the U.S. economy can withstand another interest rate cut. However, the industry does not expect this report to make a difference.

Instead, President Trump can use his considerable influence. He has already voiced support for interest rate cuts. Trump has described himself as the "Cryptocurrency President," and his administration has aligned with the industry. He can also influence the FOMC.

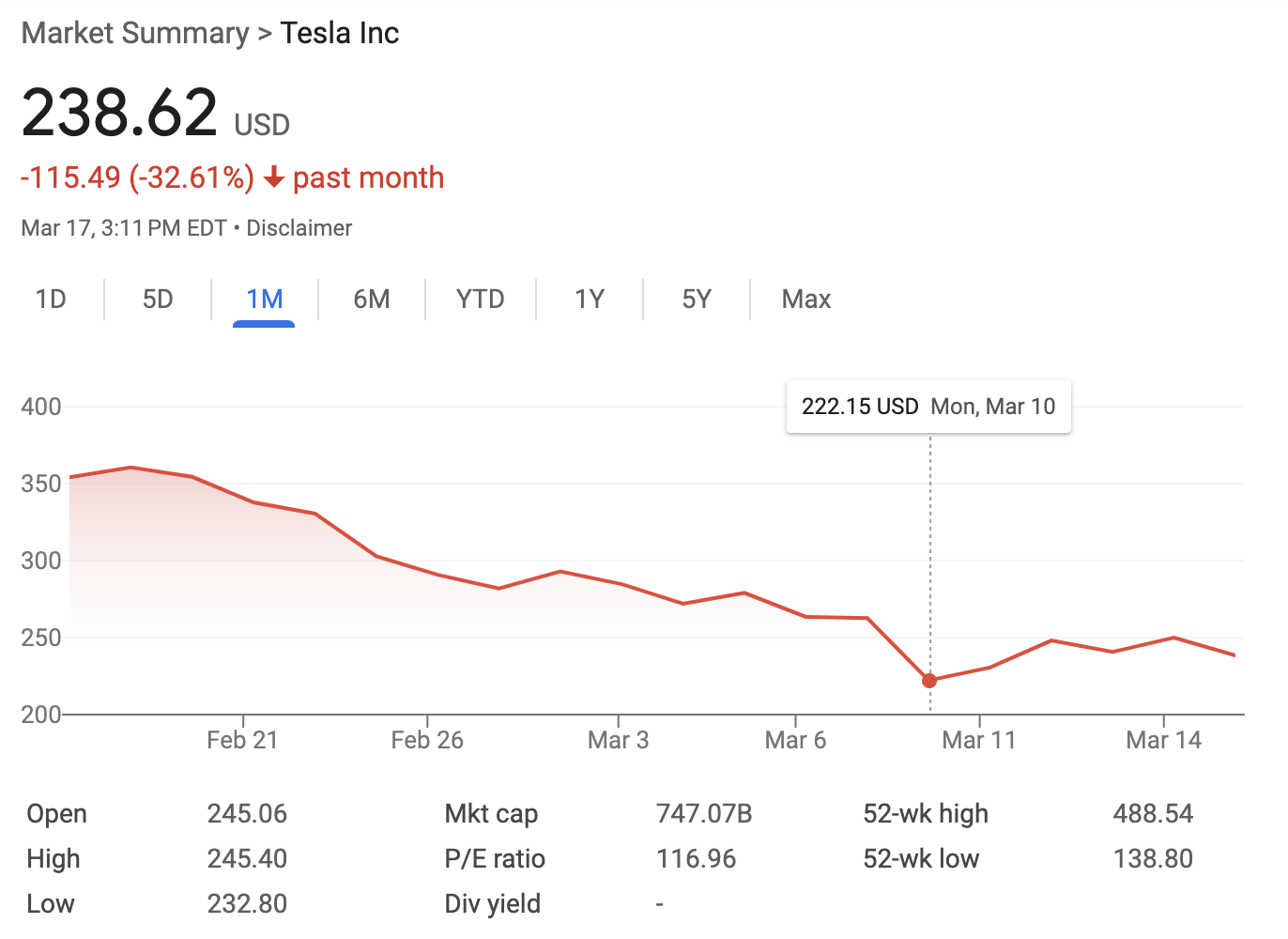

As an example of how this could work, consider Trump's recent Tesla product display. Tesla's stock price was declining, and there was a belief that its valuation could collapse. However, after Trump expressed his prominent support on March 10, Tesla's stock price rebounded. Tesla is also deeply intertwined with the cryptocurrency market.

In other words, President Trump is well aware of the impact that market narratives can have on asset prices, and he is prepared to act to influence them. Trump's intervention could persuade the FOMC to implement interest rate cuts, which could provide a lifeline for cryptocurrencies. Regardless, the community is watching closely.