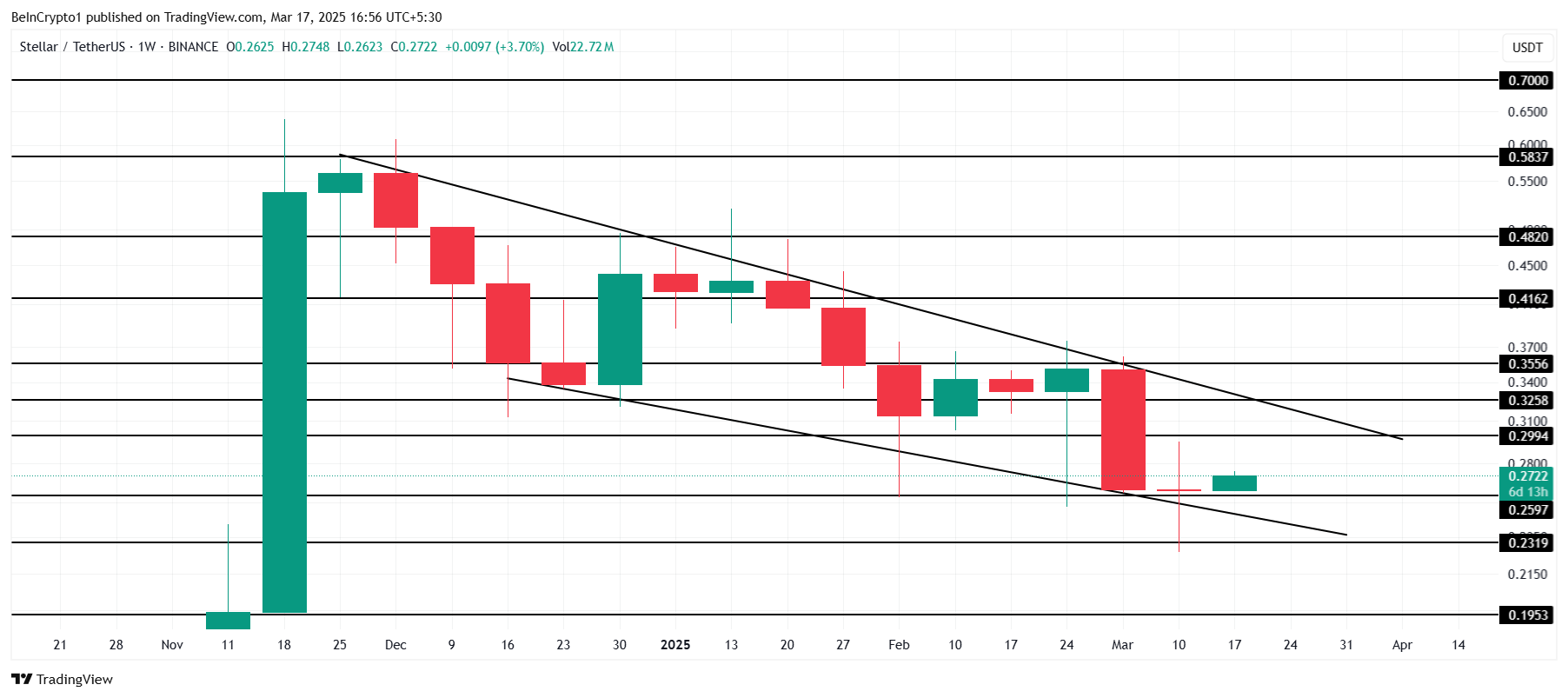

Stellar (XLM) has been experiencing a downward trend for almost 3 months. While it has attempted to recover, the altcoin is facing major obstacles ahead.

This is because the likelihood of breaking through the $0.325 resistance is gradually diminishing. Considering the current market conditions, the price may continue to face difficulties.

Stellar Faces a Death Cross

Stellar's price movement is currently being impacted by the approaching death cross. This is a bearish signal in technical analysis. The 200-day Exponential Moving Average (EMA) is attempting to cross below the 50-day EMA, which will be Stellar's second death cross this year. The previous cross occurred in April 2024 and this upcoming cross may further signal a weakening of the altcoin's price momentum.

The potential death cross suggests a transition to persistent selling pressure. This could prevent a breakout above the $0.30 level and push the price lower.

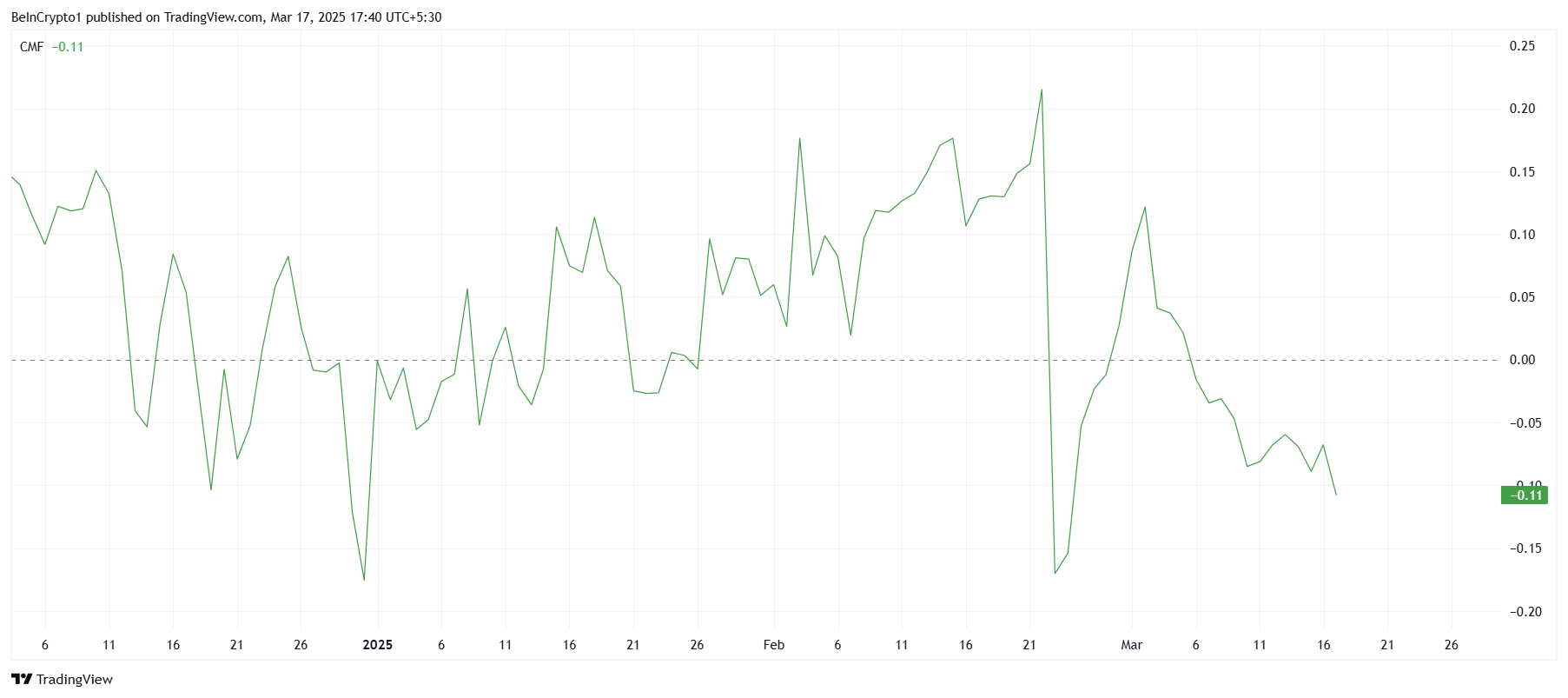

Stellar's overall macroeconomic momentum is also reflecting a bearish outlook. The Chaikin Money Flow (CMF) indicator, which tracks the accumulation and distribution of the asset, has shown a sharp decline this month. It is currently below the 0 line, indicating that outflows are dominating inflows, suggesting that investors are withdrawing funds from XLM.

This outflow trend reflects increasing bearish sentiment among investors, making the asset's recovery more difficult. Without inflows of buying pressure, XLM may struggle to regain its upward momentum.

XLM Price, Breakout Targets

At the time of writing, XLM is trading at $0.272 and is above the $0.259 support level. The altcoin has been moving within a descending wedge pattern over the past 3 months, but considering the current market conditions, a short-term breakout from this pattern appears unlikely. The ongoing death cross and bearish market sentiment are likely to keep XLM within this range.

As long as XLM remains below $0.299, it may experience further downside. If the altcoin falls below $0.259, it could test $0.231 or lower. The formation of the death cross may trigger additional selling pressure, further solidifying the bearish outlook for Stellar in the coming days.

For the bearish narrative to be invalidated, XLM needs to break above $0.299 and surpass the $0.325 resistance level. A successful breakout above $0.355 could signal a reversal and allow the altcoin to escape the current downtrend. However, such a scenario would require a shift in market sentiment and investor confidence.