After several weeks of outflows, the Bitcoin exchange-traded fund (ETF) finally reversed course and recorded $274.6 million in inflows on March 17.

This represents the largest single-day net inflow in 41 days, suggesting that investor interest is increasing again. A positive day does not confirm a trend, but it raises an important question: Is demand for Bitcoin ETFs returning, or is it just a temporary respite?

Bitcoin ETFs See Massive Inflows After Weeks

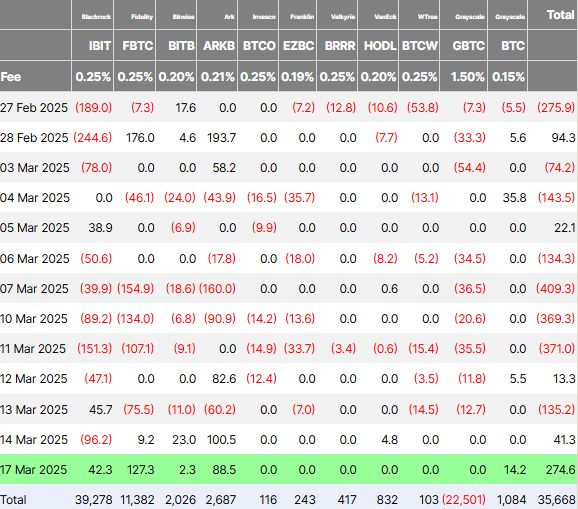

According to the latest data from Farsight Investors, BlackRock's iShares Bitcoin Trust (IBIT) saw $42.3 million in inflows on Monday. Despite the positive momentum, IBIT has not been able to lead the pack due to headwinds from its correlation with the stock market.

Fidelity's Bitcoin ETF (FBTC) was the day's biggest beneficiary, attracting $127.28 million. The ARK Bitcoin ETF (ARKB) managed by ARK Invest and 21Shares also garnered significant interest, pulling in $88.5 million.

Meanwhile, the Grayscale Bitcoin Trust (GBTC), which was at the center of major outflows, saw no change at $0. This is noteworthy as it has lost billions of dollars in assets since converting to a spot ETF.

Grayscale's other Bitcoin products, however, saw a modest $14.22 million in inflows. Valkyrie, Invesco, Franklin, and WisdomTree's Bitcoin ETFs had no daily inflows.

While Bitcoin ETFs have shown strength, Ethereum-based spot ETFs have continued their downward trend. According to Farsight Investors' data, they experienced $7.3 million in net outflows, marking the 9th consecutive day of net outflows.

"Bitcoin spot ETFs are attracting $275 million in inflows, while Ethereum ETFs are experiencing outflows, reflecting a shift in investor preference," a user suggested on X.

Notably, this could suggest that demand for Bitcoin ETFs is returning after weeks of outflows, but analysts say that a single positive day does not make a trend. Nevertheless, it is a noteworthy change.

Bitcoin ETFs Lose Billions in Recent Weeks

Just a week ago, Bitcoin ETFs recorded over $4.5 billion in net outflows for four consecutive weeks. Profit-taking, regulatory concerns, and widespread economic uncertainty had triggered a shift in investor sentiment.

The broader cryptocurrency market also experienced capital outflows. According to BeInCrypto, cryptocurrency outflows exceeded $800 million last week, indicating strong negative sentiment among institutional investors.

In this context, the $274 million inflow on Monday can be seen as a sign of stabilization, but it is too early to determine if this marks the beginning of a broader recovery.

Nevertheless, the surge in ETF inflows raises questions about whether this is a revival of the so-called "Trump crypto boom" or fear of missing out (FOMO) on an opportunity that cannot be missed. Some analysts believe that hedge funds and institutional investors have a greater impact than retail investors.

Crypto entrepreneur Kyle Chasse has argued that hedge funds play a key role in Bitcoin ETF flows. He claims that large investors strategically withdraw and reinvest capital to manipulate price movements, making it difficult to discern organic demand.

"The 'demand' for ETFs was real, but some of it was simply for arbitrage. There was genuine demand to own BTC, but not as much as we came to believe. This volatility and choppiness will continue until real buyers get involved," the analyst explained.

If true, the recent ETF inflows may not represent new buyers. Instead, they could signify the recycling of institutional capital to capitalize on short-term price fluctuations.

Adding to the uncertainty is the fact that many investors are considering the Federal Reserve's future policy decisions. Some have speculated that the Fed will soon pivot to quantitative easing (QE), but industry experts warn that such expectations are misguided.

Financial analyst and The Coin Bureau founder Nick Perkrin believes that those expecting immediate QE are "delusional." He points out that the Fed's rates are currently at 4.25-4.5%, and historically, QE has not started until rates are close to 0%.

"I don't understand why people suddenly expect a massive liquidity injection into the system. Realistically, if large-scale monetary stimulus is to come from anywhere, it will more likely come from China or Europe, who have already implemented easing measures. The most investors can hope for from Powell this week is a hint on the timing of the next rate cut, and even that may not be forthcoming. So investors should be prepared for another volatile week in the markets." - Nick Perkrin, BeInCrypto interview

.