The price of Bit(BTC) has experienced several bear traps historically. Depending on market conditions, these traps have manifested in the short or long term.

Some analysts believe that Bit(BTC) is currently in such a bear trap, and that a bull market will begin after the current stage is over.

What does the Bit(BTC) bear trap cycle mean?

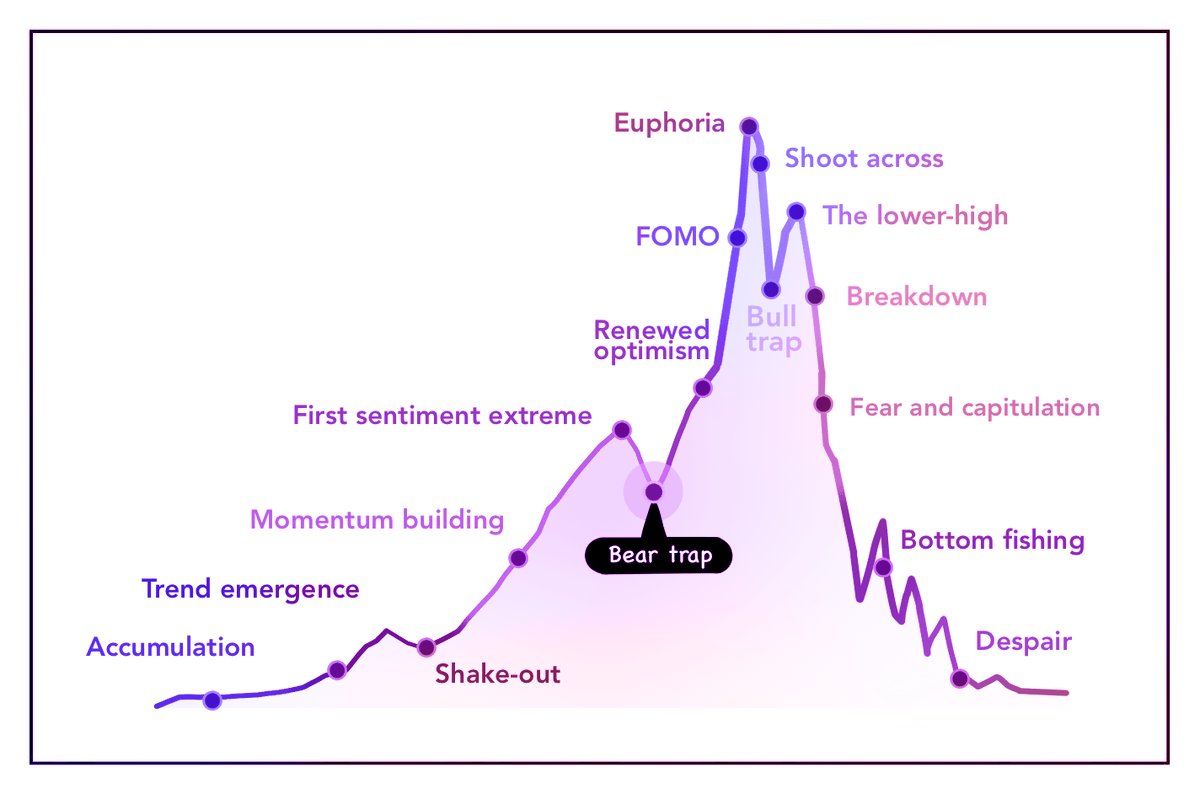

Bear traps occur when the price of an asset (stocks, cryptocurrencies, indices, etc.) drops sharply. This decline convinces investors that a bearish trend has begun. However, the price soon reverses and starts rising again, trapping those who sold or closed their positions expecting further declines.

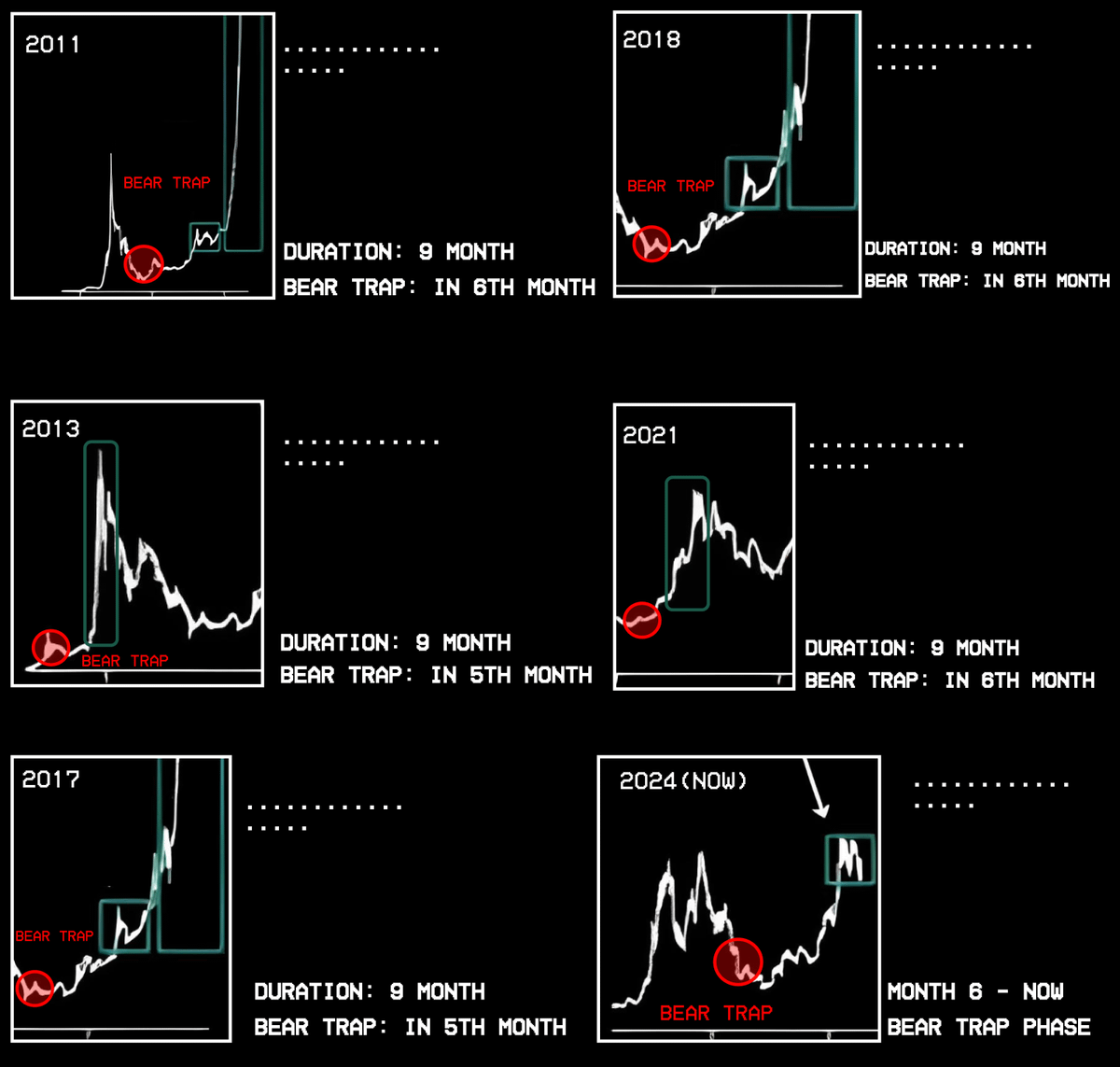

According to the anonymous cryptocurrency analyst Finish, Bit(BTC)'s bull market cycles generally last about 9 months. Bear traps often appear in the sixth month of the cycle. At this stage, Bit(BTC)'s price drops sharply, triggering fear and selling. However, the price then recovers and sets new highs.

Historical data from previous cycles, including 2011, 2013, 2017, 2021, and the current cycle (2024–2025), consistently shows this pattern repeating.

"The 2025 cycle is the same. A new all-time high after a six-month bear trap," Finish predicted.

Finish also explains the factors that have triggered bear traps in each cycle. For example, the 2013 bear trap was caused by the closure of the online black market Silk Road and China's ban on Bit(BTC), which instilled fear in the market.

In 2017, the ICO boom fueled Bit(BTC)'s bull market, pushing the price up to $20,000. However, the bear trap in the sixth month was triggered by the launch of Bit(BTC) futures on the CME exchange, combined with high media attention and transparency issues surrounding Tether (USDT).

Similarly, in 2021, Bit(BTC) reached $69,000, but the bear trap in the sixth month was triggered by an overheated market sentiment and Elon Musk's change of stance on Bit(BTC) payments.

For the 2024–2025 cycle, Finish believes that Bit(BTC) is currently in the bear trap stage. He believes that the policies of former U.S. President Donald Trump play an important role.

Trump's policies—interest rate cuts, trade wars, and his promise to make the U.S. the global "crypto capital"—have fueled optimism, but also caused short-term price volatility. This is consistent with Finish's six-month bear trap model.

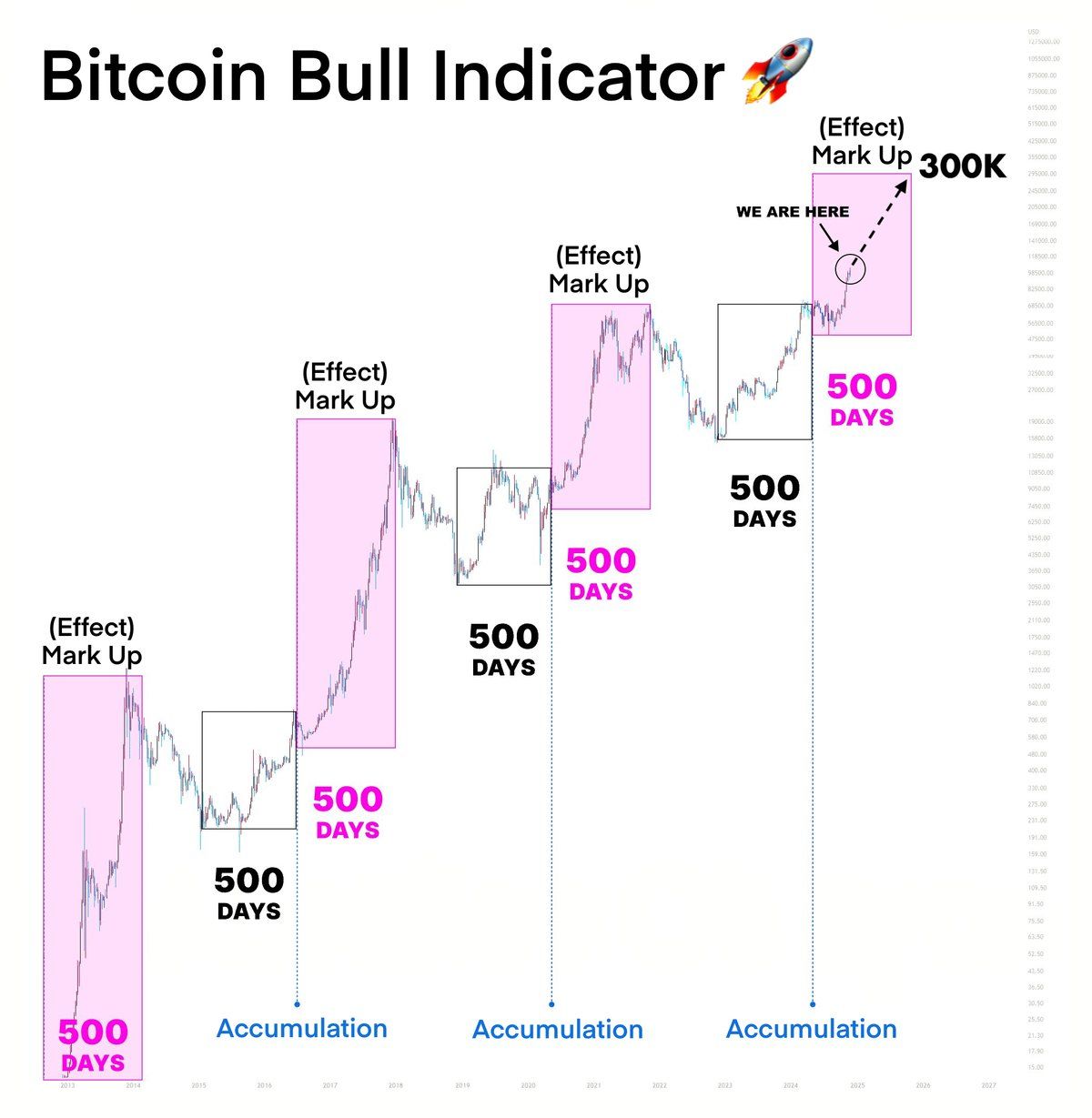

Analyst Danny also agrees with this outlook. He predicts that the current bear trap stage will end, and the biggest Bit(BTC) bull market will officially begin in April 2025. Danny suggests that Bit(BTC) could reach $300,000 by 2026.

"We are in the markup stage and have just passed the classic bear trap. Historically, the biggest gains come as Bit(BTC) dominance declines and capital flows into mid-cap tokens," Danny predicted.

However, some analysts have lowered their expectations for Bit(BTC)'s growth. Econometrics has observed that the growth rate of Bit(BTC) in this cycle is significantly lower than in previous cycles. Cryptoquant CEO Joo Kyung-young analyzed Bit(BTC)'s profit cycle signals and predicted that the Bit(BTC) bull market has already ended.