XRP is rising after the SEC officially withdrew its lawsuit against Ripple, triggering a 13% price surge in 24 hours. Strong technical signals and increasing market participation are supporting the upward momentum.

XRP's network activity has also reached record levels, with active addresses hitting new highs. As traders digest the legal victory and positive market signals, the outlook for XRP is strengthening, and the potential for further short-term gains is increasing.

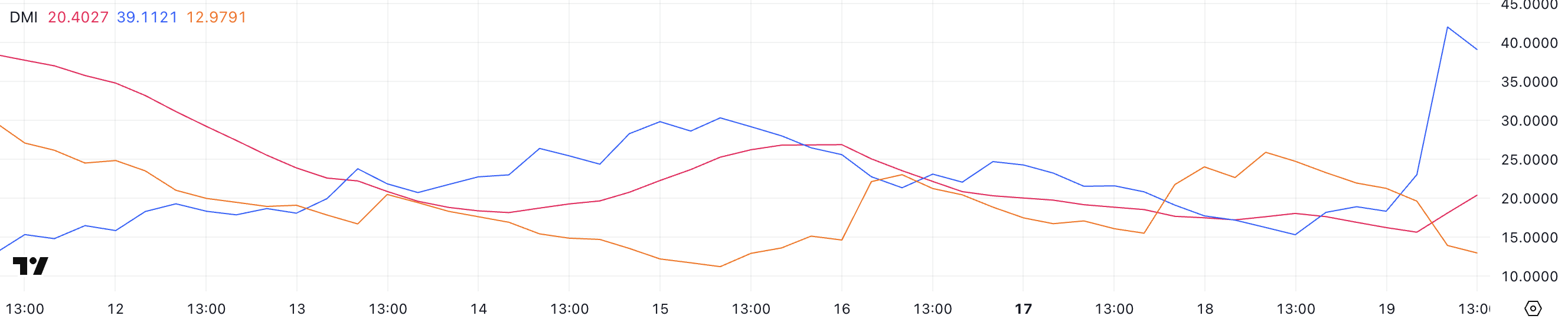

XRP DMI, Buyers in Full Control

The XRP DMI chart is showing a notable shift in momentum, with the ADX (Average Directional Index) rising from 15.64 to 20.4 after the news of the SEC dropping its lawsuit against Ripple.

This increase indicates that the market trend is strengthening, as the ADX tracks the overall strength of the trend without designating the direction.

The recent surge suggests that the market is gaining confidence in the price movement as it digests the positive legal developments surrounding Ripple.

The ADX is used in conjunction with the +DI and -DI indicators, which help identify the trend direction. Generally, an ADX above 25 confirms a strong trend, while below 20 indicates a weak or range-bound market.

In the case of XRP, the +DI has surged from 18.3 to 39, while the -DI has declined from 19.63 to 12.97, showing a clear bullish divergence.

This sharp rise in buying strength (+DI) and weakening of bearish signals (-DI) supports the notion that XRP is attempting to maintain and extend its upward trend. If this dynamic continues, additional short-term gains could be seen, and the upward momentum could build.

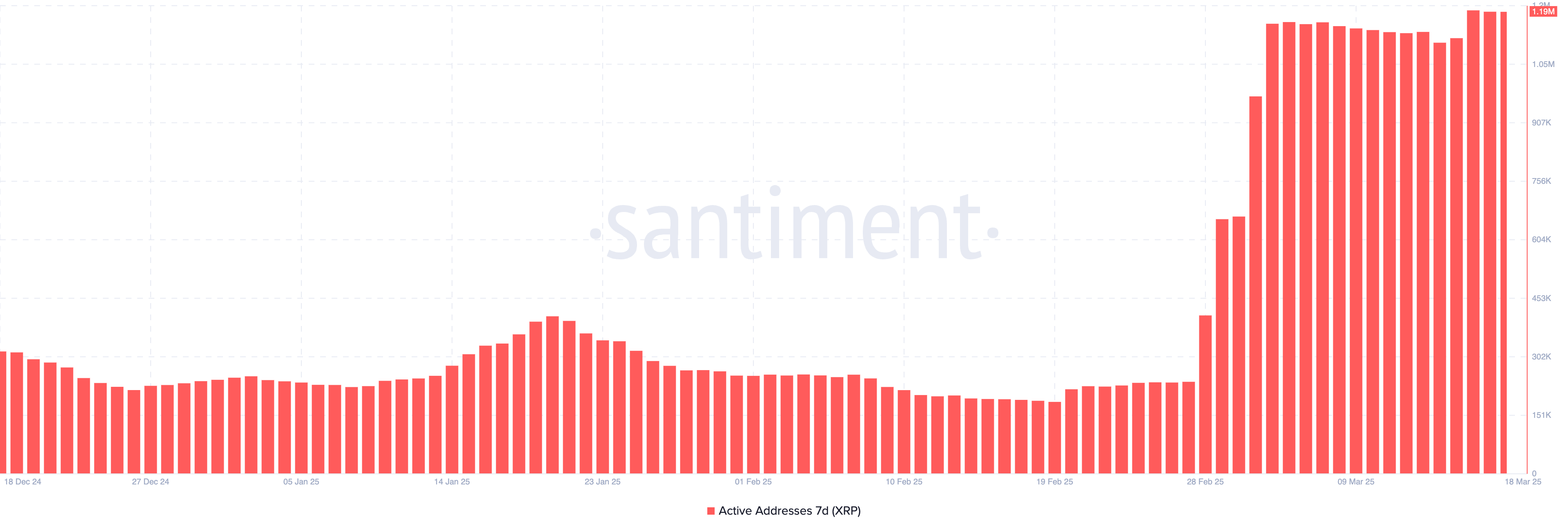

XRP Active Addresses Hit Record High

XRP's network activity has surged, with the 7-day active addresses reaching a record high of 1.19 million, nearly five times the 237,000 recorded on February 27.

The spike in active addresses indicates that XRP's blockchain is seeing high participation from retail traders, institutional investors, or speculative interest.

Such elevated levels of activity are rare and may signal increased interest and usage of the network.

Tracking active addresses is crucial to understanding user engagement levels and actual demand for the blockchain.

Generally, an increase in active addresses can suggest more participants are interacting with the network and transacting, which can often correlate with stronger liquidity and potentially higher price volatility. In the case of XRP, this record surge in activity could act as a bullish signal, hinting at increased interest and capital inflow.

While it does not guarantee immediate price appreciation, this robust network participation can help support XRP's price and reduce downside risk, especially when combined with other bullish technical or fundamental factors.

Will XRP Soon Reach the $3 Resistance Level?

Currently, the EMA lines are indicating the potential for a new golden cross to form soon.

If this scenario unfolds, XRP's price could first challenge the $2.648 resistance. With further strengthening of the buying momentum, the price could push towards $2.99, potentially breaking through the $3 barrier.

Conversely, if the upward momentum fails to materialize and XRP's price fails to hold above the current range, a new downtrend could form.

In this case, the crucial support level of $2.47 would become more apparent. A breakdown below this threshold could expose XRP to further downside risk, potentially testing $2.21 and even $1.90.