Stablecoins are reshaping digital finance, providing a way to move money quickly and easily across borders. The total supply is $214 billion, and $35 trillion in remittances have been made in the past year. Stablecoins are now a growing financial powerhouse, not just a niche cryptocurrency tool.

However, excessive transparency is now emerging as a major issue that could hinder their wider adoption.

Stablecoins and Transparency... A Hurdle to Mainstream Adoption

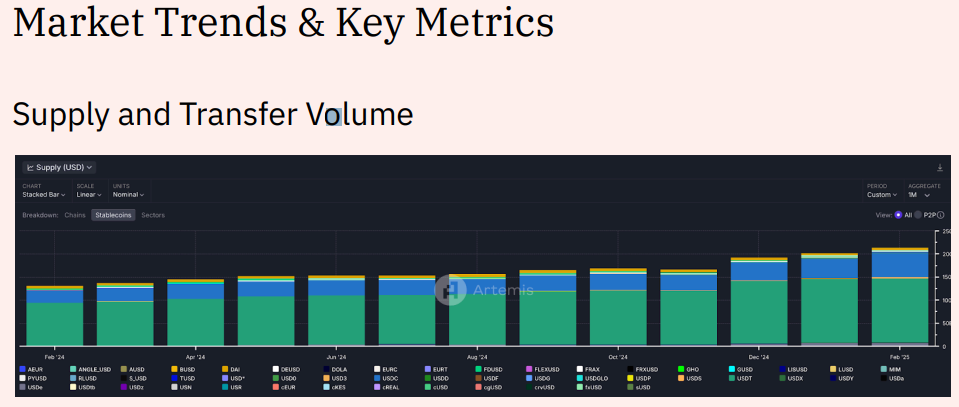

Artemis and Dune Analytics have produced a report on the state of stablecoins in 2025, exploring supply, adoption, and market trends. According to the research, the total stablecoin supply has reached $214 billion, with up to $35 trillion in remittances made in the past year.

Their trading volume exceeds major payment networks like Visa and Mastercard, demonstrating their growing influence.

However, despite their rapid adoption, transparency remains a major obstacle for stablecoins. The openness of the blockchain is good for security and trust, but not always ideal for everyday payments.

"Crypto payments failed because of one small problem. When sending USDC, the recipient should be able to see the transaction but not the address. No one wants to expose their wallet for a 10 USDC beer payment." – DeFi researcher Ignas said.

Another user compared it to exposing their bank balance every time they split costs with friends. Similarly, the dominance of USDT and USDC stablecoins is evident. Tether's USDT and Circle's USDC account for the majority of the market.

Jean Rossi, co-founder of the DeFi platform SMARDEX, is concerned about this.

"The surge in stablecoin wallets shows that investors trust them during market volatility. But most of the growth is happening in centralized stablecoins that carry counterparty risk, like traditional banks." – Rossi, told BeInCrypto.

Crypto executives believe the future lies in decentralized stablecoins backed by assets like Ethereum (ETH) and equipped with automated yield mechanisms.

Banks Eyeing Stablecoin Regulation

The Artemis and Dune report shows that stablecoins have already surpassed Visa and Mastercard in trading volume. This trend has effectively captured the attention of traditional financial institutions.

In this context, stablecoins are no longer just for cryptocurrency traders. Institutional interest is surging, and U.S. banks can now offer stablecoin services. Bank of America (BoA) is considering launching its own stablecoin, which is pending regulatory approval.

However, with greater adoption comes increased scrutiny. Privacy-focused cryptocurrencies like Monero (XMR) solve the transparency issue by hiding transaction details, but have faced legal hurdles due to money laundering concerns.

Despite the transparency issue, stablecoins are thriving in countries fighting inflation. In places like Nigeria, they are becoming a reliable alternative to unstable local currencies. At the same time, new competitors are challenging the dominance of Tether and Circle.

For stablecoins to truly go mainstream, they need to strike a balance between transparency and privacy. Regulators demand oversight, but everyday users don't want to expose their financial records. Technologies like zero-knowledge proofs and selective disclosure could provide solutions that allow users to control the information they share.