Bitcoin (BTC) recently rose after the FOMC meeting but is currently experiencing a correction, dropping nearly 3% in the past 24 hours. The price is struggling below key resistance levels, with short-term momentum weakening.

Technical indicators such as the Ichimoku Cloud and Exponential Moving Averages (EMA) are signaling potential challenges for BTC. Meanwhile, whale activity has stabilized after a sharp accumulation phase, raising questions about whether BTC can recover to higher levels this month.

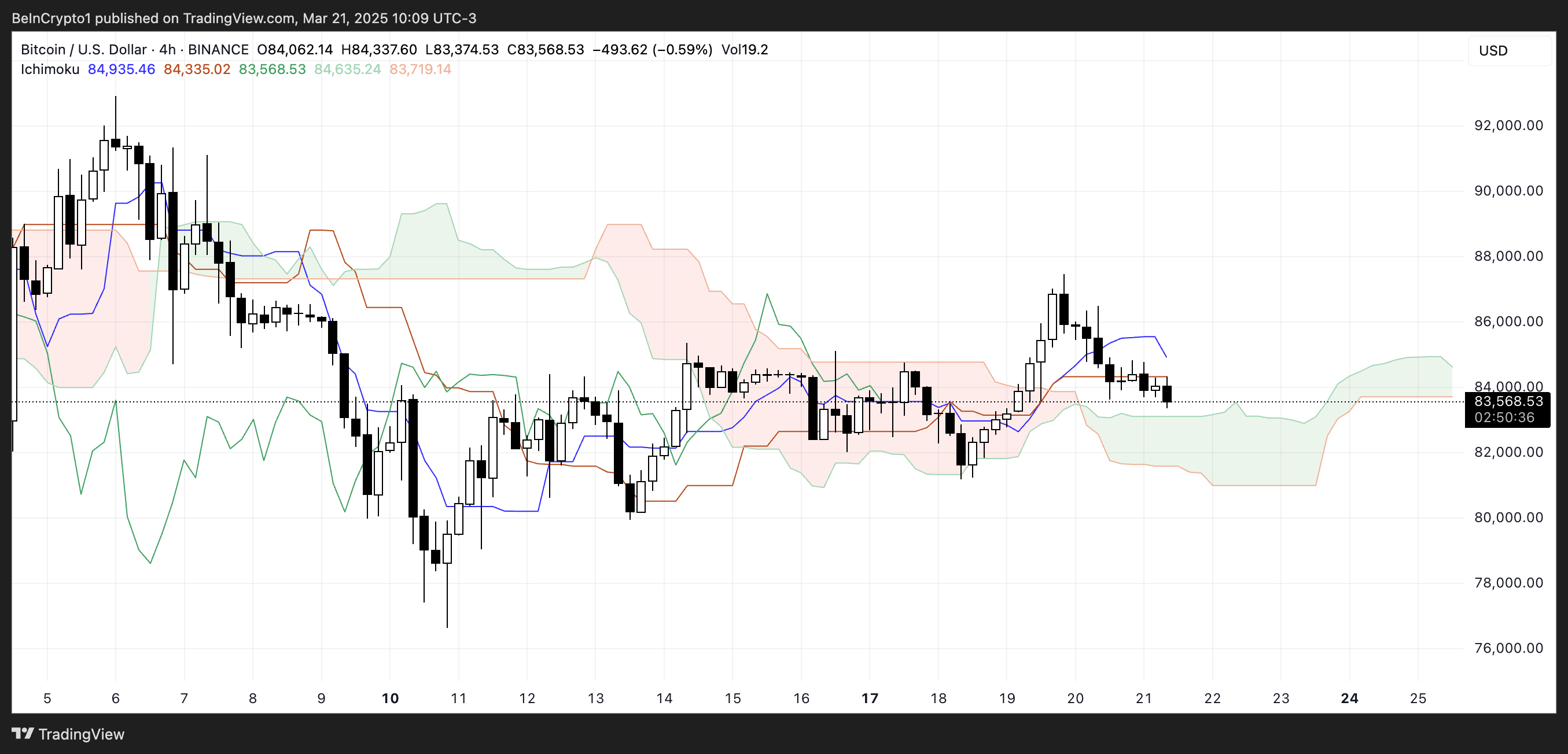

BTC Ichimoku Cloud Indicates Challenges

Bitcoin is currently trading below the Ichimoku Cloud, showing a short-term downward trend. The price has fallen below the Conversion Line (blue line) and Base Line (red line), intensifying downward pressure.

The upcoming cloud is thin and flat, suggesting weak momentum and the possibility of continued sideways movement or further decline, unless the price recovers to higher levels.

The Lagging Span (green line) is also positioned below the price movement and cloud, confirming the current downward trend. However, the price is approaching the lower boundary of the cloud, which could serve as immediate support.

If buyers fail to defend this zone, downward momentum could expand further. Conversely, a rebound above the Conversion and Base Lines could be an early signal of recovery, though cloud resistance remains a major obstacle.

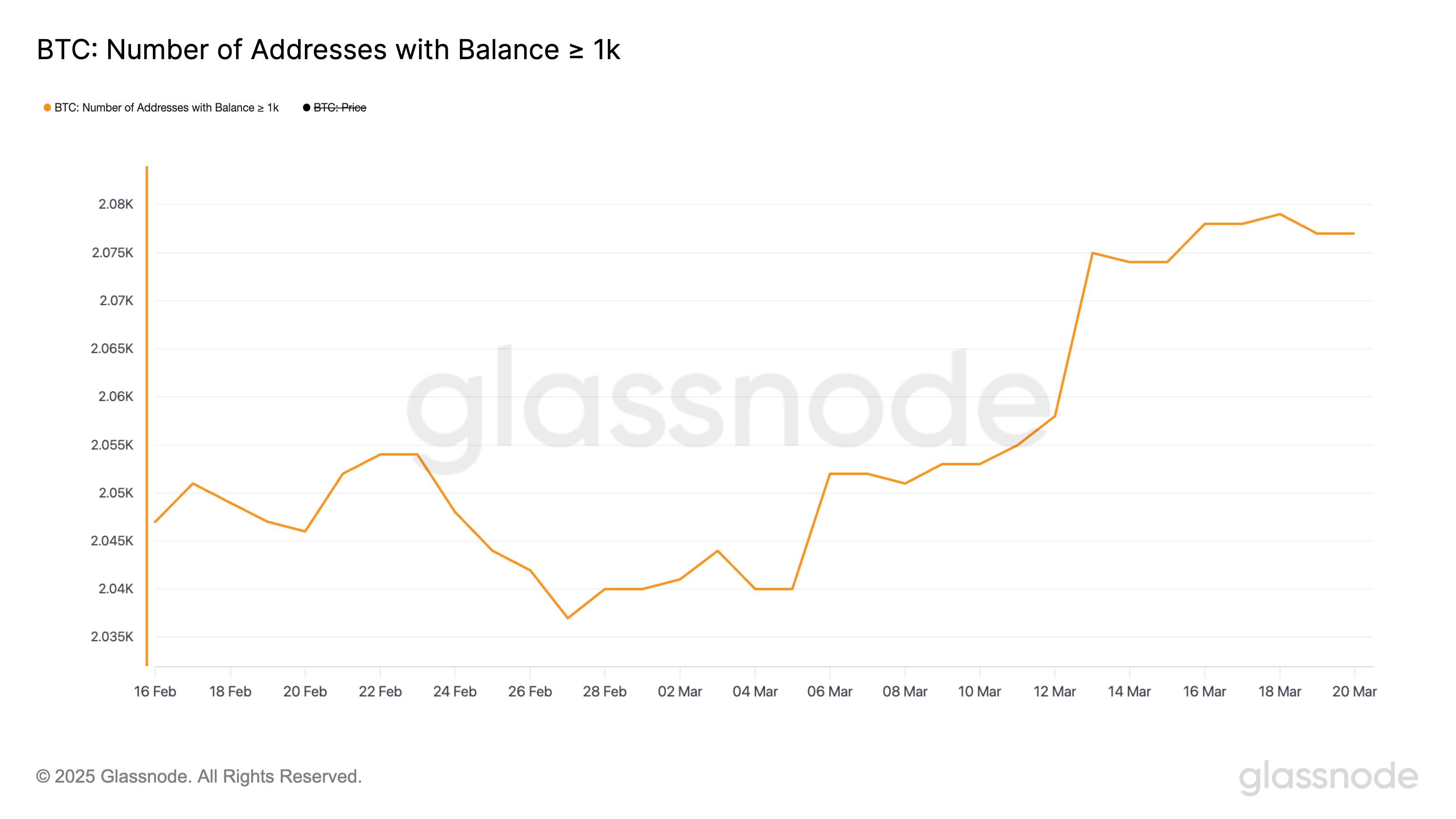

Bitcoin Whales Stabilize After Recent Surge

The number of Bitcoin whales recently surged, increasing from 2,040 on March 5th to 2,079 on March 18th, the highest level since mid-December 2024.

The sharp increase indicates strong accumulation during that period, but it has slightly stabilized at 2,077 in recent days, suggesting a current slowdown in accumulation.

Monitoring whale activity is crucial as their position sizes can significantly impact Bitcoin prices. The increase in whale numbers suggests rising confidence among major investors, which could lead to upward price pressure.

The recent increase in whale addresses may indicate institutional investors or high-net-worth individuals preparing for potential price increases or attempting accumulation while BTC consolidates over recent weeks.

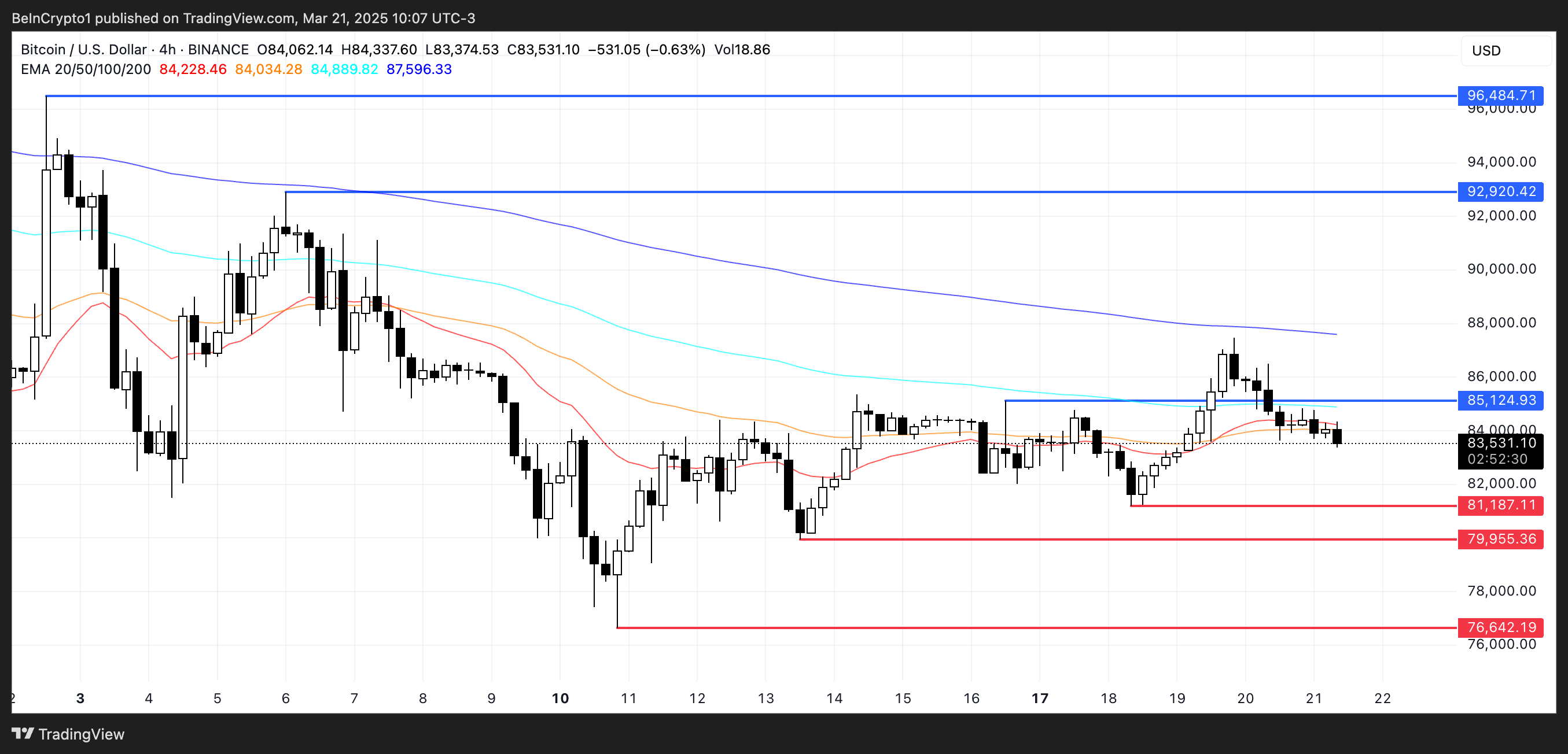

Can Bitcoin Exceed $90,000 in March?

Bitcoin's price is currently adjusting between resistance at $85,124 and support at $81,187. The EMA lines are moving close together, showing no clear direction. The recent price surge after the FOMC meeting is losing momentum, aligning with Nick Pocklington's insights based on current market conditions:

"The slight 'Powell pump' seen in the cryptocurrency market brought Bitcoin back above the 200-day moving average. This is certainly a positive signal. However, whether it can maintain this path is another matter. If BTC continues its current upward trend, the key resistance levels to watch would be around $92,000-$93,000. Breaking through this could extend the rally to previous all-time highs. However, there may be too much uncertainty to provide the market with the necessary support." Pocklington told BeInCrypto.

If Bitcoin breaks through the $85,000 resistance zone, it could open the door to rises to $92,920 or even $96,484, if upward momentum strengthens.

However, if it fails to maintain support at $81,187, it could drop to $79,955, and if sellers gain more control, there's a risk of further decline to $76,642.