Cryptocurrency Airdrop is always expected to promote wealth and adoption, but Binance's latest report reveals serious flaws. Reduced rewards and insider benefits and bot exploitation are increasingly undermining community trust.

Once the engine of growth, cryptocurrency Airdrop now risks becoming a liability. Can the industry address this before users lose trust?

Binance's Recent Cryptocurrency Airdrop Analysis

This report highlights a flawed system that turns excitement into disappointment. Binance rhetorically asks: Is Airdrop the golden ticket of cryptocurrency, or a time bomb?

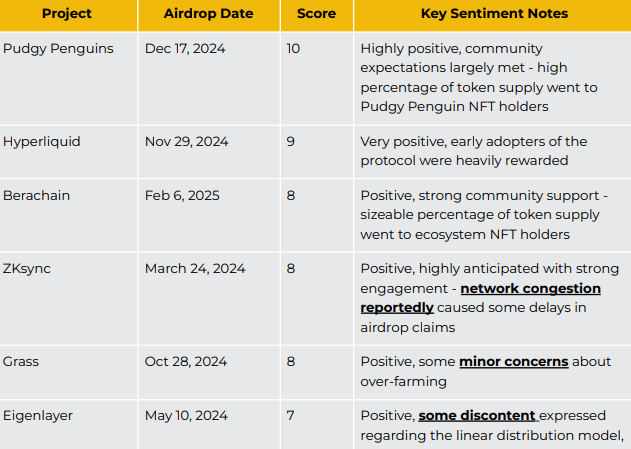

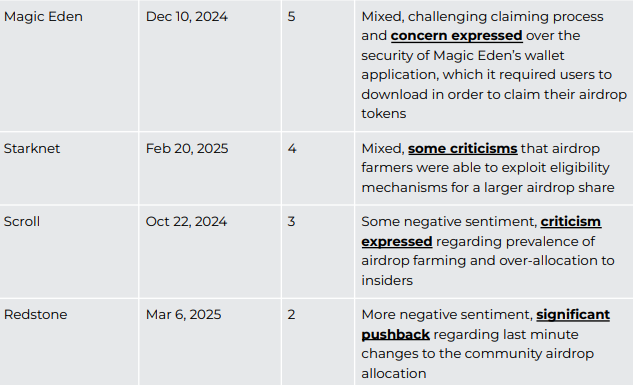

Binance exchange's analysis received almost a perfect 10/10 in community sentiment for the Pudgy Penguins Airdrop. Hyperliquid was rated 9/10 for setting new DeFi standards and generously rewarding participants.

However, when Airdrops fall short of expectations, the consequences are swift and severe. Binance Research cites Redstone (RED), which originally promised 9.5% of token supply to the community but reduced it to 5% at the last moment.

This triggered widespread backlash, and according to Binance's Grok AI analysis, it received a low sentiment score of 2/10.

It also cites Scroll's October 2024 Airdrop as another failure case, with ambiguous rules and unclear eligibility criteria leading to a disappointing 3/10 rating.

Similarly, in February 2025, Kaito distributed 43.3% of supply to insiders and allocated only 10% to the community. This move caused influencers to quickly sell their holdings and eroded trust.

Additionally, the report cites Sybil farming, where bots collect tokens en masse. Technical failures like Magic Eden's incorrect claiming process in December 2024 further fueled user dissatisfaction.

Why Most Airdrops Fail

Beyond revealing flaws, Binance's report analyzes the mechanisms of these failures. Last-minute allocation changes, like in Redstone's case, indicate poor planning and damage credibility. Lack of transparency, as seen in Scroll's unclear eligibility criteria, breeds suspicions of favoritism.

Insider-centric token distribution, as with Kaito, alienates retail participants. Meanwhile, technical inefficiencies like Magic Eden's malfunctioning wallet claims turn Airdrops into frustrating user experiences.

With billions of dollars at stake, these issues are no longer trivial but an existential threat to the cryptocurrency Airdrop model.

"Tokens are a new asset class... Airdrops are their wild frontier." – Joshua Wong, Binance Macro Research

Despite the confusion, Binance suggests potential paths to restore trust in cryptocurrency Airdrops. First, it demands transparency, urging post-Airdrop projects to set clear eligibility criteria in advance.

Meanwhile, participation-based models must promise a fixed point-to-token ratio.

Next, projects must prioritize genuine community engagement and treat tokens not as mere digital assets but as tools for building loyal ecosystems.

Finally, technical solutions like on-chain monitoring and human verification tools, similar to those used by LayerZero, can help prevent Sybil farming and increase fairness.

Comprehensively, Binance's report warns that cryptocurrency Airdrops offer a unique opportunity to democratize wealth and strengthen blockchain communities, but also risk collapsing under the weight of mismanagement and exploitation.