An early Bitcoin investor has restarted activity after almost 10 years, drawing attention in the cryptocurrency industry.

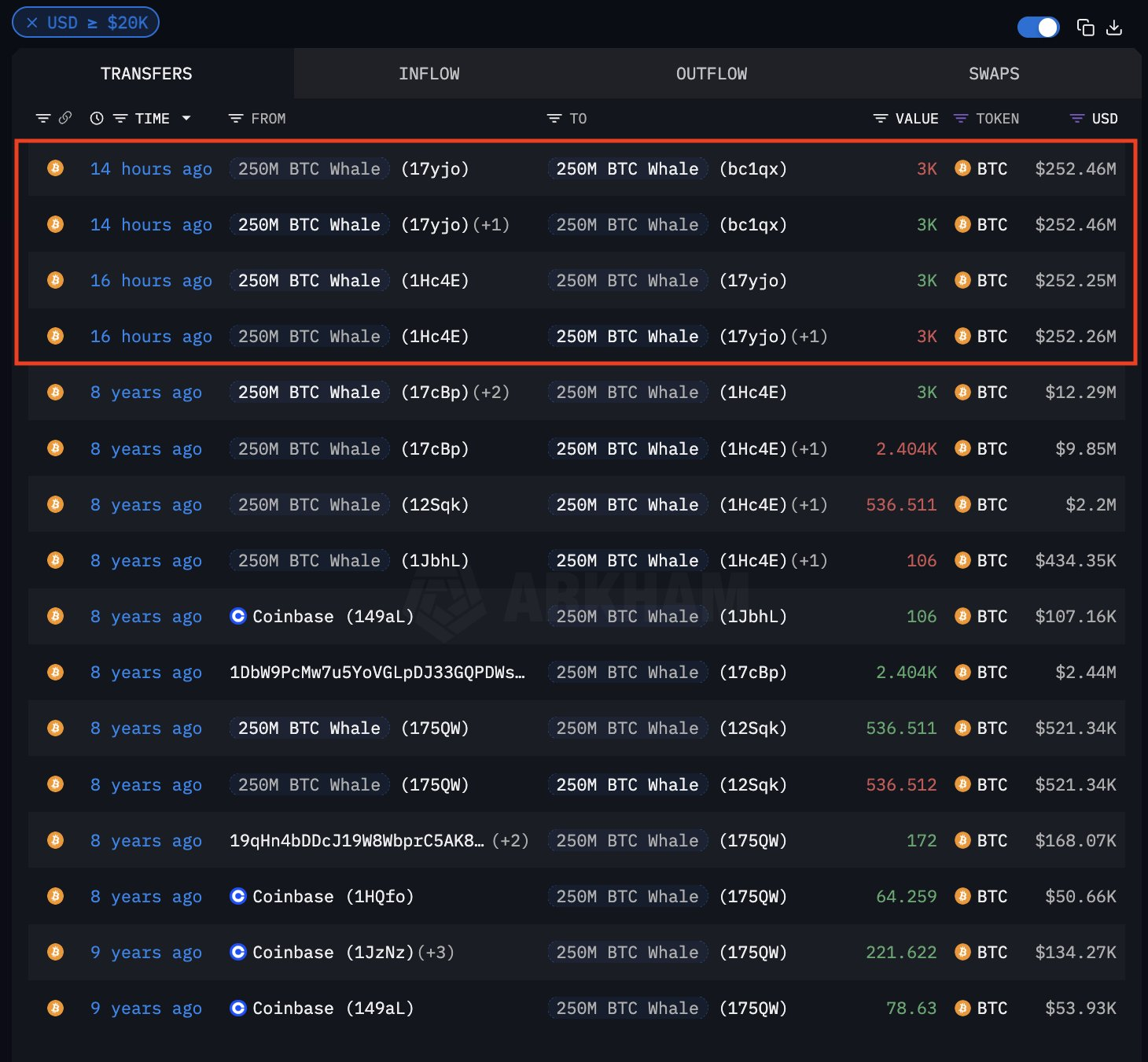

On March 22, a Bitcoin whale moved 3,000 BTC. This is a volume worth over $250 million at the time. Generally, a Bitcoin whale refers to an individual or entity holding over 1,000 BTC.

Why is the Bitcoin Whale Active After 8 Years?

According to Arkham, the Bitcoin whale's wallet dates back to the end of 2016. At that time, Bitcoin was trading for less than $1,000 per coin.

The investor's initial investment is estimated at around $3 million. This reflects the long-term potential of the asset and has grown into a massive fortune.

During this holding period, Bitcoin reached an all-time high of nearly $110,000 in January 2025. The price has since been adjusted to around $84,274, but the whale's ROI remains impressive.

The previous motive is unclear. However, analysts noted that the funds moved to a wallet other than an exchange. This suggests the holder may be restructuring rather than preparing to sell.

These details seem to have calmed concerns about market dumping. According to BeInCrypto data, the cryptocurrency market remains stable despite the whale's activity. Bitcoin and other major assets show little price volatility.

Meanwhile, this transfer is not an isolated case. Several long-dormant wallets have shown activity over the past year.

Some analysts believe early holders are reassessing their positions as Bitcoin trades near historical highs. Others suggest these investors might be preparing more complex strategies, including futures or options.

Nevertheless, this case reinforces Bitcoin's reputation as a long-term store of value. The whale's decision to hold for almost 10 years demonstrates the asset's performance, surpassing traditional stores of wealth like gold and the US dollar.

Moreover, the recent integration into traditional finance, strengthened by the launch of spot Bitcoin ETFs and the US strategic Bitcoin reserve plan, further reinforces this narrative.