The total cryptocurrency market capitalization (TOTAL) and Bitcoin (BTC) have grown over the past day, despite the market sentiment still being fearful. The Ethereum-based SPX led the altcoin market, recording a double-digit increase over the past 24 hours.

Fearful Sentiment, Increasing Buying Pressure

The cryptocurrency fear and greed index shows that market sentiment is still considerably fearful, as traders continue to process losses. Today's index is 28, indicating market fear. This suggests that investors have become cautious due to recent price declines.

However, historically, such fear sometimes appears as an undervalued period that provides buying opportunities. Traders seem to be taking advantage of this buying signal, which was reflected in TOTAL's surge over the past day.

An additional $98 billion was added over the past 24 hours, reaching $2.8 trillion at the time of reporting. The positive Balance of Power (BOP) on the daily chart confirms increased buying pressure among market participants, currently at 0.58.

The BOP indicator analyzes price movements within a given period to measure the strength of buyers and sellers. Such a positive BOP value indicates that buyers are in control, pushing prices up and signaling potential upward momentum.

If buyers strengthen their control and drive out sellers, TOTAL could maintain its upward trend and rise to $2.87 trillion.

However, if profit-taking surges or sentiment turns more bearish, TOTAL could drop to $2.70 trillion.

BTC Maintains Above Key Moving Average… Target $89,000

The major coin Bitcoin is trading at $87,182, recording a 3% price increase over the past 24 hours. BTC's steady rise last week pushed the price above the 20-day Exponential Moving Average (EMA), forming a dynamic support level at $85,047.

The 20-day EMA measures the average price over the past 20 trading days, giving more weight to recent prices and being sensitive to market changes.

When an asset breaks through this moving average, it suggests increased upward momentum and the possibility of transitioning to an uptrend. If BTC continues its weekly uptrend, it could rise to $89,434.

However, if buying pressure weakens again, BTC might lose its recent gains and test the support level at $85,036.

If buyers fail to defend this level, the decline could reach $77,114.

SPX Leads Market Rise… Increasing Buying Interest

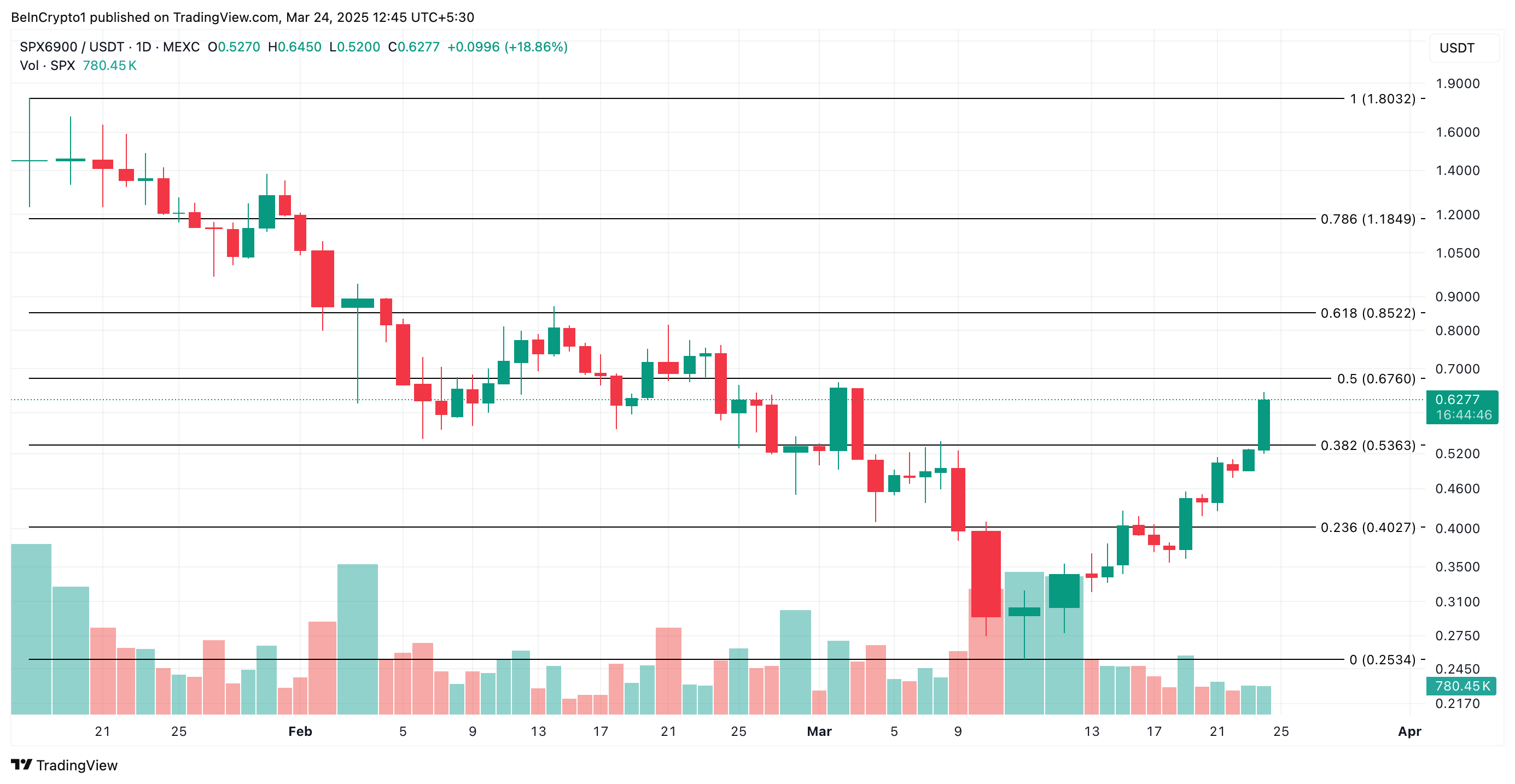

SPX is the top performer during the review period. Currently trading at $0.62, it has increased by 20% over the past day.

The double-digit increase is accompanied by a surge in daily trading volume, emphasizing demand for altcoins. Trading volume has increased by 112% over the past 24 hours, reaching $34 million at the time of reporting.

The sharp price increase of SPX, coupled with the daily volume increase, indicates strong buying interest and confirms the validity of the upward movement. If this trend continues, the altcoin's price could rise to $0.67.

Conversely, if a reversal occurs, it could drop to $0.53.