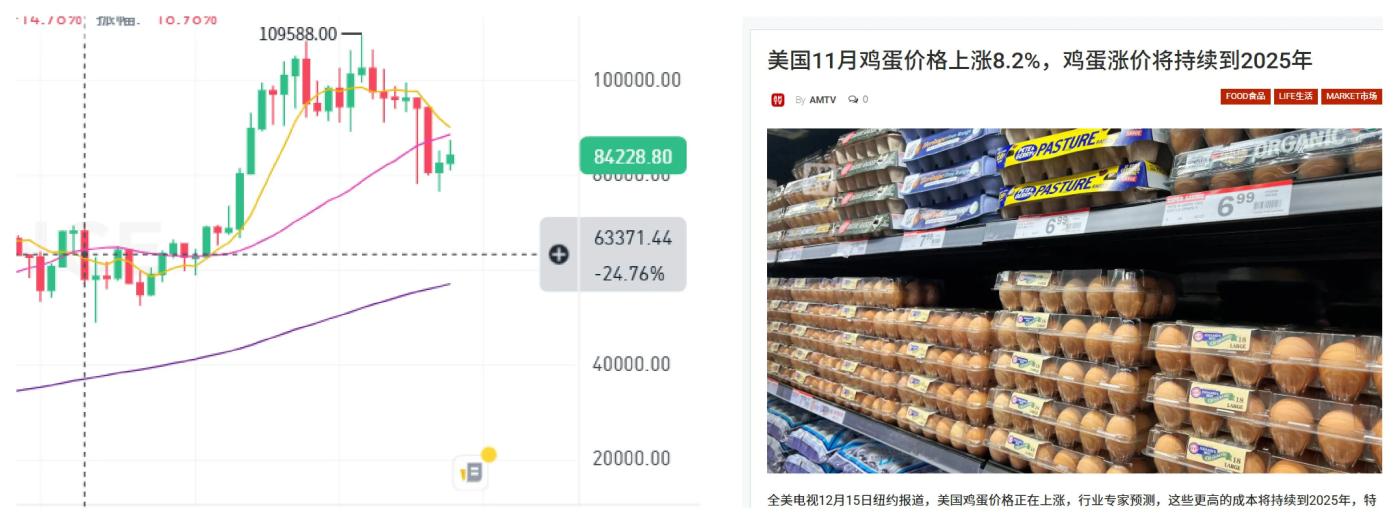

People always ask me: "The total number of bitcoins is only 21 million. Isn't it much more reliable than the US dollar? Will it replace the US dollar in the future?" Every time I hear this kind of question, I want to take out my mobile phone to show them two pictures: one is the K-line of Bitcoin's price jumping from 60,000 to 110,000 and then falling back to 80,000 in the past six months; the other is the price tag of eggs in the supermarket, which has increased by 8%.

What does it mean? Bitcoin and the US dollar are not on the same track at all, just like you can't use a sports car to transport goods, nor can you use a truck to race . Today, let's put aside those "subvert hegemony" slogans and talk about this matter from the underlying logic of economics.

The essence of money: a division of roles that lasted for thousands of years When humans first used shells as money, they probably didn't expect that there would be a series of twists and turns such as gold, copper coins, paper money, and digital currency. But after thousands of years of evolution, the monetary system has always followed an iron rule: no currency can be a "safe" and a "wallet" at the same time . Why did gold withdraw from daily circulation? Because it is ridiculous to carry gold ingots to buy vegetables. Why doesn't the US dollar dare to follow Bitcoin and fix the total amount? Because the economy needs the central bank to adjust the tap to prevent droughts and floods.

Behind this is a fundamental split in the functions of money. Economists have long divided money into three roles: piggy bank (value storage), payment code (transaction medium), and meter (accounting unit) . Gold is the only one in the field of "piggy bank", but it will be fatal if it is used as a "payment code" - during the Cyprus financial crisis in 2013, someone really tried to use gold bars to pay for surgery at the hospital, but the doctor used a vernier caliper to check the purity and delayed the rescue for half an hour. However, the US dollar has achieved the ultimate "payment code", but its purchasing power has shrunk by 40% in the past 20 years. Saving US dollars is like putting ice cubes in the sun.

The total amount is fixed and it is easy to save. Such things are suitable as piggy banks, which are called "means of value storage" in economics because they can store your value. When you hold it, you don't have to consider the risks of inflation and depreciation like holding legal currency. However, since the total amount of such things is fixed and there is a scarcity effect, the price cannot remain unchanged. If there is enough consensus, it will continue to appreciate, so it is not suitable as a "payment code."

Things that are suitable for being payment codes must have a controllable and constantly changing total amount. When the price needs to rise, the issuance amount is reduced, and when the price needs to fall, the issuance amount is increased. This is the only way to ensure a constant price and facilitate use in daily life. Such things are called exchange media. But correspondingly, if they can be issued at will, there is no scarcity, and such things cannot be used as exchange media.

Therefore, Bitcoin and the US dollar are two things on different tracks. There is no competition between them, and there is no question of one replacing the other.

The emergence of Bitcoin is essentially the blockchain technology that has spawned a "piggy bank" that is more suitable than gold. It uses code to ensure a constant total amount, uses decentralization to prevent human intervention, and uses a global ledger to solve the problem of carrying. But its fatal flaw is exactly the same as gold - the price fluctuates too much. In 2021, the Salvadoran government forced Bitcoin to be used as legal tender. As a result, the Bitcoin used to buy a chicken in the morning may not be enough to buy it in the afternoon, and both transactions and pricing have created great obstacles. In the end, 70% of the transactions were still secretly settled in US dollars. We will never deny the value of Bitcoin, but we can't help but complain about the fact that Bitcoin can be used as legal tender: Can't we find a person in El Salvador who has studied basic economics?

US dollar hegemony: an imperfect but irreplaceable payment machine

Those who say that the dollar hegemony is about to collapse may not understand the real competitiveness of the dollar. It is indeed depreciating, and the US Treasury bonds are indeed piling up, but there is no other currency in the world that can do this at the same time: buy coffee in New York in the morning, pay for gas in Dubai at noon, and settle the payment in Bangkok at night, all using the same payment system, settled at the same price, and received on the same day with a handling fee of less than 1% . Behind this system is the triple moat of the SWIFT international settlement system + the Federal Reserve's liquidity regulation + the US aircraft carrier battle group. Not to mention Bitcoin, even the euro has been struggling for 20 years and has not been able to really shake it.

The core competitiveness of the US dollar is actually the illusion of stability . Although the purchasing power has shrunk for a long time, the daily volatility is so low that it can be ignored. In the past three years, the increase of Bitcoin has not been as amazing as before, but the annualized volatility is still more than 70% on average, while the US dollar index is only about 7%. If you ask multinational companies why they use US dollars for settlement, the financial department will only tell you: "Because all suppliers accept US dollar quotes, and the price will not suddenly drop in half tomorrow." This kind of stability cannot be solved by technology. The central bank needs to adjust the money supply at any time: pump money to prevent inflation when the economy is overheated, and release money to prevent collapse in times of crisis. If the United States also adopted the fixed total amount of Bitcoin, when Lehman Brothers went bankrupt in 2008, ATMs across the United States would have been smashed by the crowds queuing to withdraw money.

More importantly, modern legal tender is essentially an IOU for national credit . When you hold US dollars, you actually hold "a debt certificate that the US government promises to protect with taxes, laws, and even force." The value of Bitcoin is entirely based on the consensus of global users. This is like comparing the payment function of company shares and bank checks. It is not the same species as the US dollar.

The real substitution relationship: Bitcoin eats gold, and stablecoins eat the US dollar

When it comes to substitution, the battlefield is not in one place. When the global central banks were flooding the market with money in 2020, there was an interesting data: gold ETF holdings increased by 35%, while Bitcoin holdings soared by 400%. Young people began to exchange their wedding gold bracelets for BTC wallets and their ancestral gold bars for Grayscale Trust shares.

Bitcoin's substitution for gold is a dimensionality reduction attack . BTC is equally resistant to inflation, and it does not need to hire armed escorts; it is equally circulated globally, and BTC transfers are several orders of magnitude faster than transporting gold; it is equally limited in total volume, and BTC does not need to worry about a new gold mine suddenly being dug up in South Africa. When the market value of Bitcoin exceeds one trillion US dollars in 2023, the total size of global gold ETFs will barely reach 230 billion, and the outcome of this "digital vs. physical" war is already clear.

The real challenger to the US dollar is actually its twin brother, the stablecoin. USDT now has a daily on-chain settlement volume of more than 30 billion US dollars, which is faster and cheaper than JPMorgan Chase's cross-border payment system. But if you look closely at the composition of Tether's reserves, 80% are short-term US bonds and cash deposits. This is essentially using blockchain to cover the dollar, which in turn allows the dollar to penetrate into areas that were originally difficult to reach: Argentines use USDT to fight against the depreciation of the peso, Vietnamese programmers use USDT to receive Silicon Valley wages, and even Russian oil traders have begun to use USDT to circumvent SWIFT sanctions. Ironically, the US dollar stablecoin is both the most successful "gravedigger of the US dollar" and the best salesman of the US dollar hegemony .

A lesson from reality: How those fantasies of replacing the dollar went bankrupt

In 2018, the Venezuelan government issued the Petro, claiming to use digital currency to break the blockade of the US dollar. However, six years later, this thing cannot even be circulated in the country's vegetable markets - after all, no one believes that a government with an inflation rate of 300% can maintain currency stability. In 2022, the Central African Republic pushed for the legalization of Bitcoin, but the national Internet coverage rate was less than 10%, and farmers did not even have mobile phones, so it ended in a mess.

On the contrary, Singapore, which seems to be conservative, has quietly built up its voice in digital currency in three steps: first, using the regulatory sandbox to attract compliant stablecoins such as USDC and PAX to settle in; second, using the central bank digital currency (CBDC) to connect with the traditional banking system; third, using blockchain to upgrade the cross-border payment network. With this combination of measures, although the SGD has not replaced the USD, Singapore has become the transit hub for the digital USD.

These cases reveal a cruel truth: **Currency substitution is never a one-on-one duel at the technical level, but a contest of comprehensive national strength**. Behind the US dollar are the interest rate weapons of the Federal Reserve, the capital network of Wall Street, and the cultural output of Hollywood, all of which Bitcoin does not have. But on the other hand, when the penetration rate of USDT in Africa exceeds that of Visa credit cards, it also shows that cracks are appearing in the old order - except that the wall-breaker is not Bitcoin, but a stablecoin in the disguise of the US dollar.

Answer: Bitcoin does not need to replace the dollar

What the US dollar fears most is not Bitcoin, but another legal currency that can provide "stable payment + international settlement + bulk pricing". The real historical mission of Bitcoin is to become the gold 2.0 of the digital age - when central banks of various countries secretly increase their holdings of BTC as reserve assets, when wealthy people write BTC into family trusts, and when young people use BTC instead of real estate as marriage gifts, this silent infiltration is far more subversive than replacing the US dollar.