Solana rose by 12% last week, joining the market's recovery attempt. Currently, the Layer-1 (L1) is trading at $139.41.

However, major technical indicators are showing a bearish divergence, raising questions about the strength of this upward trend. This analysis covers the details.

Solana Rally Headwind... Bearish Divergence

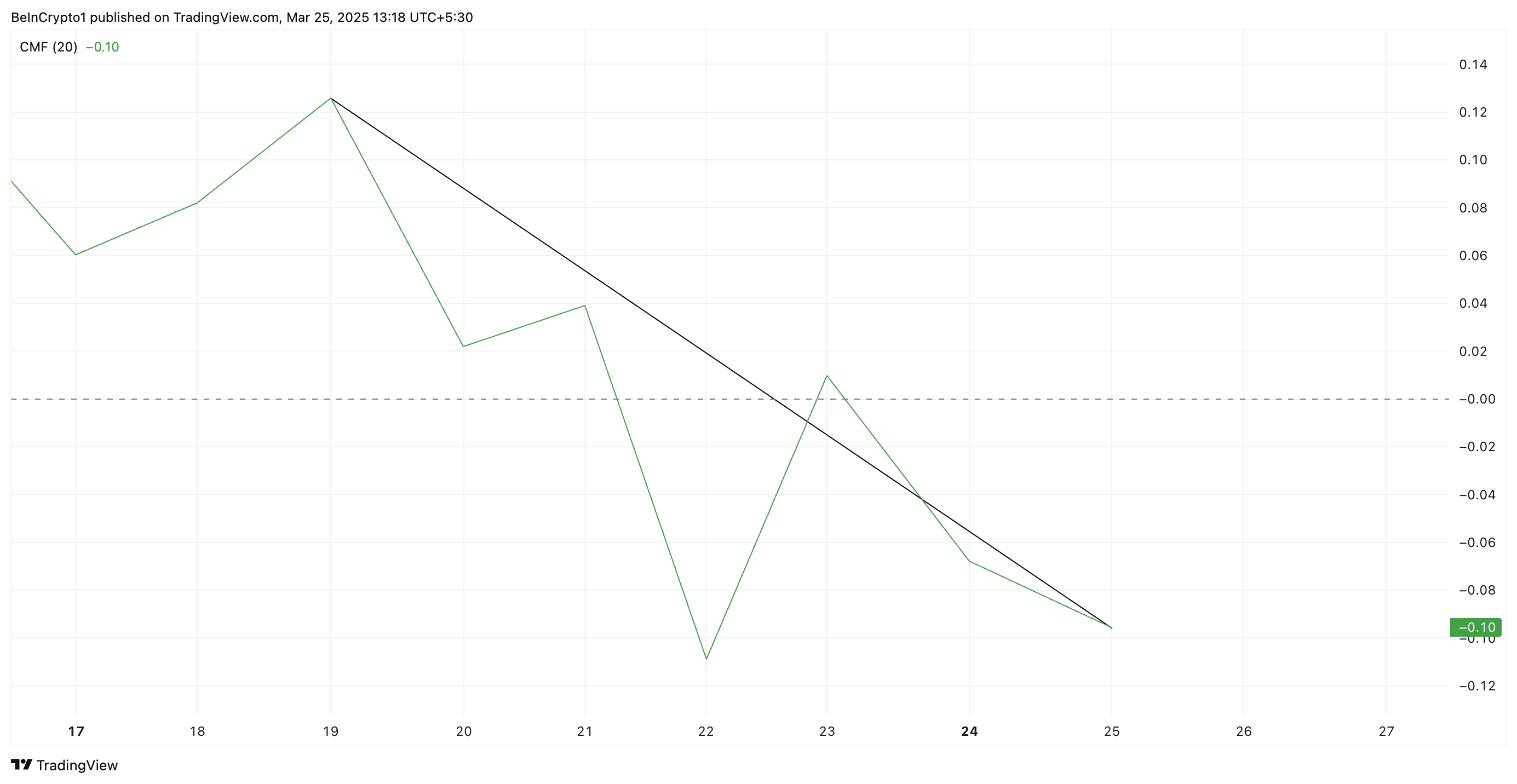

Evaluating the SOL/USD daily chart, while SOL's price increased over the past 7 days, the Chaikin Money Flow (CMF) declined, forming a bearish divergence.

The CMF indicator analyzes trading volume and price movements over a specific period to measure the strength of buying and selling pressure. This indicator ranges from -1 to +1, with positive values indicating strong buying pressure and negative values indicating selling dominance.

A bearish divergence occurs when an asset's price is rising but the CMF is declining, suggesting the rally lacks strong buying support. This means capital inflows are weakening despite SOL's price increase, implying the potential for a reversal or slowdown in the coin's upward trend.

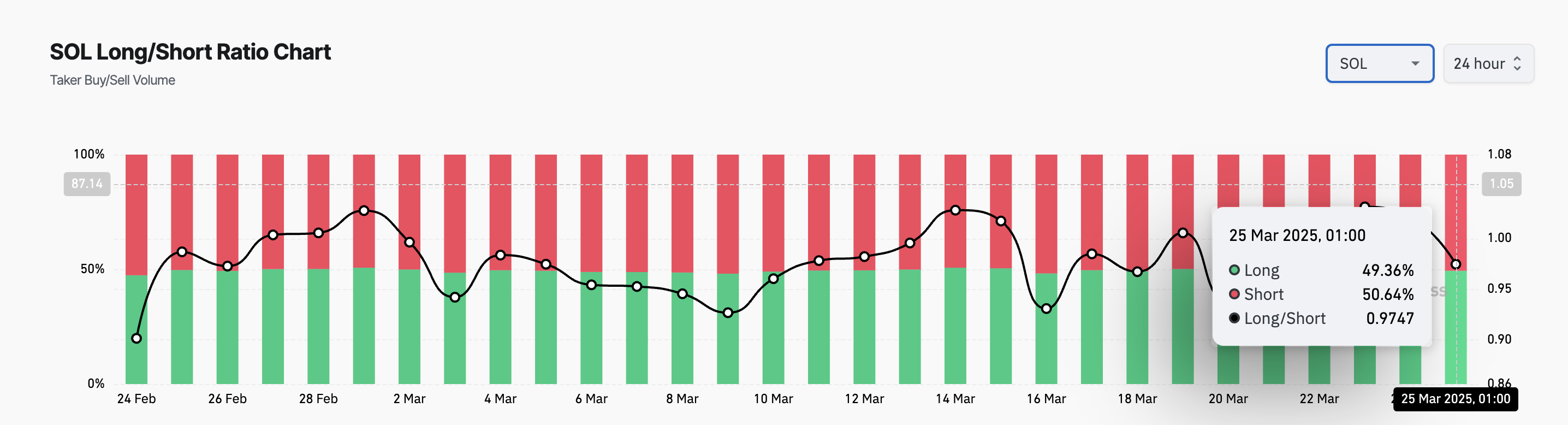

Solana's Longing/Short ratio further supports this bearish outlook. Currently, this ratio remains at 0.97, reflecting high demand for Short positions among derivatives traders.

The Longing/Short ratio measures the proportion of Longing positions (betting on price increases) and Short positions (betting on price decreases) in the market. A ratio below 1 means Short positions outnumber Longing positions. This indicates traders anticipate a downward trend for SOL and are betting on short-term price declines.

Solana at a Critical Moment in the Battle Between Strength and Weakness

SOL is currently trading at $139.41, remaining above the support line at $136.92. If buying pressure weakens and SOL sellers gain dominance, the coin's price may test this support level.

If this price level is not maintained, downward pressure on SOL could intensify, potentially causing the price to drop to $130.82.

Conversely, if actual demand for SOL increases again, this bearish outlook will be invalidated. In this case, the coin's price could rise to $152.87.