ONDO is experiencing significant downward pressure. It has fallen by more than 5% in the past 24 hours and has been adjusting by over 19% in the past 30 days. Its market capitalization is currently around $2.5 billion, which is much lower than competitors like Chainlink and Mantra in terms of market cap.

Recent technical indicators and whale behavior suggest that the current weakness may not have ended, despite a slight recovery in momentum.

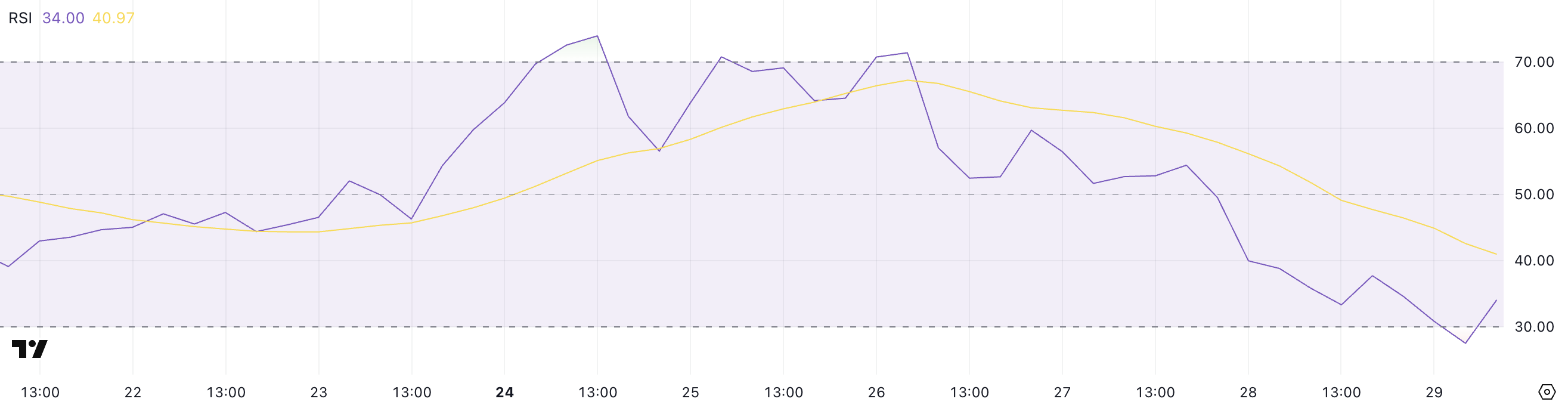

ONDO RSI Recovering from Oversold Levels

ONDO's Relative Strength Index (RSI) is currently located at 34 after slightly rebounding from previous declines. Just two days ago, the RSI was 54.39, showing how quickly momentum has changed.

RSI is a momentum indicator that measures the speed and magnitude of recent price changes. It ranges from 0 to 100.

Readings below 30 are typically considered oversold, suggesting the asset may be undervalued and likely to rebound. Conversely, readings above 70 are considered overbought and indicate potential correction.

ONDO's RSI is currently at 34, technically out of the oversold zone but still at a low level. This suggests that the strongest selling pressure may have eased, but the market remains vulnerable and investment sentiment remains cautious.

If the RSI continues to recover and crosses 40 or 50, it could indicate a transition to stronger upward momentum.

However, if selling resumes and the RSI drops below 30 again, it would indicate a resumption of downward risk and the possibility of further price declines.

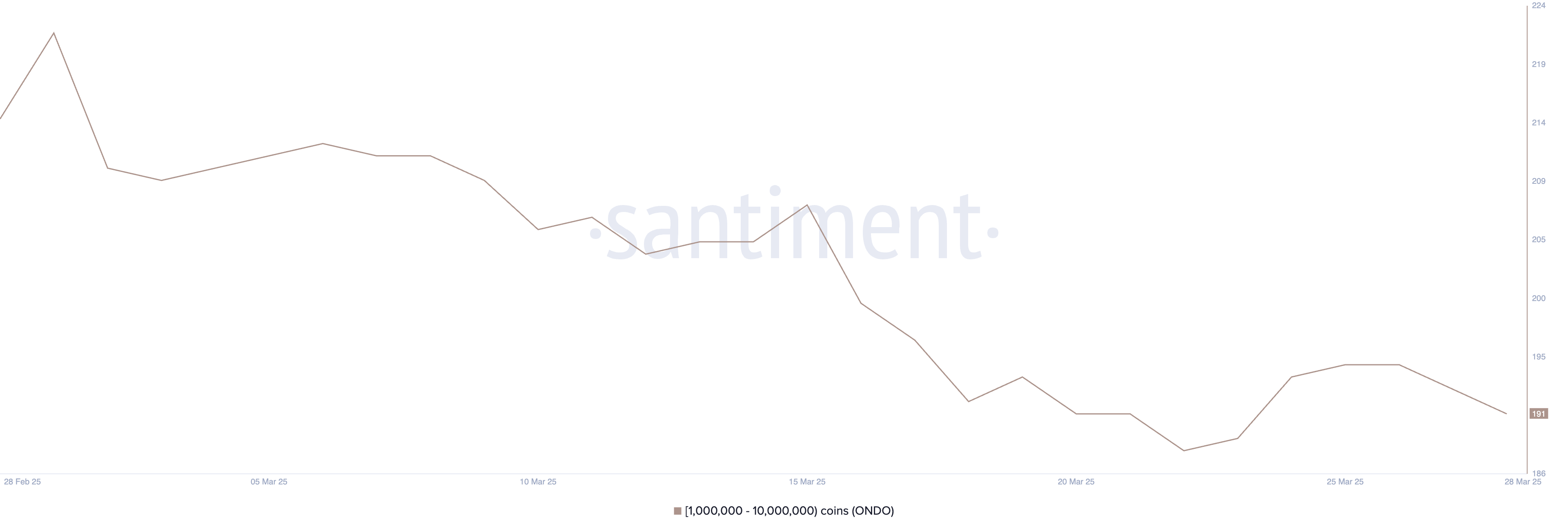

Whales Halt Recent Accumulation

The number of ONDO whales, or addresses holding between 1 million and 10 million ONDO, fluctuated at the end of March. It increased from 188 to 195 between March 22 and March 26, then recently decreased to 191.

This whale activity pattern is significant. These large holders can influence market sentiment and price movements, and their accumulation or distribution stages can signal broader market trends.

Tracking whale addresses provides valuable insights into how influential investors are positioning themselves, which can help predict potential price movements.

The whale addresses not exceeding 195 and returning to 191 could indicate bearish sentiment among large investors.

This retreat may suggest that whales are realizing profits or reducing exposure, which could exert downward pressure on ONDO in the short term.

When large holders begin to reduce positions after accumulation, price corrections often follow, suggesting that ONDO may experience resistance in maintaining upward momentum until whale confidence is restored and accumulation resumes.

ONDO Below $0.70 for the First Time Since November?

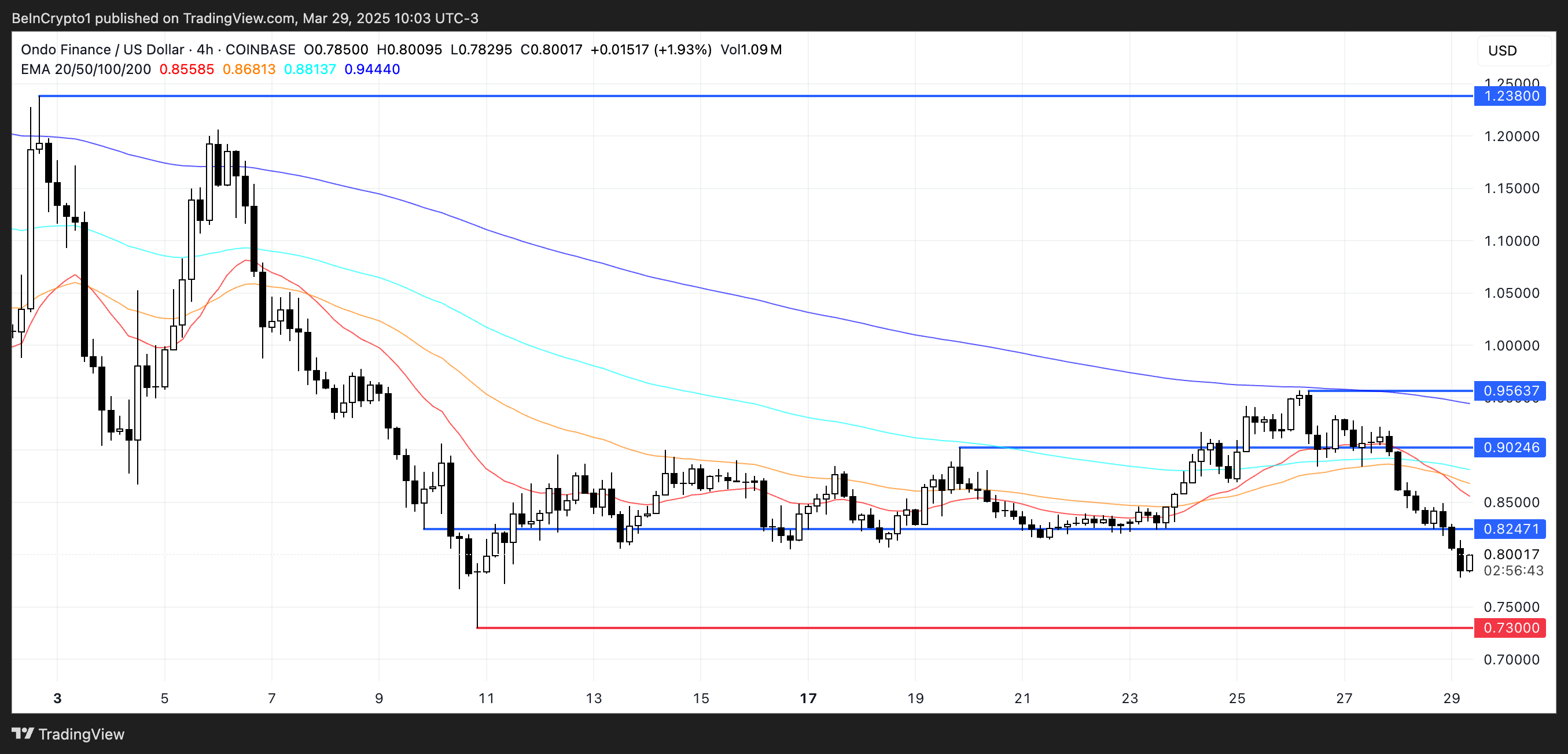

ONDO's Exponential Moving Average (EMA) is currently aligned with a bearish formation, suggesting continued downward trend may persist. If this weakness continues, ONDO could test the key support level of $0.73.

A drop below this level would be significant, potentially pushing the price below $0.70 for the first time since November 2024.

The token is struggling to keep pace with other Real World Asset (RWA) coins like Mantra, and this underperformance adds additional pressure to ONDO's short-term outlook.

However, if investment sentiment changes and ONDO can reverse the trend, the first major level to watch would be the $0.82 resistance.

Breaking through this level could trigger a broader recovery, with price targets of $0.90 and $0.95.

If the entire RWA sector recovers momentum, ONDO could potentially surpass $1 and target the next major resistance at $1.23.