The cryptocurrency market has high expectations this week. The first quarter (Q1) is coming to an end. The second quarter (Q2) begins on Tuesday, and several US economic data will influence the sentiment of BTC and cryptocurrencies this week.

Traders and investors will be watching the release of US economic data that could impact Bitcoin and altcoin prices.

5 US Economic Data Points to Watch This Week

These US macroeconomic indicators will provide new insights into the health of the world's largest economy and could trigger volatility.

"Get ready—volatility is coming. Just in time for monthly moves," a user joked on X.

JOLTS

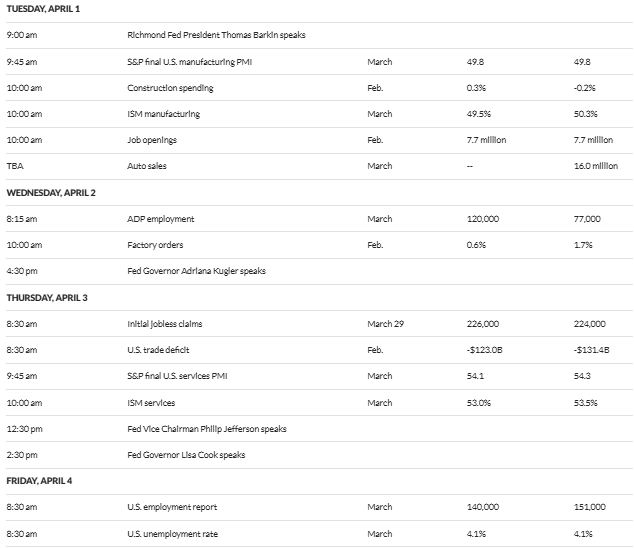

First is the Job Openings and Labor Turnover Survey (JOLTS), set to be released on Tuesday, April 1. This report tracks job openings in the US, providing a window into employer confidence and labor market demand.

Job openings significantly exceeding the recent trend of around 7 million suggest a strong economy. This would strengthen the US dollar but reduce its appeal as a hedge against Bitcoin's weakness.

Conversely, a sharp decline in job openings could stimulate expectations of a Federal Reserve rate cut to bolster the economy. This result would elevate risky assets like Bitcoin and cryptocurrencies as investors seek alternatives to low-yield bonds.

ADP Non-Farm Employment Report

Added to the list of US macroeconomic indicators this week is the ADP Non-Farm Employment Report, to be released on Wednesday, April 2. This report provides a snapshot of private sector payrolls, offering a preview of the major event on Friday.

The mid-forecast for March is 120,000, with the previous record at 77,000. If employment growth appears higher than market predictions, it could create dollar strength and pressure cryptocurrency prices.

Meanwhile, non-farm employment figures falling below the expected 77,000 would heighten market concerns about an economic slowdown.

US Tariff Liberation Day

Meanwhile, the US economy faces uncertainties like policies from the Trump era. This includes tariffs and government streamlining efforts. BeInCrypto reported on Liberation Day, expected to bring new tariff announcements targeting countries imposing trade barriers.

"Already damaging US businesses and consumers over the past two months, the April 2 deadline could make everything look like a storm in a teacup. We don't know exactly what they'll do, but it sounds like new tariffs on all US imports," said Joseph Politano, economic policy analyst at Apricitas Economics.

Analysts predict extreme market volatility. If Trump implements broad tariffs, stocks and cryptocurrencies could drop 10-15%.

"April 2 is like election night. It's the biggest event of the year. 10 times more important than FOMC. And anything can happen," predicted Alex Kruger.

Initial Jobless Claims

On Thursday, April 3, the cryptocurrency market will watch the Initial Jobless Claims report. This report shows the number of US citizens applying for unemployment insurance, released weekly, providing a real-time pulse on layoffs and labor market stability.

Claims lower than the previous week's 224,000 suggest resilience, supporting the dollar but potentially suppressing cryptocurrency enthusiasm. Exceeding the mid-forecast of 226,000 could signal a warning about economic health.

These results will promote demand for diversified assets as a hedge against potential disruption. Due to its weekly cycle, this report tends to trigger quick reactions in the cryptocurrency market, especially when amplified by broader narratives like government efficiency cuts or 2025 tariff impacts.

US Employment Report

The week's climax arrives on Friday, April 4, with the release of the US Employment Report, or Non-Farm Payrolls. This comprehensive labor market update, including job gains, unemployment rate, and wage increases, is central to global markets.

A strong report exceeding the previous figure of 151,000 jobs and the stable 4.1% unemployment rate could reinforce economic confidence. This might suppress cryptocurrency rises if the dollar strengthens.

However, robust wage increases over 0.3% monthly could reignite inflation concerns, indirectly supporting Bitcoin as a store of value.

Conversely, disappointing results falling below the 140,000 job midpoint forecast and exceeding the 4.1% unemployment rate could trigger recession fears. This would drive investors towards Bitcoin and cryptocurrencies.

Historically, a difference of over 50,000 jobs from consensus predictions has seen Bitcoin move dramatically by 1-2% or more.

"BofA [Bank of America] Securities anticipates job increases in March. Keep an eye on those numbers." – Cryptocurrency researcher Orlando noted.

Cryptocurrency market participants have a clear plan: track economic calendar consensus estimates, monitor real-time reactions, and prepare for volatility. This week's data could especially determine Bitcoin's next moves in Q2 2025.

Jerome Powell, Chairman of the Federal Reserve, is scheduled to deliver a speech on the economic outlook at the SABEW Annual Conference at 11:25 AM EST on Friday.

According to BeInCrypto data, BTC is currently trading at $82,192 and has fallen by more than 1% over the past 24 hours.