Bitcoin's recent price movement is showing worrying signs. Bitcoin has been unable to break through major resistance levels for several days, leaving it vulnerable to further decline.

As Bitcoin tests the $80,000 support level in the coming days, the possibility of a death cross increases, and market bearish sentiment is expected to grow.

Bitcoin Short-Term Investors Skeptical of the Market

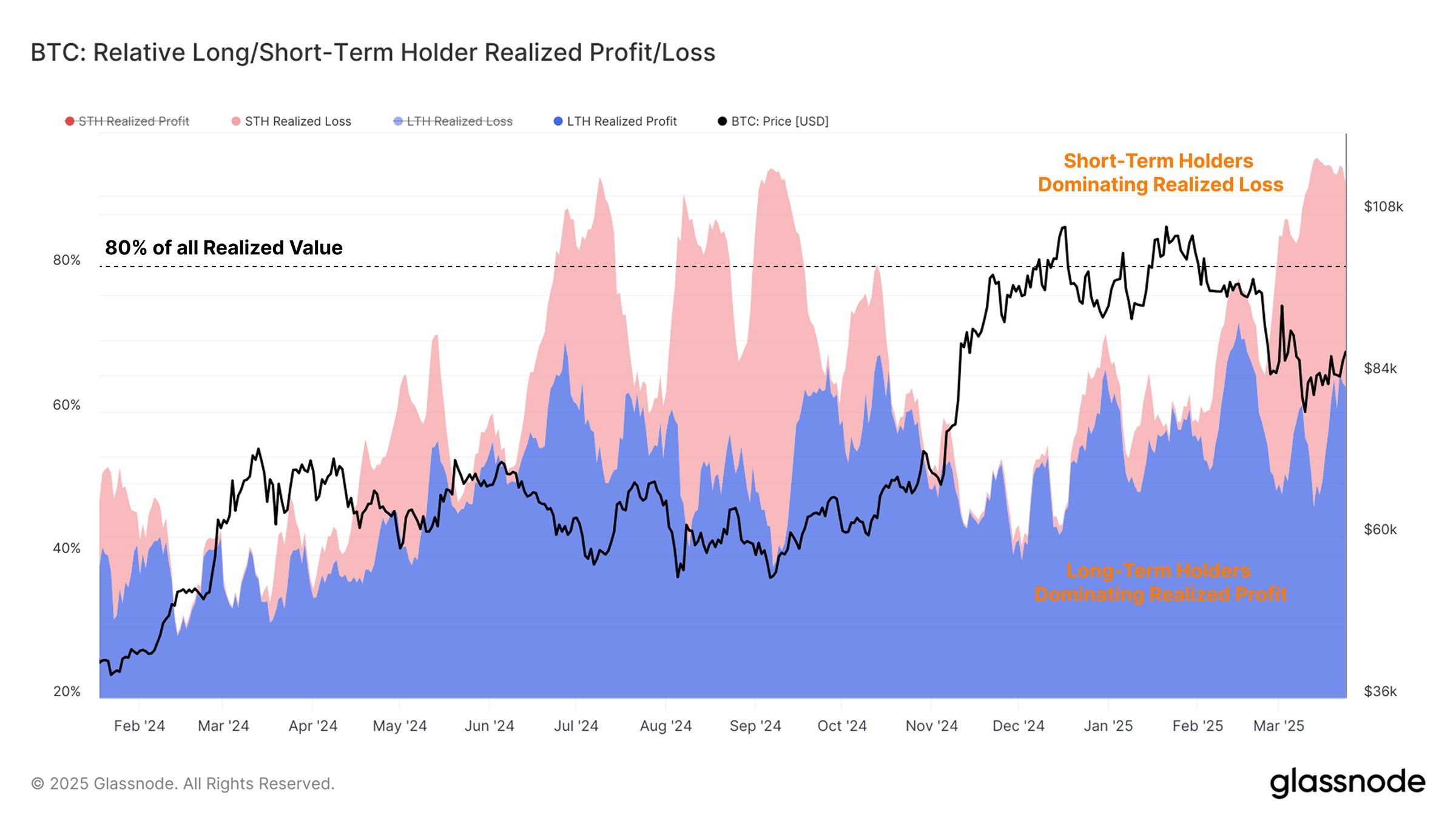

Short-term holders (STH) who bought at high prices are currently the main cause of losses. These investors are recording losses in response to Bitcoin's volatile market conditions, reflecting an unpredictable environment difficult for new investors to navigate.

Meanwhile, long-term holders (LTH) continue to realize profits and benefit from their long-standing market presence. However, the current market situation shows a stagnation of new capital inflows, with LTH profits being offset by STH losses. This weakens demand and resistance, suggesting potential momentum slowdown.

Consistent capital inflow is necessary to maintain market strength, but the current market appears to lack this crucial support. The overall atmosphere reflects a neutral stance with balanced profit and loss realization.

Bitcoin's macro momentum shows additional downward pressure, especially with moving averages (EMA). The 200-day EMA is within 3% of crossing with the 50-day EMA, which could trigger a death cross. This technical pattern historically signals significant price adjustment and potentially marks the end of Bitcoin's 18-month golden cross.

As the EMA approaches this critical point, traders and investors are carefully observing signs of correction. Fear of a death cross raises additional concerns about Bitcoin's price stability. If the 50-day EMA crosses below the 200-day EMA, it could trigger more selling and reinforce market bearish sentiment.

Is BTC Price Prepared for Further Decline?

Bitcoin is currently trading at $82,248, approaching the key psychological support level of $80,000. Despite breakthrough attempts, Bitcoin has not escaped the two-month expanding descending wedge pattern. This pattern suggests Bitcoin may be on the verge of further decline.

If downward momentum continues, Bitcoin is likely to break through the $80,000 support level and approach $76,741. This scenario strengthens the downward outlook, considering technical indicators and lack of strong buying support. A drop below this level could signal deeper correction and imply further potential decline.

However, this short-term decline thesis could be invalidated if Bitcoin's price recovers to support at $82,761. If Bitcoin breaks through the $85,000 barrier, it could signal a potential reversal and escape the current pattern. A strong rally above $86,822 would invalidate the prevailing downward momentum and suggest a resumption of bullish trend.