Bitcoin (BTC) is set to record its worst first quarter performance since 2019. Without an unexpected recovery, BTC could close the quarter with a 25% decline from its all-time high (ATH).

Some analysts have mentioned that experienced Bitcoin holders are transitioning to an accumulation phase, suggesting potential price increases in the medium term.

Veteran Investors Signaling Renewed Accumulation

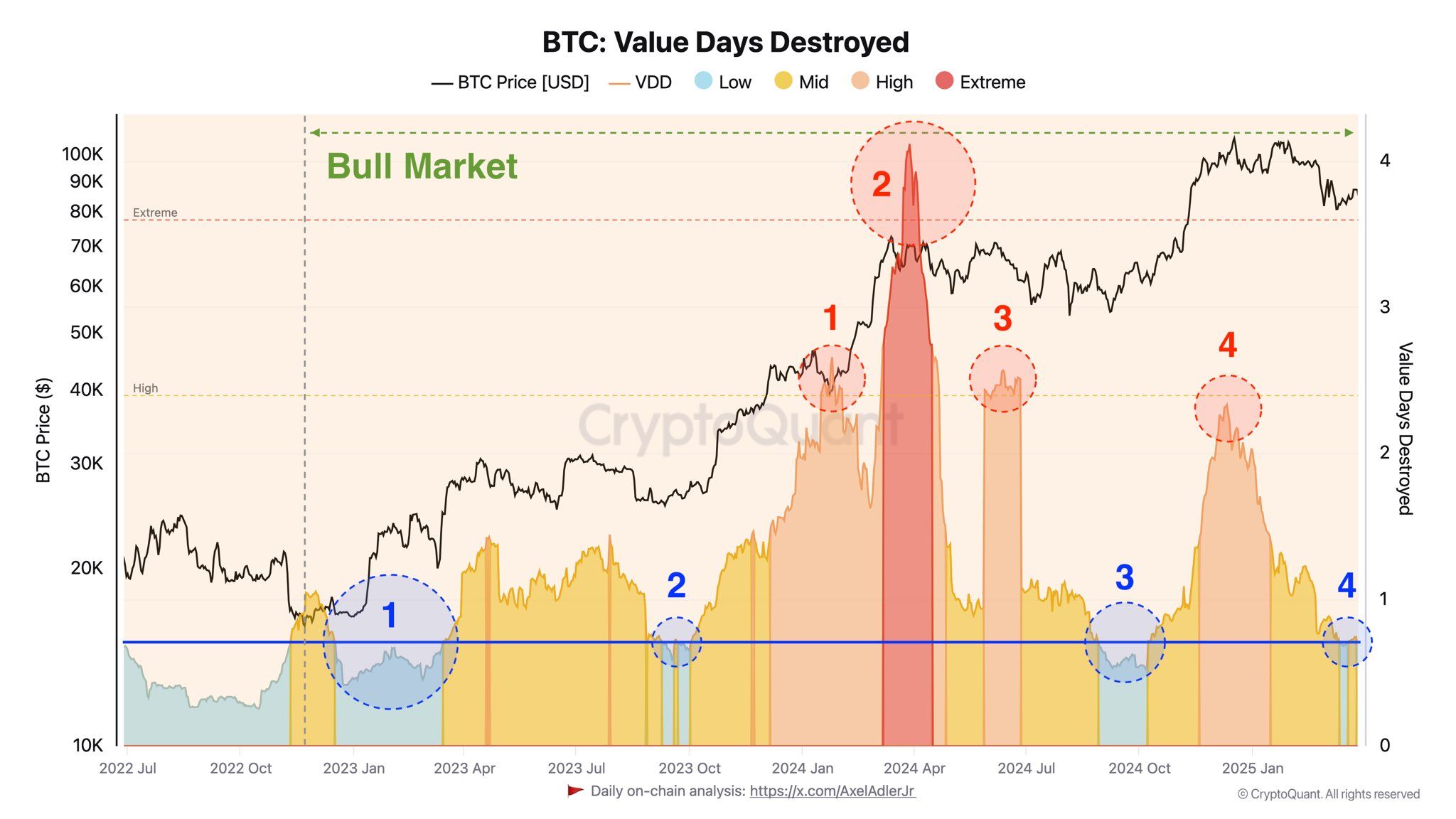

According to AxelAdlerJr, March 2025 is a period when veteran investors are shifting from selling to holding and accumulating. This change is reflected in the low Value Days Destroyed (VDD) indicator.

VDD is an on-chain indicator that tracks investor behavior by measuring the number of days Bitcoin remains untouched before being traded.

High VDD indicates old Bitcoin is moving, which could suggest selling pressure from whales or long-term holders. Low VDD suggests most trades are made by short-term holders with minimal market impact.

Historically, periods of low VDD precede strong price increases. These stages suggest investors are accumulating Bitcoin in anticipation of future price growth. AxelAdlerJr concluded that this change indicates potential medium-term growth for Bitcoin.

"Experienced players transitioning to a holding (accumulation) phase suggests additional BTC growth in the medium term." – AxelAdlerJr Prediction.

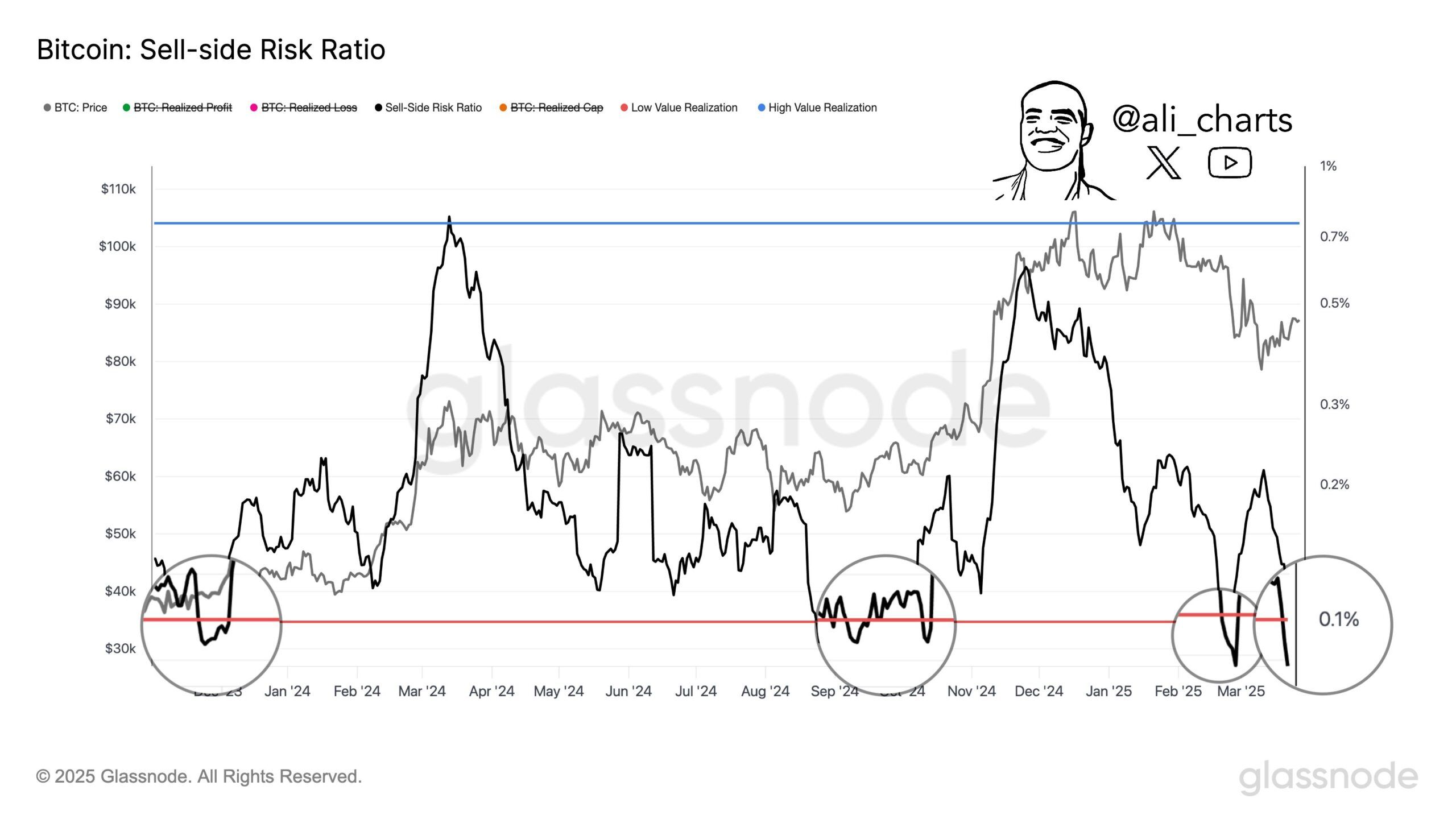

Bitcoin Sell-Side Risk Ratio at Lowest Level

Simultaneously, analyst Ali highlighted another bullish indicator: Bitcoin's sell-side risk ratio has dropped to 0.086%.

According to Ali, every time this ratio has fallen below 0.1% in the past two years, Bitcoin has experienced a strong price rebound. For example, in January 2024, Bitcoin reached its then all-time high of $73,800 after the sell-side risk ratio dropped below 0.1%.

Similarly, Bitcoin reached a new peak after this indicator reached a low level in September 2024.

Veteran investors accumulating Bitcoin and the sharp decline in sell-side risk ratio are positive market signals. However, a recent BeInCrypto analysis warns of a concerning technical pattern, with a death cross beginning to form.

Additionally, investors remain cautious about market volatility in early April. Uncertainty stems from the upcoming announcement of major retaliatory tariffs by the former president.