Author: Arthur Hayes, founder of BitMEX; Translated by: AIMan@ Jinse Finance

Jerome Powell and Haruhiko Kuroda have developed a strong friendship in global central bank circles. Kuroda's term as governor of the Bank of Japan ended a few years ago, and Powell often called him for advice or just to chat. In early March, Powell had a very messy meeting with new US Treasury Secretary Scott Bessent. It left him psychologically traumatized, and he needed someone to talk to - let's hear what he had to say.

Powell: Hiroki, I really need to talk to you. I just had a very disturbing meeting with Scott.

Kuroda: I'm all ears?

POWELL: You won't believe what just happened. Scott called me and asked me to come to Washington to talk. I said, "I'm busy; I have a FOMC meeting in a few days. Can we talk on the phone?" But Scott insisted. I should have known something strange was going to happen.

Kuroda: Wait a minute - before you say anything, I have a suggestion. Have you heard of the Jung Center for Central Bankers?

POWELL: No. When you say Jung, do you mean the psychiatrist Carl Jung?

Kuroda: Yes, that was him. While at the German National Bank, he created a program to help the then-famous central bankers deal with all the pressures and responsibilities that came with their new roles as masters of the universe. After World War II, the practice expanded to London, Paris, Tokyo, and New York.

POWELL: That's great; I've always felt very lonely. I really wanted someone to talk to about the unique pressures that I face as the world's most important banker.

Kuroda: I'll let Justin know you're coming. She receives clients at her apartment at 740 Park Avenue.

POWELL: Thank you, I'm going to try to make an appointment tomorrow.

Kuroda: Don't worry. There is only one client who is eligible for her service at any given time. That is the Chairman of the Federal Reserve. She exists to serve you and you alone.

Jerome felt a wave of relief. He couldn't believe there was a mental health professional working just for him. He couldn't believe her address either. He had spent his entire career trying to get a co-op at an address like 740 Park Avenue. "What the hell is going on here," he thought to himself. With just one word he could bankrupt most of the financiers who lived in that building. They were a bunch of egotistical, over-indebted assholes.

The next day, Jerome went downtown to meet Justin. He checked in at the front desk and was led to a private elevator that went straight to Justin's room. As soon as he stepped out of the elevator, he saw a goddess. The deity of the central bank must have read his mind. In addition to her appearance, the interior was decorated just as he wanted it decorated. Justin greeted him and motioned for him to lie down on the Le Corbusier lounge chair. A smoothie was placed on the Noguchi coffee table next to him. Powell took a sip; it tasted great and was refreshing. Justin seemed to know him well.

Justin: It's perfect, isn't it?

Powell: I'm amazed; we've never met, and yet you know me so well.

Justin: My firm has been serving central bankers for nearly a century. We know you inside out. I think I understand why you came to me today. Usually, the Fed chair learns of our existence after an uncomfortable meeting with his counterparts in the finance or financial sectors. Let me guess: you witnessed the manifestation of dominance.

Powell: You're right, you're good at that. Yes, it's very traumatic for me mentally, and I don't feel like a man anymore, no - like a human being after this recent experience.

Justin: Tell me what happened.

Powell: First of all, I was a little mad at Scott for insisting that I go to Washington, D.C. New York is the capital of the empire, not Washington, D.C. Who the hell does he think he is!

Justin: This is a safe space, this is your space. Let it all out.

POWELL: OK, so I get to Scott's office on time. He makes me wait for an hour. Asshole. Then he leads me into the room, and I don't know how to react. I see a RealBotix female sex doll on all fours. There's a piece of paper wrapped around her head that says "Fiscal Dominance." There's another piece of paper taped to her lower back that says "Fed Inflation Fighting Credibility." Scott then has me sit in a chair across the room. There's a sign on the back of the chair that says, "Cuck Chair." Scott then says to me, "You know what I have, I have the BBC (the Big Bessent Cock)." And then he starts fucking the doll.

When it was over he said, “I did this to show you who is really in power. I have the BBC and next week at the FOMC you will begin to taper my QE on Treasuries and announce that QE on Treasuries will begin in the near future. Do you understand? When I say it is time to grant the SLR exemption to Treasuries, you better approve it immediately.”

I was very mentally unstable, crying and nodding in the affirmative.

Justin: I guess that's what happens. Look, don't feel bad. You're not the first Fed chair to be pushed around fiscally. It's not your fault. It's not your fault.

POWELL (crying): But Justin, I'm the new Paul Volcker; he's my hero. While Scott was fucking that doll, I tried to regain some mental strength by saying to myself, "I'm Paul Volcker, I'm Paul Volcker." You know what Scott said when I walked out of his office? Like he read my mind? "Bitch, you're just another Arthur Burns."

Justin: It's okay, I know. It's heartbreaking to realize that you're being financially controlled and to be told off to your face as the president of the most powerful central bank in the world. But others have been there before you. You remember that the Fed was merged with the Treasury Department during World War II until 1951. I know you think you're independent, but deep down, you know you're not. You need to accept that. I can help you with that, come back every week and we can talk. But in the meantime, I want you to read a speech by Arthur Burns called "The Agony of Central Banking." It will give you strength and let you know that you never had a choice. What you're doing is the right thing. Today's meeting is over; you still have homework to do. I hope this makes you feel better about performing your duties on the FOMC in a few days. It's okay; the universe still loves you. Before you go, let me heal your energy with some crystals.

POWELL: Thank you. I feel much better.

I feel like some brilliant irony is needed to underscore this point: After the Fed’s recent March meeting on global dollar liquidity, the rules of the game have substantially changed. Powell laid out a path to resume quantitative easing, with a focus on the U.S. Treasury market. While everyone is wondering whether the impact of tariffs is good or bad, the crypto market should be thankful that quantitative easing will resume this summer.

The rest of this article will focus on the political, mathematical, and philosophical reasons why Powell capitulated. First, I will discuss President Trump's consistent campaign promises and how this mathematically forces the Federal Reserve and the U.S. commercial banking system to print money and buy Treasury bonds. Then, I will discuss why the Fed never has a chance to maintain tight enough monetary conditions long enough to keep inflation in check. Finally, I will discuss how Maelstrom should be positioned to profit from the recent Powell turnaround.

Make a promise, keep it

Over the past few weeks, I have been reading articles from my favorite macroeconomic analysts. A large portion of every article I read is devoted to analyzing Trump’s true intentions. Some say that Trump will take tough measures and disrupt the status quo until his approval rating drops below 30%. Others say that Trump sees it as his mission to reshape the world order and get America’s financial, political, and military in order during the final stages of his term. In short, he is willing to endure great economic pain and a sharp drop in popularity to do what he believes is good for America. As traders, we must remove “right” and “wrong” from the equation and measure ourselves with probability and mathematics. Ultimately, our portfolios do not care about whether the United States is strong or weak relative to other nation states, but whether there will be more or less fiat currencies circulating around the world in the near future. Therefore, rather than trying to predict Trump’s inclinations, I will focus on a chart and a mathematical identity.

Trump’s consistent message since 2016 has been that the United States has gotten a raw deal over the past few decades because its trading partners took advantage of it. While you might think he has or will screw up his plans, his intentions have not changed. The Democratic Party, while not as enthusiastic about changing the global order, is somewhat in favor of achieving the same changes. Former U.S. President Biden continued Trump’s policies of restricting China’s access to U.S. semiconductors and other market sectors. Biden’s Vice President Kamala Harris also used tough rhetoric on China during his failed presidential campaign. While Republicans and Democrats may disagree on the pace and depth of change, both parties advocate for change.

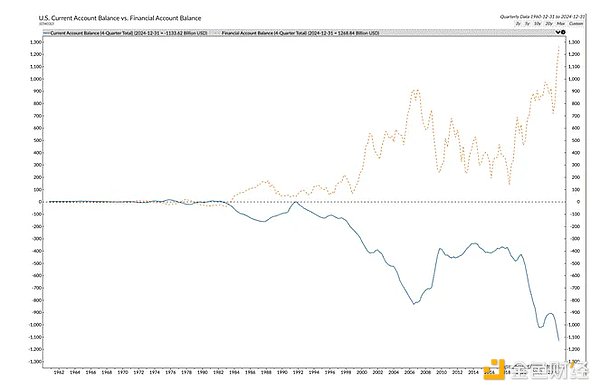

The blue line is the U.S. current account balance, which is basically the trade balance. You can see that starting in the mid-1990s, the U.S. imported far more goods than it exported, and that growth accelerated after 2000. What happened during that time? China.

In 1994, China dramatically devalued its currency, launching its journey as a mercantilist export powerhouse. In 2001, U.S. President Bill Clinton allowed China into the World Trade Organization, drastically reducing tariffs on Chinese exports to the U.S. As a result, the U.S. manufacturing base shifted to China, and the rest is history.

USDCNY y-axis inverted.

Trump's supporters are those who have been negatively affected by the offshoring of American manufacturing. These are people who don't have college degrees, live inland, and own few financial assets. Hillary Clinton called them deplorables. Vice President JD Vance affectionately called them and himself rednecks.

The orange dotted line and top of this chart is the U.S. financial account balance. As you can see, it is effectively a mirror image of the current account balance. China and other exporting countries can consistently run large trade surpluses because when they earn dollars from selling products to the U.S., they do not reinvest those dollars back home. Doing so means they sell dollars and buy their own currencies like the renminbi, which then makes their currencies appreciate, making their exports more expensive. Instead, they use those dollars to buy U.S. Treasury securities and U.S. stocks. This has allowed the U.S. to run large deficits without causing a collapse in the Treasury market, and to have the best performing global stock market over the past few decades.

The US 10-year Treasury yield (white) is slightly lower, while the total outstanding debt (yellow) has increased 7 times over the same time frame.

Since 2009, the MSCI USA Index (white) has outperformed the MSCI World Index (yellow) by 200%.

Since 2009, the MSCI USA Index (white) has outperformed the MSCI World Index (yellow) by 200%.

Trump believes that by bringing these manufacturing jobs back to the United States, he can provide good jobs to the approximately 65% of the population who do not have a college degree, strengthen the military because sufficient quantities of weapons, etc. can be produced to fight against equal or near-equal competitors, and achieve above-trend economic growth, such as 3% real GDP growth.

There are some obvious problems with this plan. Without dollars backing Treasuries and stocks from China and other countries, prices will fall. Treasury Secretary Scott Bessant needs buyers for the massive debt that must be rolled over and for the ongoing federal deficits in the future. His plan is to reduce the deficit from about 7% to 3% by 2028. The second problem is that capital gains taxes from rising stock markets are a marginal revenue driver for the government. When the rich don’t make money, the deficit grows. Trump didn’t run on a platform to stop military spending or cut benefits like Medicare and Social Security. He ran on a platform of growth and eliminating fraudulent spending. So he needs capital gains tax revenue even though all the stocks are owned by the rich and, on average, they didn’t vote for him in 2024.

That's Trump's number one policy goal. Let's dig deeper.

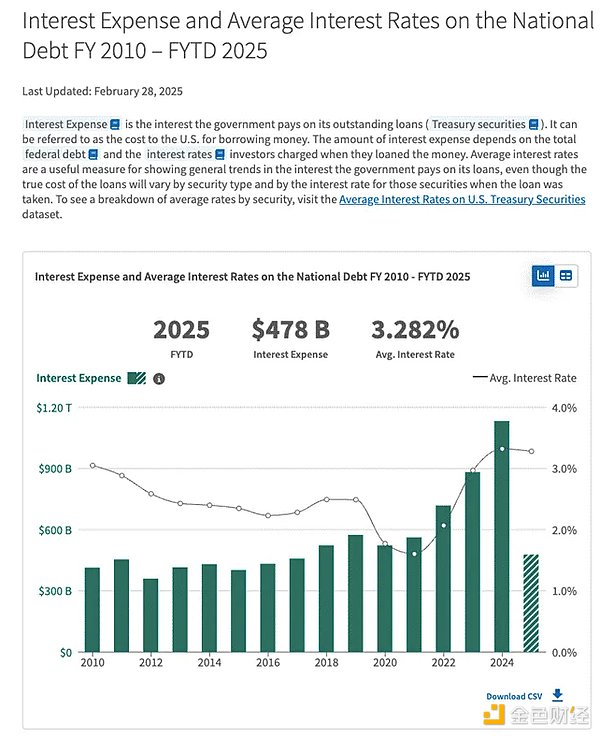

Assuming Trump succeeds in reducing the deficit from 7% to 3% by 2028, the government will still be a net borrower year after year, unable to repay any existing debt. Mathematically, this means that interest payments will continue to grow exponentially.

This sounds bad, but mathematically the US can grow its way out of this and reduce the leverage of its balance sheet. If real GDP growth is 3% and long-term inflation is 2% (I don't think this will happen, but let's be generous), this means nominal GDP growth is 5%. If the government issues debt at 3% of GDP growth, but the nominal economy grows at 5%, then mathematically the debt-to-GDP ratio will fall over time. One question remains unanswered: At what interest rate can the government finance itself?

In theory, if the U.S. economy grows at a nominal 5%, Treasury investors should demand a yield of at least 5%. But that would significantly increase interest costs, since the U.S. Treasury currently pays a weighted average rate of 3.282% on its roughly $36 trillion and growing debt.

Unless Bessant can find buyers for Treasuries at high prices or low yields who don't care about the economic gain, the numbers don't make sense. China and other exporters can't and won't buy Treasuries because Trump is busy reshaping the global financial and trade system. Private investors won't buy Treasuries because the yields are too low. Only U.S. commercial banks and the Federal Reserve have the ability to buy debt at levels that the government can afford.

The Fed can print money and buy bonds, which is called quantitative easing (QE). Banks can print money and buy bonds, which is called fractional reserve banking. However, it is not that easy.

The Fed is busy in its quixotic quest to get a manipulated, unrealistic measure of inflation below their fictitious 2% target. They are actively removing money/credit from the system by shrinking their balance sheet, which is called quantitative tightening (QT). Because banks performed badly in the 2008 Global Financial Crisis (GFC), regulators require them to collateralize the Treasury bonds they purchase with more of their own equity, which is called the Supplementary Leverage Ratio (SLR). Therefore, banks cannot use unlimited leverage to finance the government.

However, it is very simple to change this status quo and make the Fed and banks inelastic buyers of Treasuries. The Fed could at least decide to end quantitative tightening and at most restart quantitative easing. The Fed could also exempt banks from SLR restrictions, allowing them to buy Treasuries using unlimited leverage.

So why would Jerome Powell’s Fed (he is the Fed Chairman) help Trump achieve his policy goals? The Fed cut interest rates by 0.5% in September 2024, openly helping Harris win the election, and after Trump’s victory, the Fed stubbornly refused Trump’s request to increase the quantity of money and make long-term Treasury yields fall. To understand why Powell would do what the government asked, let’s look back to 1979.

The Cuck Chair

Now, Powell is sitting in the "Cuck Chair" (a chair facing the bed in a hotel room, which implies being dominated by others) and watching the BBC undermine the Fed's credibility in fighting inflation.

Scott Bessent is leading because fiscal dominance is working. Simply put, once total debt becomes too large, the Fed will abandon its independence and do whatever is necessary to finance the government at an affordable rate.

If you think this is new, let’s look at a seminal speech by former Federal Reserve Chairman Arthur Burns.

Western financial historians have castigated Burns for creating an easy monetary environment in the 1970s that led to the alarming inflation of the early 1980s. Powell is rumored to have declared within the hallowed walls of the Marriner Eccles Building that he would go down in history not as the 21st century’s Arthur Burns, but as Paul Volcker. The same historians have heaped praise on former Fed Chairman Volcker for the inflation and US economic “turnaround” he promoted with US President Ronald Reagan, much of it undeserved. That’s why, I guess, Powell muttered to himself “I’m Paul Volcker, I’m Paul Volcker” as he sat in the Cuck Chair while the BBC tore his credibility to shreds on the other side of the room.

In 1979, Burns gave a famous speech entitled “The Pain of Central Banking.” I will extract a few quotes to help understand the current political and monetary situation that Powell finds himself in. I will add some wonderful annotations to focus on what I think are the key points. Sorry, not about the long quotes, this speech is so prescient and so relevant today that it must be reread and learned from.

…philosophical and political currents have been shaping economic life in the United States and elsewhere since the 1930s, with a resulting tendency toward persistent inflation. The nature of the unique inflation of our time, and the reasons for the ineffectiveness of central bankers in combating it, can be understood only in terms of these currents and the political environment they have created.

The politicians asked me to do this.

Together, these and other New Deal measures laid the foundation for an activist government—one charged not only with relieving hardship and guarding against economic adversity but also with limiting “harmful” competition, subsidizing “beneficial” activities, and correcting inequalities in market power. Within a decade, government had become a major player on the economic stage.

The New Deal was the awakening, inclusion, and DEI of the 1970s. The rich always agree with the central bank printing money to bail out their financial assets, but never agree with the poor getting some government assistance. This is not to say that government handouts actually lift people out of poverty, but they do make people feel good and are less likely to cause social unrest.

But the rapid growth of national wealth did not bring contentment. Instead, the 1960s were a time of social unrest in the United States, as in other industrial democracies. Partly, the riots reflected dissatisfaction among blacks and other minorities with widespread conditions of social discrimination and economic deprivation—dissatisfaction that erupted in the "hot summers" of the mid-1960s, leading to arson and looting. Partly, the social unrest reflected a growing sense of injustice among other groups (the poor, the elderly, the physically disabled, minorities, farmers, blue-collar workers, women, and so on). Partly, it reflected a growing rejection of the existing system and cultural values by middle-class youth. Partly, it reflected a more or less sudden realization among the general public that the economic reforms of the New Deal and the recent growth in national wealth had not touched on problems in all areas of American life (social, political, economic, and environmental). Interacting with all these sources of social unrest was the heightened tensions caused by the Vietnam War.

Then, as today, "prosperity" was not evenly distributed, and people demanded that their government do something to change that.

The interaction of government actions and private demand created an internal dynamic that led to the escalation of both. When the government addressed the “unfinished business” of reducing frictional unemployment, eliminating poverty, expanding the benefits of prosperity, and improving the quality of life in the mid-1960s, it awakened new expectations and demands.

The people got what they wanted, and the government stepped in directly to try to address the issues in key constituencies. “Try” is the key word. Actual results may vary.

This interaction of government and citizen activism has produced many beneficial results. However, their cumulative effect is to give the U.S. economy a strong inflationary bias. The proliferation of government programs has led to an increasing tax burden on individuals and businesses. Even so, the government's willingness to tax remains significantly lower than its propensity to spend.

People think it is the government's job to solve their problems. The government solves problems by spending money to do things, which causes inflation to creep deep into the economy.

Indeed, the expansion of government spending was driven in large part by a commitment to full employment, and inflation was widely viewed as either a temporary phenomenon or, as long as it remained mild, an acceptable state of affairs.

Why does the Fed tolerate 2% inflation per year? Why does the Fed use phrases like "transitory" inflation? 2% inflation over 30 years adds up to an 82% increase in the price level. But if unemployment rises 1%, the sky will fall. It makes you sigh...

Theoretically, the Federal Reserve System had the power to nip inflation in the bud at any time 15 years ago or later, and it has the power to end inflation today. At any time during that time, it could have restricted the money supply and created sufficient pressure in financial and industrial markets to end inflation without delay. It did not do so because the Federal Reserve itself was caught up in the philosophical and political currents that were changing American life and culture.

Here’s the punchline. The Fed is supposed to be independent, but as an arm of government that is philosophically inclined to solve everyone’s problems, it will not and cannot prevent the inflation that would require such intervention. The Fed has acted as a willing accomplice, and in the process created the inflation they swore to eliminate.

Faced with these political realities, the Fed remained willing to apply the monetary brakes aggressively at certain times—such as in 1966, 1969, and 1974—but its tightening stance was not maintained long enough to end inflation. In general, monetary policy was constrained by the principle of suppressing the inflationary process while still withstanding a significant portion of the pressure in the market.

That is exactly what Powell has done and is doing with regard to monetary policy. That is the definition of fiscal dominance. The Fed will do whatever is necessary to fund the government. You can debate whether those policy objectives are good or bad. Burns' message, though, is that when you become Fed chair, you implicitly agree to do whatever is necessary to ensure that the government can fund itself at sustainable levels.

I know Powell and the Fed will continue to sit in the "cuck chair" because he said so in the most recent Fed press conference. Powell must explain why he is reducing the pace of quantitative easing because by all accounts the U.S. economy is strong and monetary conditions are loose. I say this because unemployment is low, the stock market is at an all-time high, and inflation remains above the 2% target.

The Federal Reserve said on Wednesday it will begin to slow the pace of shrinking its balance sheet next month as an impasse over raising the government's borrowing limit persists, a shift that is likely to last for the rest of the process. – Reuters

Such limits always exist; even Paul Volcker, the highly respected former Fed Chairman, relaxed tight monetary policy when the economic pain became too great. The following quote is from the Federal Reserve's historical archives:

By the summer of 1982, House Majority Leader James C. Wright Jr. called for Volcker’s resignation. Wright said he had met with Volcker eight times in an effort to get the Fed chairman to “understand” the impact of high interest rates on the economy, but Volcker clearly did not get it (Todd 2012).

However, data from July showed the recession had bottomed out. Volcker told lawmakers he was abandoning his previous goal of tighter monetary policy and said a second-half recovery was "highly likely" - a recovery long touted and targeted by the Reagan administration.

Even Paul Volcker, the most respected Fed Chairman ever, could not resist the political pressure to keep monetary policy liberalized. Volcker took so much pressure, and the US government’s fiscal situation was much better in the early 1980s, for example, when debt was 30% of GDP, and today debt is 130% of GDP.

Powell demonstrated last week that fiscal dominance is here to stay. Therefore, I believe that quantitative easing (at least as far as Treasuries are concerned) will cease in the short to medium term. Powell further stated that while the Fed will likely maintain a reduction in mortgage-backed securities (MBS), it will be a net buyer of Treasuries. Mathematically, this allows the Fed's balance sheet to remain unchanged; however, this is straight Treasury QE. Once this is officially announced, Bitcoin will rise sharply. In addition, due to the banks and the Treasury's request, the Fed will provide banks with an SLR exemption, which is another form of Treasury QE. The reason is simple, because otherwise the math I posted above will not work. Even if Powell hates Trump, he can't sit back and let the US government falter.

Here are some direct quotes from Powell and Bessant that support my predictions for the future.

Here is Powell talking about what I call the QT Twist at the March 19th FOMC press conference:

We will stop the net reduction at some point…We haven’t made any decisions on that. We strongly prefer that the MBS be reduced from our balance sheet at some point. We will be very focused on getting the MBS reduced but keeping the overall balance sheet the same size…at some point…We are not there yet.

Here’s what Bessent said about SLR on a recent All-In Podcast:

So I think if we eliminated what's called the supplementary leverage ratio, it could potentially become a constraint on banks. We could actually lower Treasury yields by 30 to 70 basis points. Each basis point is equivalent to $1 billion per year.

Finally, let’s scale the wall of tariffs. At the March FOMC meeting, when asked about his views on the impact of Trump’s proposed tariffs on inflation, Powell said his base case was that any tariff-induced inflation would be “transitory.” The belief in “transitory” inflation allows the Fed to continue accommodative policy even if inflation spikes due to large tariff increases. Tariffs, at least for assets that trade solely on fiat liquidity, no longer matter. So I no longer care about Trump’s self-proclaimed “Liberation Day” on April 2, or how high, if at all, Trump will raise tariffs.

Federal Reserve Chairman Jerome Powell said in a news conference after the meeting that the current outlook is that any price increases caused by tariffs are likely to be short-lived.

Asked if the Fed was “back in transition again,” the central bank leader responded: “So I think that’s kind of the base case. But like I said, we really have no way of knowing that.” – CNBC

Dollar Liquidity Mathematics

Remember, we are concerned with forward-looking changes in U.S. dollar liquidity relative to prior expectations.

Treasury bond QT early progress:

$25 billion less per month

Treasury bond QT progress after April 1:

$5 billion less per month

net:

US dollar liquidity is increasing by $240 billion annually

What is the role of QT inversion:

Reduce MBS holdings by up to $35 billion per month

If the Fed's balance sheet remains unchanged, then they can buy:

Maximum national debt of $35 billion per month or $420 billion per year

We know that starting on April 1, an additional $240 billion of relative dollar liquidity will be generated. In the near future, which I believe will happen by the third quarter of this year at the latest, the $240 billion will rise to an annualized $420 billion. Once quantitative easing begins, it will not stop for a long time ; as the economy needs more money printing to remain stable, quantitative easing will increase .

The Ministry of Finance is taking action

To round out my dollar liquidity analysis, I can’t forget some specific questions about how the Treasury will fund the government. Specifically, will the Treasury replenish its general account (TGA) after the debt ceiling is raised?

Currently, the TGA is about $360 billion, down from $750 billion at the beginning of the year. The TGA is used to finance the government as the debt ceiling is reached. In the past, the TGA was refilled once some last-minute political deal raised the debt ceiling. This is negative dollar liquidity. But holding such a large cash balance is a bit silly; during Yellen's tenure, the target balance of the TGA was $850 billion. Given that the Fed can print money at will, the Fed should of course lend money to the Treasury when needed. And the Treasury can issue some Treasury bonds to repay the Fed. This reduces the government's financing needs. This will require more coordination between the Fed and the Treasury, even though the heads of each organization support different political factions. But now we know that Powell has to bow to the BBC, so I think it is very likely that in the next Quarterly Refinancing Announcement (QRA) in early May, the Treasury will predict that the TGA will not increase relative to the current level when the QRA is issued. This will eliminate any negative dollar liquidity shock once the debt ceiling is raised.

2008 Global Financial Crisis Case Study

Both stocks and gold have responded positively to increases in fiat liquidity. However, stocks require a statist legal fiction to exist. Therefore, during deflationary depressions, when the solvency of the statist system is in question, stocks may not respond as quickly to injections of fiat liquidity as an anti-establishment commodity-financial asset like gold. Let’s evaluate the performance of the S&P 500 and gold during the peak and recovery of the 2008 global financial crisis. This case study is important because I want to make sure I am being honest with myself. Just because I believe that USD liquidity has turned sharply positive, it does not mean that negative economic headwinds will not adversely affect the price action of Bitcoin and cryptocurrencies.

The index of the S&P 500 (white) and gold (gold) starts at 100 on October 3, 2008. This was the day the Troubled Asset Relief Program (TARP) bailout was announced. The program failed to quell the devastation inflicted by the collapse of Lehman Brothers, and both stocks and gold fell. When TARP proved insufficient to prevent the collapse of the Western financial system, Federal Reserve Chairman Ben Bernanke announced a massive asset purchase program, now known as quantitative easing (QE1), in early December 2008. Gold began to rise, but stocks continued to fall. Stocks did not bottom until shortly after the Fed began printing money in March 2009. By early 2010, after the collapse of Lehman, gold had risen 30% and stocks had risen 1%.

The index of the S&P 500 (white) and gold (gold) starts at 100 on October 3, 2008. This was the day the Troubled Asset Relief Program (TARP) bailout was announced. The program failed to quell the devastation inflicted by the collapse of Lehman Brothers, and both stocks and gold fell. When TARP proved insufficient to prevent the collapse of the Western financial system, Federal Reserve Chairman Ben Bernanke announced a massive asset purchase program, now known as quantitative easing (QE1), in early December 2008. Gold began to rise, but stocks continued to fall. Stocks did not bottom until shortly after the Fed began printing money in March 2009. By early 2010, after the collapse of Lehman, gold had risen 30% and stocks had risen 1%.

Bitcoin didn’t exist in 2008. But it does now.

Bitcoin Value = Technology + Fiat Currency Liquidity

The Bitcoin technology works, and nothing is going to change dramatically anytime soon, for better or worse. Therefore, Bitcoin trades purely based on market expectations of future fiat money supply . If my analysis of the Fed’s shift from QE to QE is correct, Bitcoin hit a local low of $76,500 last month, and now we are starting to climb towards $250,000 by the end of the year. Of course, it’s not an exact science, but using gold as an example, if I had to bet on whether I think Bitcoin will reach $76,500 or $110,000 first, I’d bet on the latter.

Even if the U.S. stock market continues to fall due to tariffs, plunging earnings expectations, or weakening foreign demand, I believe the odds remain good that Bitcoin will continue to move higher.

Maelstrom knows the pros and cons and deploys capital prudently. We do not use leverage and buy in small proportions relative to the size of our entire portfolio. When the market is rising, I wish I had been bigger, but I am thankful that this is not the case when the market is falling. We have been buying Bitcoin and shit coin at various levels between $90,000 and $76,500 . The pace of capital deployment will speed up or slow down, depending on the accuracy of my forecasts. I still believe that Bitcoin can reach $250,000 by the end of the year because now that the US Treasury Secretary has replaced Powell, the Fed will inject dollars into the market. This allows the People's Bank of China to stop tightening monetary conditions onshore to defend the dollar-yuan exchange rate, thereby increasing the net amount of yuan. Finally, Germany decides to build an army again to pay for its army with printed euros, and all other European countries must respond by building their own armies with euros because they are afraid of a repeat of 1939.

Investment (opportunity) begins!