Late today, US President Trump will celebrate what he calls Liberation Day while continuing his tariff policy to reduce dependence on foreign products. Depending on the severity of the tariffs, the domestic cryptocurrency mining industry will suffer significant losses.

In an interview with BeInCrypto, Matt Purl, director of the Strategic Technologies Program at the Center for Strategic and International Studies (CSIS), explained that tariffs on China would fundamentally disrupt supply chain dynamics and increase operating costs for the US mining industry.

Liberation Day Tariffs, Impact on Mining Costs?

Late today, Trump is set to announce comprehensive tariffs on US imports as part of his economic agenda, which he has named Liberation Day. However, details were lacking about how aggressive they would be or which countries would be the primary targets.

The lack of information about this event left the public in the dark, making them speculate about what might happen next. In the case of the US mining industry, participants will be closely watching Trump's announcement about China.

Just over a month ago, the Trump administration added a new 10% tariff to Chinese products in addition to the existing 10% tariff. During his campaign, Trump even proposed border taxes of up to 60% on Chinese products.

If Trump imposes additional tariffs on China on Liberation Day, US Bitcoin miners will have to make many decisions about the nature and scale of their future operations.

ASIC Hardware, Critical Imports

Cryptocurrency mining primarily relies on Application-Specific Integrated Circuit (ASIC) equipment. These computer chips are designed to perform complex mathematical calculations necessary for validating transactions and mining new coins. They are especially essential in Bitcoin and other Proof of Work cryptocurrencies.

ASICs have become the dominant hardware in Bitcoin mining due to their superior performance compared to other hardware types like CPUs or GPUs. They provide much higher hash rates per unit of energy consumed and are designed for specific mining algorithms.

"Creating an ASIC that is energy-efficient and performs everything needed in the context of Bitcoin mining is a highly research and development-intensive process," Purl explained.

The United States heavily depends on importing ASIC mining hardware, with a significant portion coming from China. China, a long-standing trade competitor of the US, has a well-established manufacturing capability to produce advanced semiconductor chips.

US Dependence on Chinese Hardware

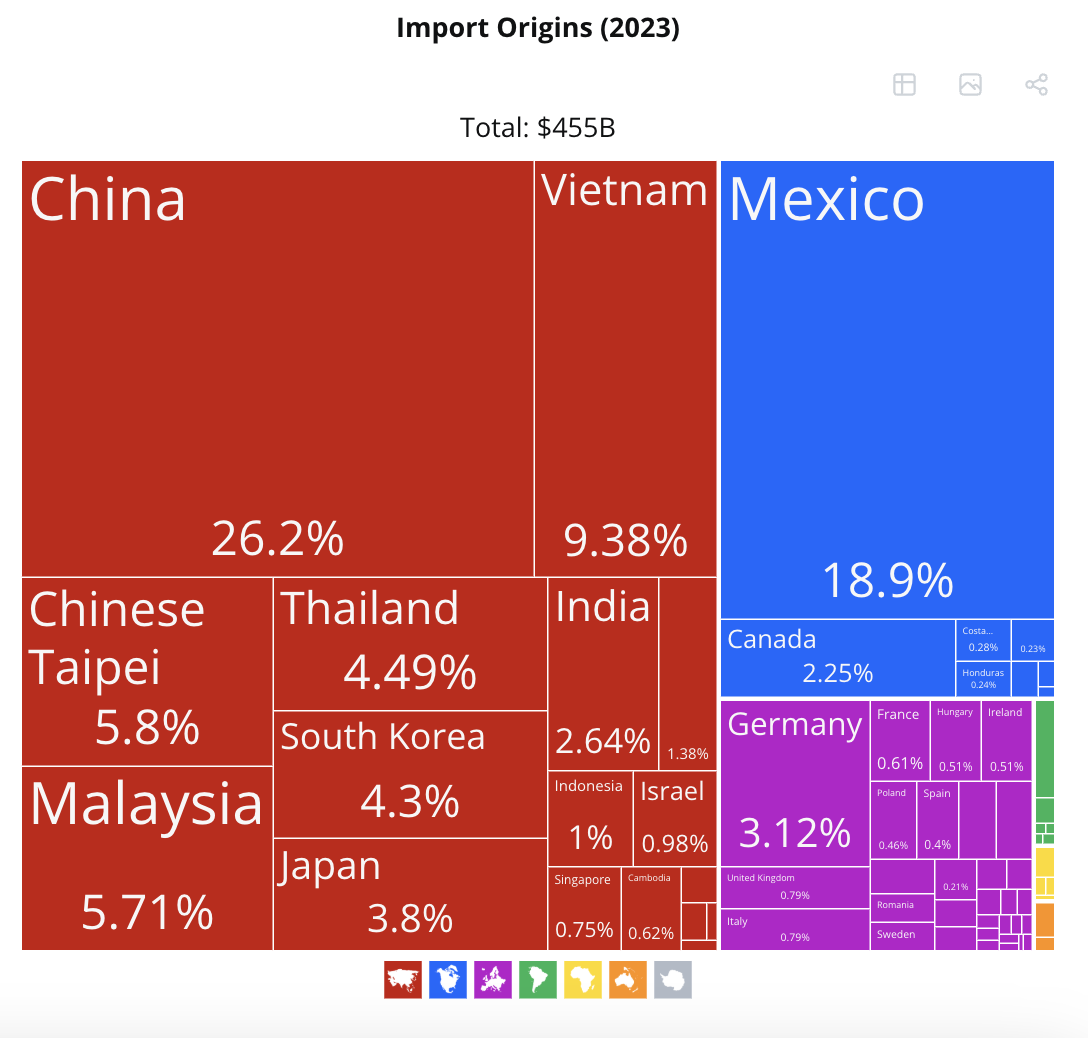

According to data from the Observatory of Economic Complexity (OEC), the US became the world's largest importer of electrical machinery and electronics in 2023. That year, the US imported hardware worth $455 billion, including integrated circuits (ASICs), semiconductor devices, and electrical transformers.

Electrical machinery and electronics were recorded as the second-largest import category, with China supplying $119 billion of that total, solidifying its position as the primary supplier to the US.

In January 2025 alone, US exports of electrical machinery and electronics reached up to $19 billion, while imports reached $41.3 billion, with most imports coming from China.

Given the US's significant dependence on this specific hardware from China, tariffs on Chinese electronic imports will directly impact ASIC mining hardware costs within the US.

The tariff policies during Trump's first term were less severe but provide a glimpse into the potential impact on cryptocurrency miners.

Lessons from Trump's First Term

In June 2018, the US Trade Representative under Trump reclassified hardware from Chinese Bitcoin mining hardware manufacturer Bitmain from "data processing machines" to "electrical machinery devices". Bitmain, especially its "Antminer" series, is a major manufacturer of ASIC mining hardware.

By reclassifying the hardware, an additional 2.6% tariff was added to the existing 25% tariff. This effectively raised US import tariffs on Chinese cryptocurrency mining equipment to a total of 27.6%.

Hardware costs are one of the largest input expenses faced by US mining business operators. After the tariff increase, cryptocurrency miners could not avoid significantly rising production costs.

The current cumulative 20% tariff on Chinese products and the potential for further increases following Trump's Liberation Day announcement suggest similar or more severe impacts.

"In the short to medium term, [the US mining industry] is very vulnerable, especially since most Bitcoin mining equipment comes from China. ASICs are not easy to produce, which will drive up the prices of Bitcoin mining equipment in the US. When Trump imposed tariffs during his first term in 2018, and this time it will have an even greater impact," Purl told BeInCrypto.

In addition to cost increases, tariffs will cause disruption in the supply chain dynamics of mining hardware.

Supply Chain Disruption, an Imminent Threat

According to Purl, if Trump imposes additional tariffs on China, US cryptocurrency miners can expect delays and shortages in mining hardware. His judgment is primarily based on the fact that such situations are already occurring.

"We are already seeing delays. Customs and Border Protection are taking longer to inspect and clear equipment, and the US Postal Service has temporarily suspended package shipments from China," Purl explained.

Two months ago, the United States Postal Service (USPS) announced that it temporarily suspended package delivery from China shortly after Trump imposed a 10% tariff on Chinese imports. USPS explained that the suspension was caused by removing the exemption that allowed duty-free, inspection-exempt shipments under $800.

"USPS and Customs and Border Protection are working closely together to implement an efficient collection mechanism for the new Chinese tariffs to minimize disruption to package delivery," the postal service stated.

However, the suspension was lifted in less than 24 hours. As new tariffs approach, similar situations may occur, which could threaten the mining plans of US Bit miners.

"When Trump imposes tariffs, costs will increase, shipment volumes will decrease, and there will be greater uncertainty about whether Customs and Border Protection or other agencies will delay shipments when they arrive in the US. It will become difficult for companies to have certainty about when they can actually start mining," Pearl added.

If tariffs continue, US cryptocurrency mining companies will need long-term restructuring.

Will US Miners Move Due to Tariffs?

While there is no evidence that US cryptocurrency mining companies moved during Trump's first term due to his tariff policy, there is a possibility this time.

"I think there is much more uncertainty this time. The president seems to be much more focused on tariffs, and the decisions of the administration so far seem to lack permanence. They impose tariffs but also adjust or increase them, so I think there is much more uncertainty than during the first administration. This will differently impact the mining industry moving outside the US," Pearl told BeInCrypto.

This week, France's Digital Minister Clara Chappaz proposed monetizing EDF's surplus energy through Bit mining. EDF is France's largest state-owned energy company. According to Chappaz, this approach could help reduce the company's debt. Many cryptocurrency communities welcomed this idea.

If Europe surrenders to such a strategy, would US companies be more likely to move overseas? Pearl says yes, but Europe is not the preferred region.

"The counterpoint is that labor costs in Europe are more expensive. There could be many bureaucratic procedures in actually building infrastructure. I think other regulatory and labor barriers will make moving to Europe less feasible than moving to other regions in Asia," he said.

However, simple relocation cannot eliminate the need for consistent ASIC supply.

The Best Mining Machines are Chinese... Will Unexpected Results Occur?

So far, no country has been able to produce ASIC at the scale of China. It might be in China's interest to transfer operations to the US.

"Some Chinese companies that produce this equipment might actually place manufacturing capabilities in the US to avoid tariffs. However, this involves transferring facilities and obtaining permits. It's a time-consuming process and won't happen tomorrow," Pearl said.

However, considering the hostility between the two countries, this seems unlikely.

Ultimately, domestic production provides the best path for US self-sufficiency. But this will be a complex and lengthy process.

Transferring Operations Domestically

Under President Biden, Congress approved the CHIPS and Science Act in July 2022. This bill was designed to promote semiconductor manufacturing within the US.

While not explicitly mentioning ASIC equipment, the bill's provisions strongly encourage and incentivize transferring and establishing all types of semiconductor production domestically, including those related to ASIC.

"If the Trump administration does not obstruct transferring manufacturing capabilities to the US under the CHIPS Act, there is a possibility that US companies will develop competitive ASICs in the coming years. However, this is a long-term project, and developing these chips is not easy," Pearl told BeInCrypto.

Two days ago, Hut 8, a major North American Bit mining company, launched American Bit in collaboration with Eric Trump to become the world's largest pure miner.

This initiative aligns with Trump's goal of bringing production back to the US, but Hut 8, like other US miners, still depends on ASIC hardware. This could potentially create conflicts with his tariff policy.

Meanwhile, US miners will need to address their existing dependence on Chinese ASICs.

US companies will continue to be affected by Trump's tariffs on critical cryptocurrency mining hardware from China. This will persist until the US can effectively transfer broader manufacturing and production domestically.

If Trump's "Liberation Day" announcement includes additional tariffs on China, domestic mining companies will experience significant production cost increases, both large and small. Disruptions in the dynamics of tightly connected supply chains will also impact operations. How they will respond remains undetermined.