An expert warned that the reverse yen carry trade is currently proceeding at a slow and controlled pace.

This could have a significant impact on traditional financial markets as well as cryptocurrencies like BTC.

Why should investors pay attention to the yen carry trade?

The yen carry trade is a strategy where investors borrow yen at low interest rates and invest in high-yield assets such as US dollars or tech stocks. The goal is to profit from the interest rate difference.

However, the risk of this strategy arises from exchange rate fluctuations. If the yen appreciates, investors converting their investment back to yen to repay the loan may see their profits decrease or disappear.

According to Michael Gade, this scenario appears to be materializing now.

"The problem today is that these borrowing costs are starting to become increasingly expensive. Traders who could essentially use capital for free for years are now sitting on costly margin positions that they potentially need to unwind," he said.

Gade explained in a recent report that rising borrowing costs will force traders to liquidate dollar-denominated assets. This will ultimately increase market volatility and drive down the prices of risk assets.

Notably, this phenomenon also occurred last year. Gade pointed out that when the Bank of Japan decided to raise interest rates twice in August 2024, the yen significantly appreciated, while the S&P 500 index experienced about a 10% correction.

He added that subsequent rebounds eased investor concerns. Nevertheless, he believes the real issue is that the situation is not fully resolved.

Gade emphasized, "The unwinding of large carry trades does not last just a few weeks and does not suddenly normalize."

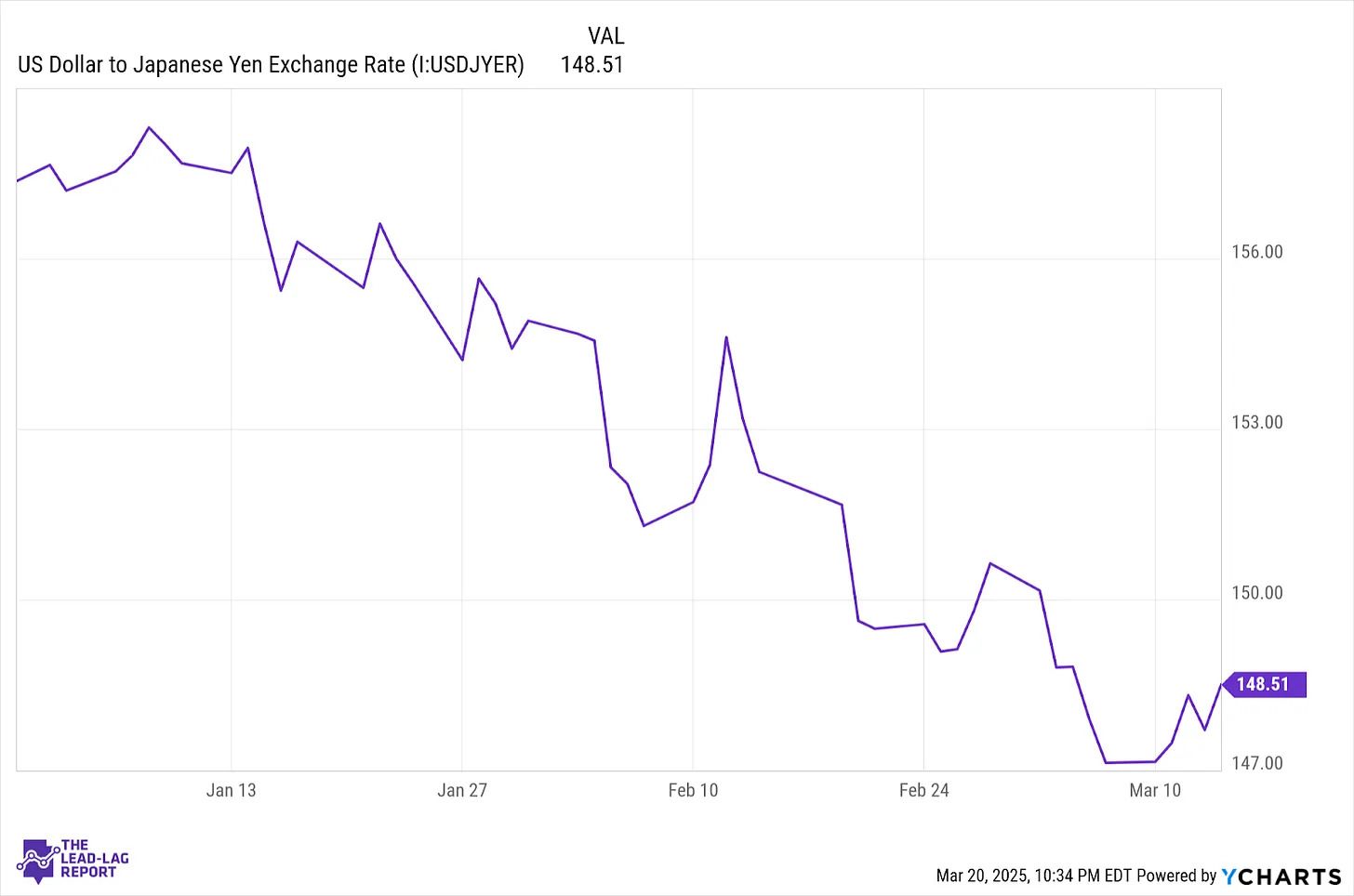

He further noted that the current market situation is similar to previous scenarios. Specifically, the Japanese 10-year yield has soared to 1.56%, the highest since 2008. As yields rise, the yen strengthens and carry trade dynamics begin to change.

"The 10-year yield continues to rise, narrowing the interest rate gap with similar US Treasury yields. This will continue to promote yen strength, which could extend until late 2025. And as long as the yen continues to strengthen, whether quickly or slowly, the remaining carry trade will continue to unwind. And it will likely be substantial," he said.

Gade also forecast that the Bank of Japan is likely to continue raising interest rates. His projection is further strengthened by the possibility that the Fed might cut rates in the coming months.

He also noted the correlation between the S&P 500 and the yen, pointing out that the yen's appreciation preceded the recent S&P 500 decline by several weeks.

These adjustments may also be related to the US economic slowdown and potential tariffs. However, he emphasized that the reverse carry trade is particularly dangerous because it could rapidly expand, especially in the current macroeconomic environment.

"Considering concerns about tariffs and economic growth slowdown, the market can adjust itself. Add to that people who need to sell US stocks to close out yen short positions, and you can easily see how quickly the situation can deteriorate. And this is already happening. Japan remains a real risk," he argued.

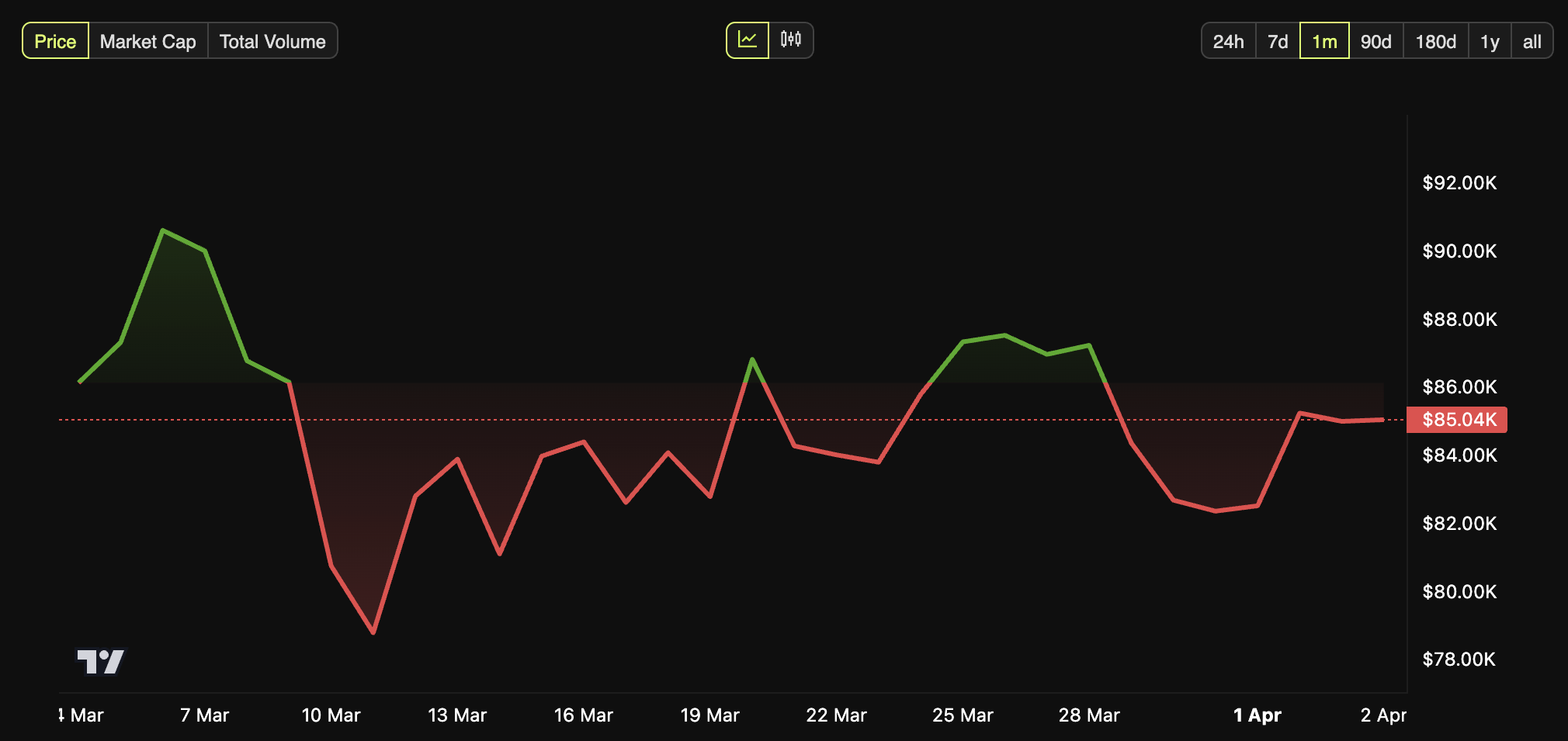

Now the question is, how will this affect BTC? Considering the close correlation between Bitcoin and the S&P 500, the latter's correction could cause problems for Bitcoin. Analyst Lark Davis noted that Bitcoin and the S&P 500 index have been closely linked since 2023.

He pointed out, "Unfortunately, the truth is that everything depends on what happens to the major stock indices when trying to determine where Bitcoin will go next."

Davis also advised crypto investors to monitor the broader US and global economy, stock markets, and M2 money supply.

Currently, Bitcoin, the largest cryptocurrency, continues to experience volatility ahead of President Trump's tariff announcement. In fact, Beincrypto reported that Bitcoin spot ETFs have seen outflows for three consecutive days.

In terms of price, Bitcoin has declined by 3.1% over the past week. At the time of reporting, Bitcoin was trading at $85,042, recording a slight 0.8% increase over the past day.