Welcome to the US Morning Crypto Briefing - We'll tell you about today's key cryptocurrency developments.

Learn how Bitcoin is holding its ground while Wall Street trembles, why Trump's tariffs could push the Fed into money-printing mode, and what this could mean for the next chapter of cryptocurrency. From Ethereum's resilience test to the increasing possibility of a US recession, we provide everything you need to know to stay ahead.

Bitcoin Enters Risk Era Amid Tariff Chaos

Bitcoin's recent response to macroeconomic shocks—especially Trump's comprehensive tariffs—has been notably calm compared to traditional markets. While Wall Street was shaking more than expected, cryptocurrency remained relatively stable.

Nexo Dispatch editor Stella Zlatareva told BeInCrypto that this is evidence that Bitcoin is entering a new stage of market maturity, not just resilience.

"A 2-3% drop in cryptocurrency is trivial compared to past cycles," she said, emphasizing that this stability amid chaos suggests Bitcoin is no longer just a speculative attempt. "Bitcoin's ability to withstand macroeconomic turmoil without the previous sharp fluctuations suggests that institutional investors are treating it as a strategic asset, not a speculative attempt," Zlatareva said.

Analysts also emphasized that Bitcoin's behavior does not align with traditional asset categories.

"Bitcoin is neither gold nor the yen. Instead, Bitcoin is emerging as a risk-dynamic asset—not collapsing like high-growth stocks, but also not attracting capital inflows as a safe haven like traditional safe assets," Zlatareva told BeInCrypto.

The concept of this "risk-dynamic" asset positions Bitcoin uniquely: thriving in uncertainty without crumbling when markets shift.

Nexo's Zlatareva also mentioned that how Ethereum and other blue-chip altcoins will respond next is crucial.

"If Ethereum reflects Bitcoin's performance, it strengthens the argument that top cryptocurrency assets are evolving into a more predictable asset class. If Ethereum wavers, it reinforces that Bitcoin is currently in a unique position."

Meanwhile, the macroeconomic background is changing rapidly. Trump's new "Liberation Day" tariffs surprised global trade partners and sent ripple effects through predictive markets. Polymarket sees almost a 50% chance of a US recession this year—a significant change since the announcement.

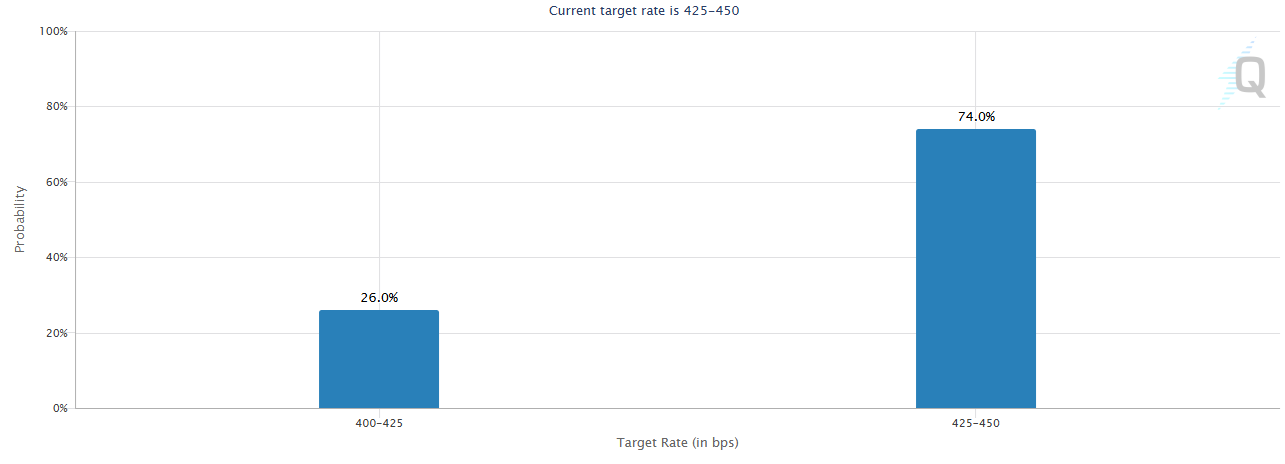

Additionally, the CME Fed Watch tool shows that rate traders have increased the likelihood of the US Federal Reserve making four rate cuts this year. Ultimately, this could alleviate the current macroeconomic pressure on Bitcoin.

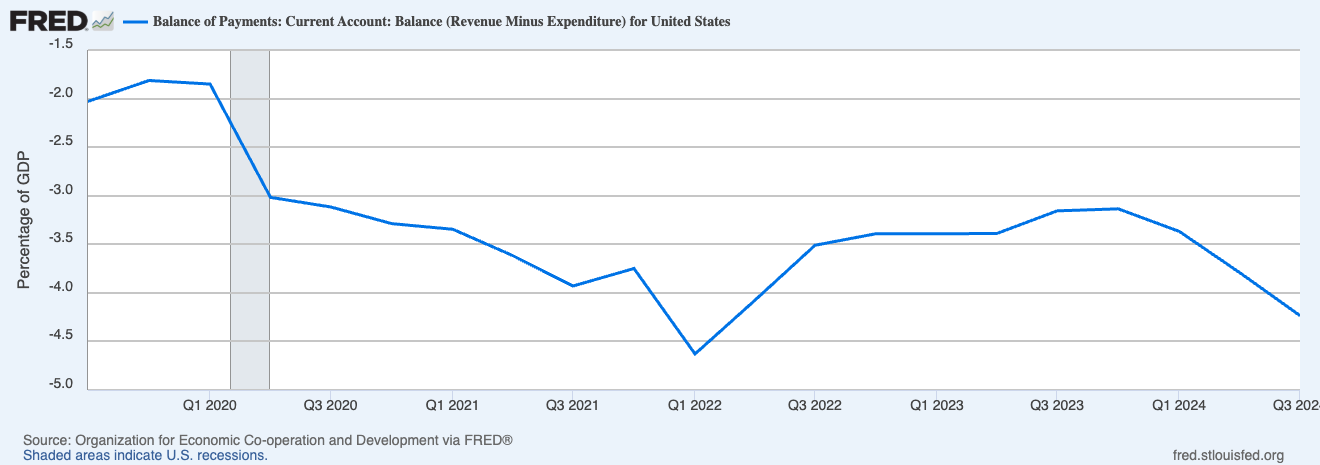

Former BitMEX CEO Arthur Hayes noted that Trump's current tariff strategy could complicate the US bond market. That is, the pressure on the Fed to intervene is increasing, with a possibility of supplying liquidity again.

Trump's tariff formula is further evidence he is laser focused on reversing these imbalances. The problem for treasuries is that without $ exports foreigners can't buy bonds. The Fed and banking system must step up to ensure a well functioning treasury mrkt, which means Brrrr. pic.twitter.com/doGPAaRfAl

— Arthur Hayes (@CryptoHayes) April 3, 2025

All of this makes Bitcoin a new subject of attention. Its stability is no longer considered coincidental. This could be the first signal that cryptocurrency, at least its most mature players, are beginning to move out of the shadow of speculation and into the focus of strategic finance.

Today's Chart

Trump's tariffs could force the Fed to inject more liquidity by reducing foreign demand for US Treasury bonds—which could weaken the dollar and elevate Bitcoin as an alternative store of value.

Today's Key News

– Trump's "Liberation Day" imposes over 10% tariffs on all imports, hitting China, EU, and Israel, triggering market decline and recession fears.

– According to Standard Chartered, Bitcoin could reach $500,000 by the end of Trump's term, Avalanche could grow 10x by 2029, and Ethereum's 2025 target drops to $4,000.

– The 2025 Stablecoin Transparency Act receives bipartisan support, intensifying competition and regulatory pressure to strengthen stablecoin rules.

– Bitcoin ETF recorded $221 million in inflows in April, but BTC derivatives are cooling due to decreased futures interest and bearish option sentiment.

– DXY hits 2024 low after "Liberation Day" tariffs, fueling short-term Bitcoin surge hopes amid global tension and policy uncertainty.

– Bitcoin shows weakness below $85,000. However, long-term holders remain steadfast, suppressing fears of a sell-off.

– Polymarket sees nearly 50% chance of US recession. Trump's tariffs trigger market fear and trade tensions.