I. On-Chain Liquidation Storm on April 7th: Whale Self-Rescue and Market Panic Threshold

Today, Ethereum's price plummeted to $1,411, hitting a new low since March 2023, with the ETH/BTC exchange rate dropping 10% within 24 hours to 0.01894, pushing the market into extreme panic.

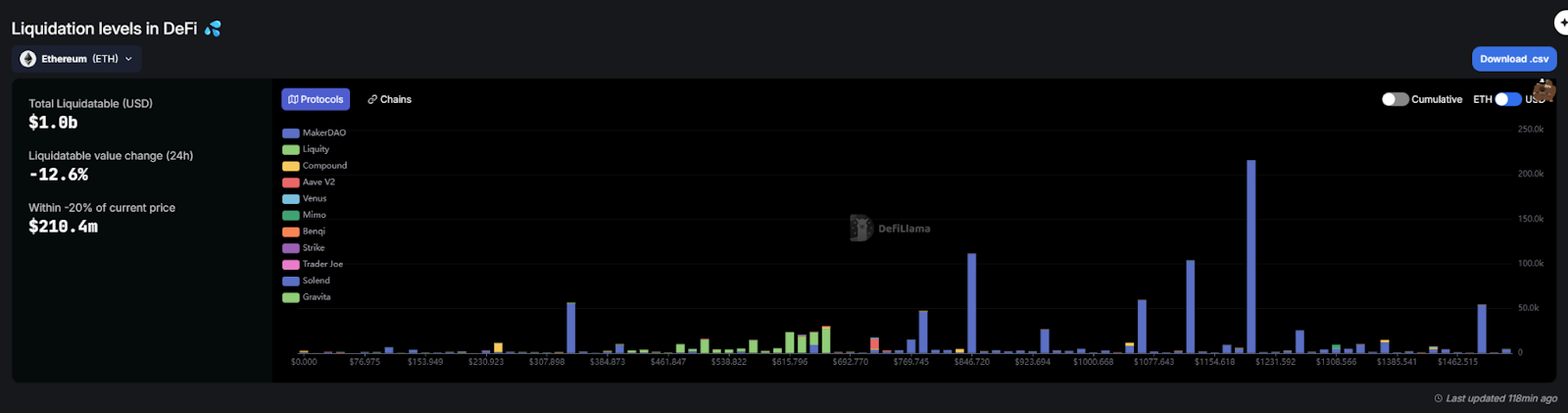

Defillama data shows that over 440,000 ETH (approximately $640 million) currently have liquidation prices concentrated above $1,000, with 5 major whale addresses driving this "liquidation domino effect".

1.1 Price Signals in Whale Self-Rescue Behavior

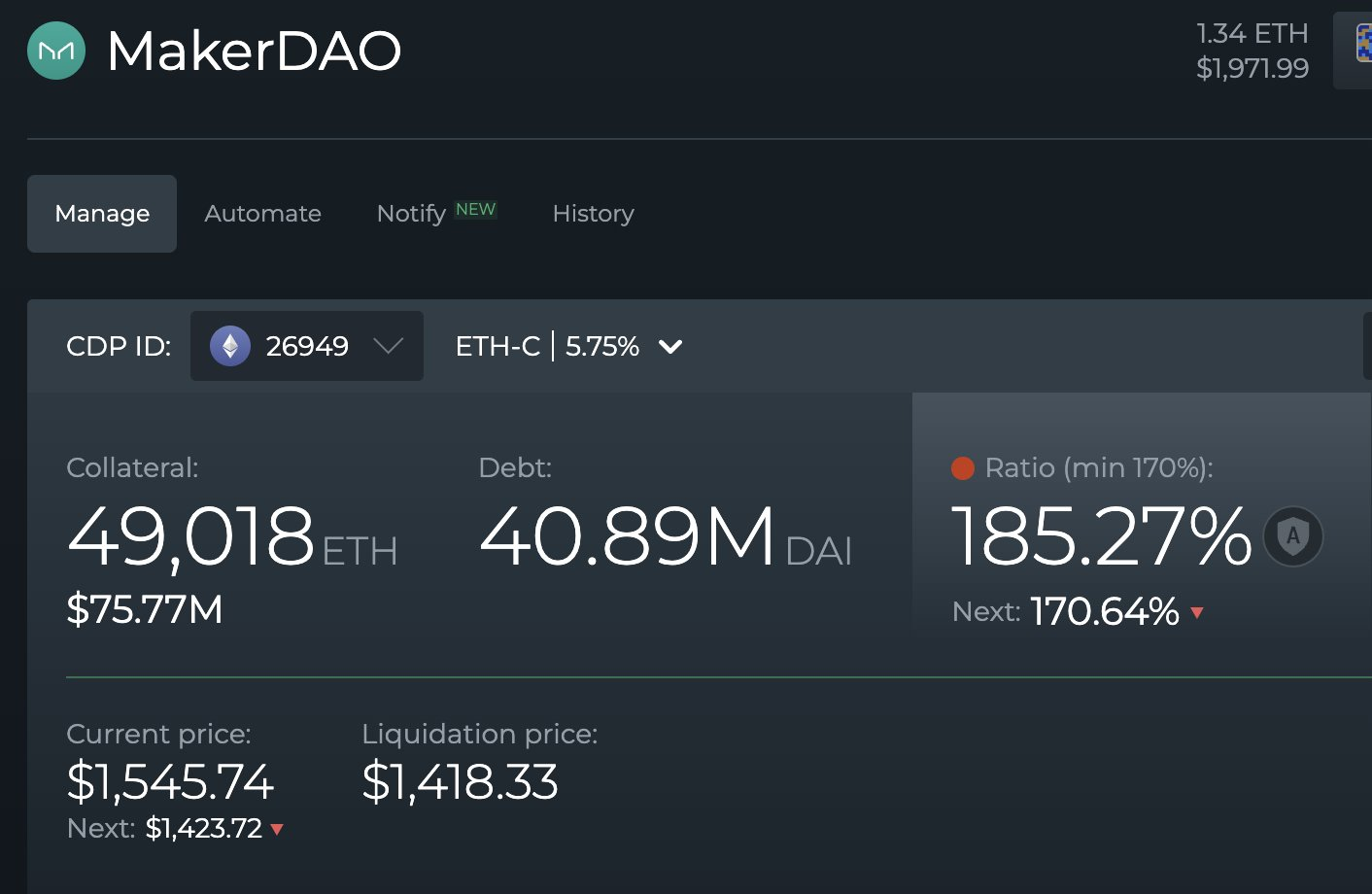

The whale's liquidation price has now dropped to $1,418 after repaying Dai.

- MakerDAO Liquidation Crisis: A whale holding 220,000 ETH urgently repaid 3.52 million Dai today and supplemented 10,000 ETH in staking, lowering the liquidation price from $1,350 to $1,119. This "last-minute margin" pattern has been repeated 6 times at this address, reflecting the whale's extreme anxiety about liquidation risks below $1,500.

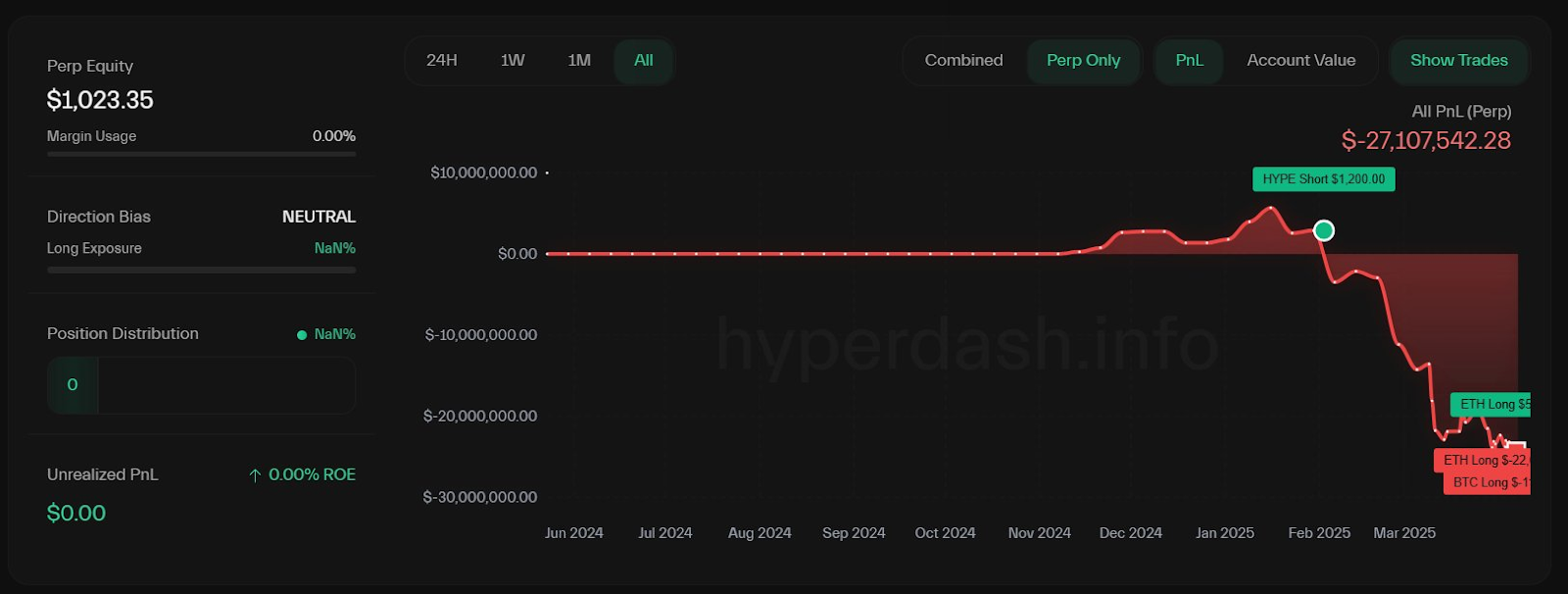

- According to Onchain Lens, the ZkCasino Rug address closed its 20x leveraged ETH position on Hyperliquid, with cumulative losses of $27.1 million, after previously scamming over $40 million.

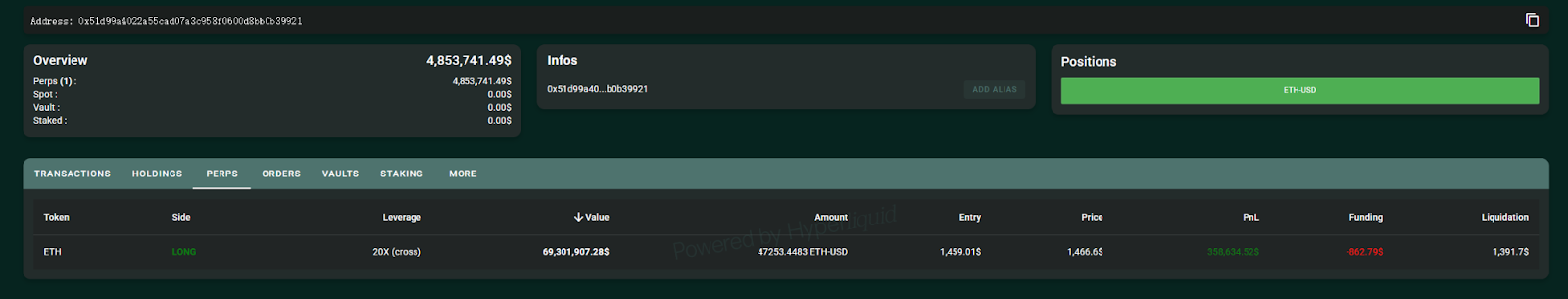

- On-Chain Whale "Buy the Dips" Signal: The [Hyperliquid 50x veteran] who hadn't operated for half a month transferred $3 million USDC into Hyperliquid around 3 PM as margin, opening a long position of 32,800 ETH at $1,461.6, worth $47.62 million. The current Ethereum price of $1,460 is just a step away from his liquidation price of $1,391.

- Head effect intensifies: The median FDV (Fully Diluted Valuation) of VC coins listed on Binance has dropped from $1.5 billion in 2024 to $500 million, with funds accelerating towards mainstream assets like ETH; the valuation logic of Altcoins has changed

- RWA narrative rises: Standard Chartered predicts that if RWA tokenization scale breaks through $1 trillion, Ethereum may occupy 80% of the security verification market share.

IV. Investment Strategy: Alpha Capture in the Bottom Range

4.1 Short-term Trading Window (1-2 weeks)

- Short hedging: Layout short positions in the MA7 ($1,590) and MA30 ($1,653) interval, with stop loss set above $1,700;

- Rebound sniping: If the price breaks below $1,300, build positions in 3 batches in the $1,100-$1,200 range, with a target of $1,500.

4.2 Medium to Long-term Allocation (3-6 months)

- Enhanced staking yield: Participate in staking through Lido (stETH) or Coinbase (cbETH), locking in an annual yield of 3.5%-4.2%;

V. Epilogue: Civilization's Spark in the Dark Forest

With the liquidation sword of 440,000 ETH hanging overhead, and staking yields intertwined with regulatory haze, Ethereum is experiencing the most complex value reconstruction in its history. However, historical experience shows that technological breakthroughs that truly change the patterns often emerge from the deepest despair - just as the 2018 bear market gaveeFand the collapse gave birth to the the L2 >

At this moment, it must be remembered: the essence of blockchain is a, time is always on the side of innovators.