During the weekend, the cryptocurrency market experienced a sharp decline, with major assets suffering significant losses. While the downward trend is causing concern, some cryptocurrency experts believe this could be an opportunity for potential future gains.

These projections emerged amid fears of a global economic recession and the spread of trade wars.

Market Collapse, Birth of New Crypto Millionaires? Expert Opinions

BeInCrypto reported today on the dramatic drop in the cryptocurrency market. The total market capitalization decreased by $216 billion in the past 24 hours. Bitcoin (BTC) also experienced a significant decline, falling below $75,000.

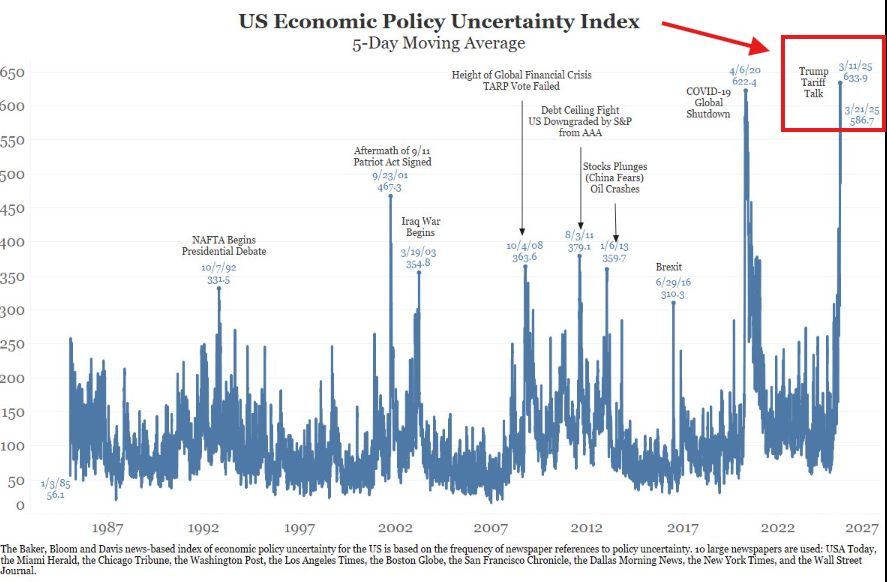

In this context, an analyst emphasized that the US Economic Policy Uncertainty Index has reached an unprecedented level. This index measures the uncertainty of the US economy related to policy changes.

It combines newspaper mentions of economic uncertainty with tax policy and budget deficit data. The higher the index value, the greater the uncertainty, which can affect market volatility, investor behavior, and economic decision-making.

Notably, it has exceeded the levels during the 2008 financial crisis and the 2020 COVID-19 market collapse.

"The current market is more uncertain than ever. It's more severe than the Great Depression and the COVID collapse," he posted.

The analyst said that trillions of dollars have been withdrawn from the stock market. However, he was optimistic that a significant portion of this capital would flow into Bitcoin. This provides potential opportunities for cryptocurrencies.

Meanwhile, another analyst addressed concerns about a repeat of the 2008 financial crisis. He mentioned that the likelihood of such an event occurring in the current market is very low. Instead, he predicted a recovery similar to the rapid rebound after the 2020 collapse.

"The current market collapse is very similar to March 2020. It was a generational entry point for cryptocurrencies, and a few with patience earned millions of dollars," he wrote.

Drawing parallels with the 2020 market decline, he pointed out that the current market is around the middle of the correction phase. The analyst also emphasized that after the 2020 collapse, central banks lowered interest rates and injected massive liquidity into the economy.

This increase in liquidity played a crucial role in driving stocks and risky assets to new record levels in the following year.

"If we're reflecting the price movements of 2020, we'll encounter a generational opportunity in cryptocurrencies. Be patient and observe carefully. The next few weeks and months will be crucial. Create fear, but don't rush. It's likely still too early," the analyst explained.

He also emphasized that several uncertainties remain. These include the duration and impact of tariffs, the responses of other countries, and whether Bitcoin can be decoupled from the S&P 500 to act as a hedge against recession.

This perspective aligns with another expert who suggested that the current chaos could pave the way for the emergence of a new generation of cryptocurrency millionaires.

"Remember the 2020 COVID collapse. BTC was at $3,850, ETH at $100, XRP at $0.11. And all these projects created millionaires in the following years!" he argued.

As the market grapples with unprecedented uncertainty, the coming months are likely to determine whether this period will be a turning point for creating new wealth or lead to a deeper economic downturn.