Strategy (formerly MicroStrategy) did not purchase Bitcoin or sell common stock this week. This interrupts their long-standing purchasing march. The company officially disclosed $5.91 billion in unrealized losses due to the cryptocurrency market's decline.

There are two possible explanations for this interruption. Strategy may be waiting for more favorable market conditions, or these losses are forcing them to be cautious. Either way, this uncertainty could indicate additional concerns among institutional investors.

Strategy Stops Bitcoin Purchase... What Could This Signal?

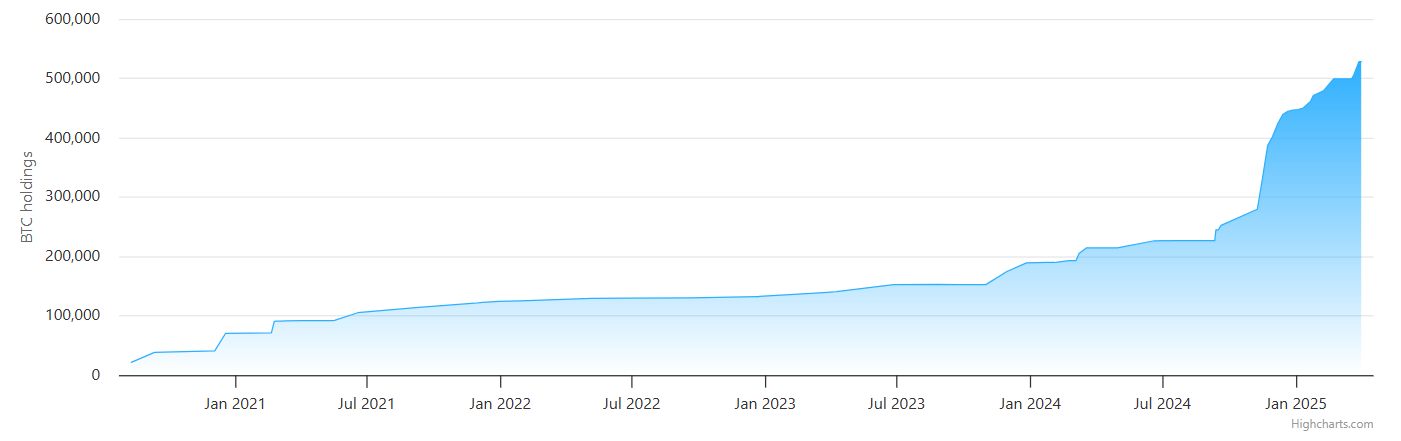

Since Michael Saylor instructed Strategy (formerly MicroStrategy) to start Bitcoin purchases, the company has become one of the world's largest BTC holders. So far, Strategy has been a major buyer in 2025, purchasing Bitcoin worth approximately $2 billion in two rounds.

However, according to the recent Form 8-K, Strategy did not purchase any BTC last week and did not sell any stocks.

This is not the first time Strategy has stopped Bitcoin purchases this year. They also paused purchases in February. However, this interruption feels significantly different due to concerns about a US recession.

The Bitcoin purchase halt may suggest that the company's management is adopting a wait-and-see attitude amid market volatility. This could indicate they believe Bitcoin might experience further decline.

Billions of dollars have been liquidated in cryptocurrencies and traditional finance, and corporate Bitcoin holders have suffered significant losses.

The company might want to break its historical continuous purchase record, avoiding additional downside risks until clear market trends emerge.

However, some prominent voices are taking a much more critical approach. The same Form 8-K shows Strategy currently has $5.91 billion in unrealized losses from its Bitcoin holdings. There were already concerns about the company's liquidity, tax obligations, and excessive debt.

Some community members are wondering how Saylor can avoid the crisis:

"Michael Saylor's average BTC cost basis is around $67,500. A 15% decline puts MicroStrategy deep in the red. This is a thin line between a 'visionary CEO' and a 'leverage maniac with a god complex'." – Edward Farina, claimed on social media.

What's Next for Strategy?

Essentially, Strategy serves as a primary pillar of trust in Bitcoin. If the company sells, the market will take notice. The cryptocurrency ecosystem carefully tracks even minor differences in the company's BTC purchasing strategy, and a sale would act very bearishly.

Meanwhile, companies are already inventing new ETF tools to short the company and plotting its collapse. What is the best way forward?

So far, Saylor has remained quiet about these market fluctuations. MicroStrategy might be planning another large Bitcoin purchase when the market bottoms out.

However, it may also be unable to act due to the debt crisis and unrealized losses. Currently, uncertainty could indicate broader concerns among institutional investors.

This cautious attitude may represent broader institutional investor concerns about the current cryptocurrency market situation and suggests a potential new accumulation phase could begin when market fundamentals improve.