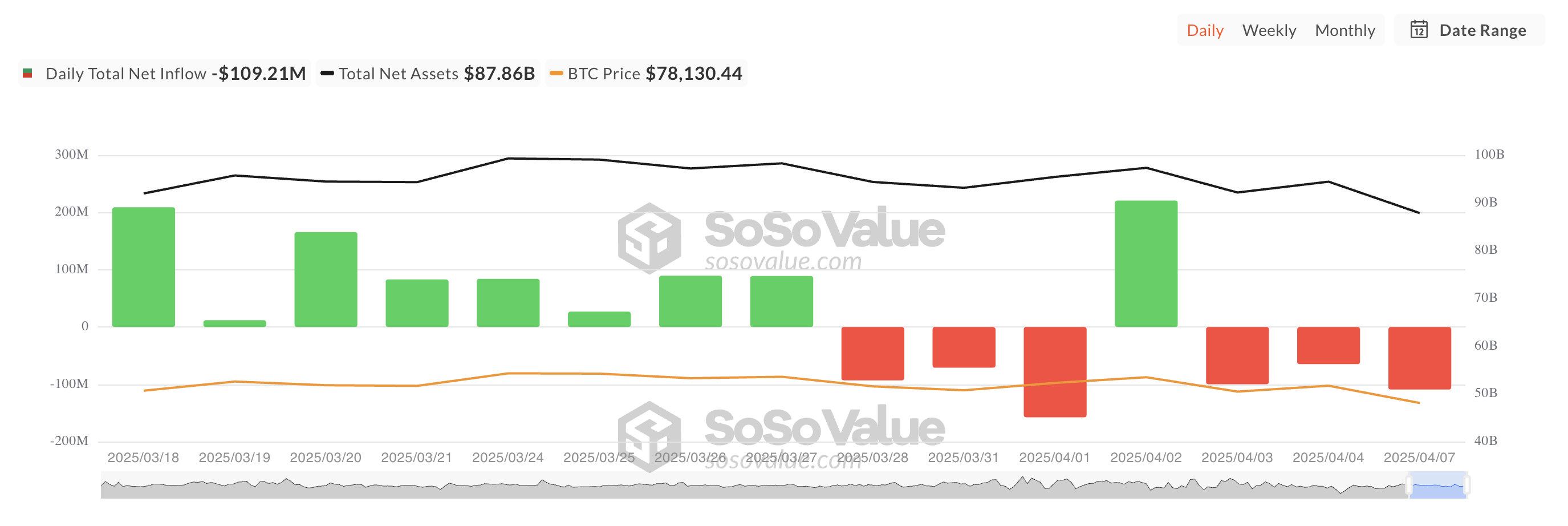

Bitcoin ETF started with a downward trend at the beginning of the week, and no net inflows were recorded in all funds yesterday. This indicates a cautious start, suggesting that investor sentiment is deteriorating.

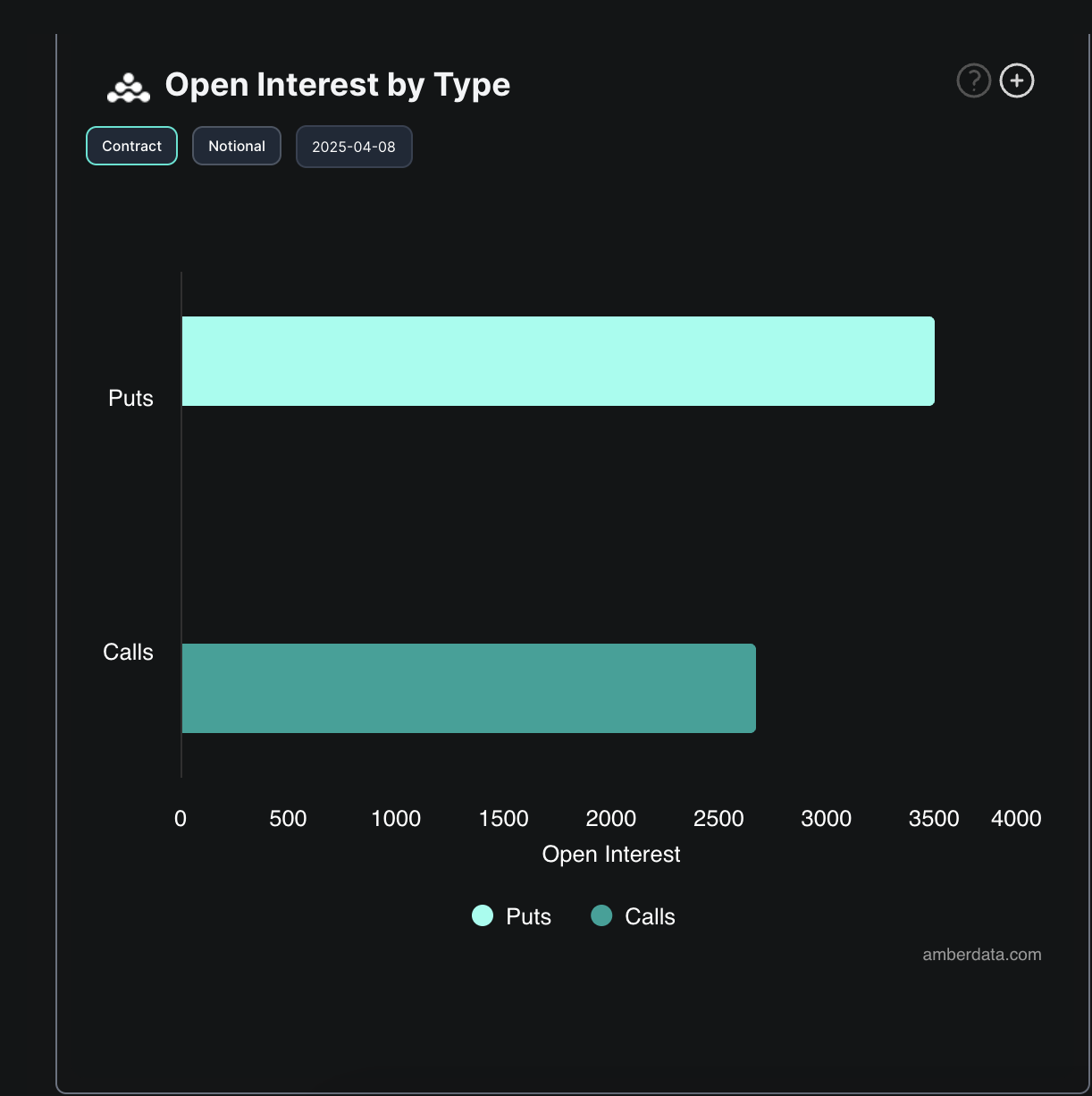

In the derivatives market, Bitcoin is seeing an increase in put contracts, which aligns with a more pessimistic outlook.

No BTC ETF Inflows, Outflows Surge

On Monday, capital outflows from spot Bitcoin ETFs reached $109.21 million, the highest in 7 days. This surge occurred after the weekend cryptocurrency market crash, triggering over $1 billion in liquidations.

According to SosoValue, Grayscale's ETF GBTC recorded the highest net outflow on Monday, amounting to $74.01 million. This brought its managed net assets to $22.7 billion.

Invesco and Galaxy Digital's BTCO recorded the second-largest daily outflow of $12.86 million. At the time of reporting, BTCO's total historical net inflows are $85.32 million.

Notably, none of the 12 spot Bitcoin ETFs recorded net inflows yesterday. This trend emphasizes an overall decrease in institutional interest at the beginning of the week. Starting at the beginning of the week.

BTC Short Covering Rally Faces Downward Bets in Derivatives Market

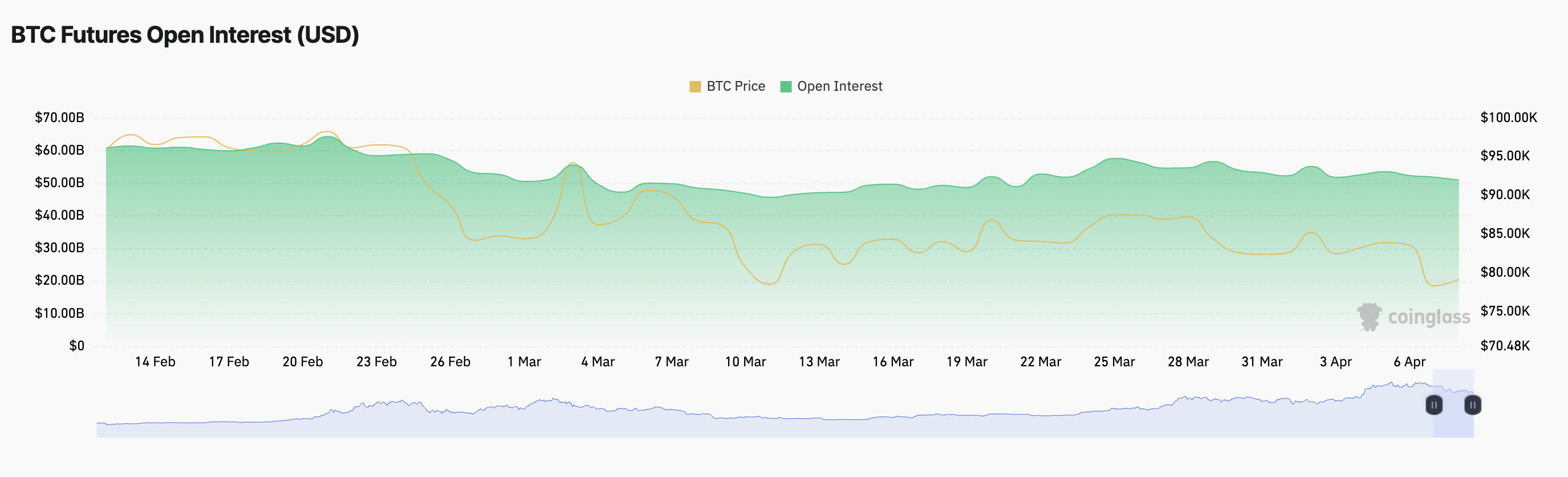

As Bitcoin struggles below $80,000, trading activity continues to decrease. This reflects a sharp decline in the coin's futures open interest, currently recorded at $50.95 billion, indicating a 2% drop relative to price.

Interestingly, during the same period, BTC's price increased by 3%. This indicates that the market is attempting to recover. When an asset's futures open interest decreases while the price rises, it suggests that the rally may be driven by short covering rather than new buying. Rather than new buying.

This indicates that BTC futures traders are closing their downward positions and temporarily driving up the price.

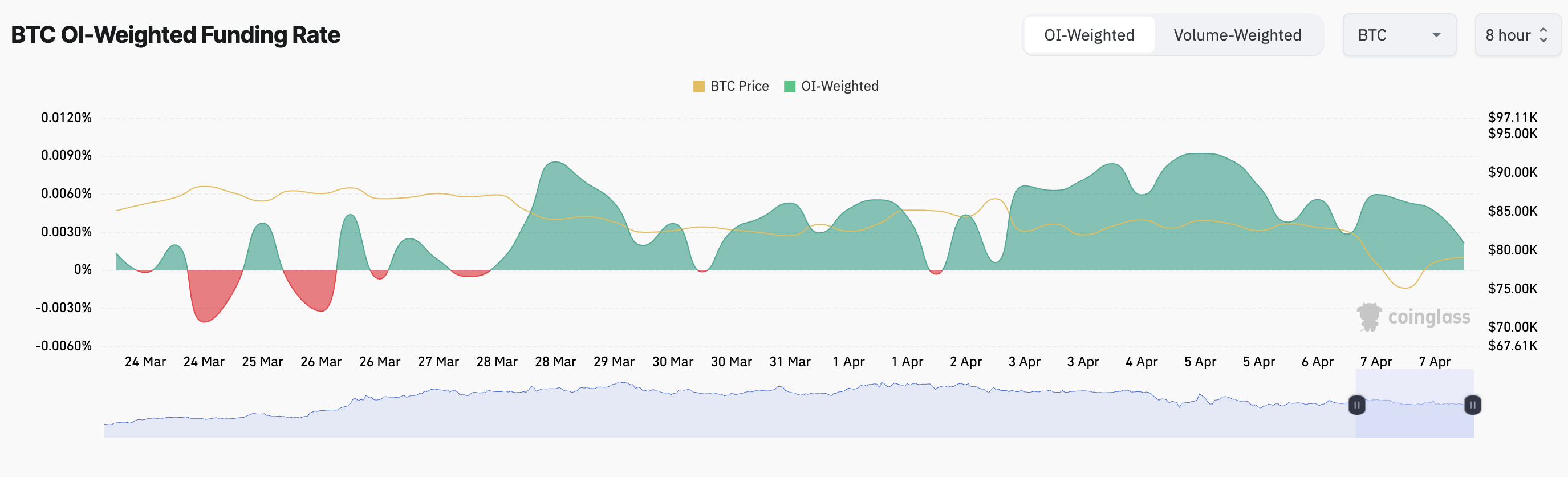

However, despite the decline in BTC's price and open interest, a steady positive funding rate still indicates an optimistic sentiment. Traders are still willing to pay a premium to maintain long positions, suggesting continued optimism about the coin's short-term price trajectory.

On the derivatives side, the situation is not as bright. Investors continue to open more put contracts, further confirming a bearish outlook on the asset price.

This indicates that BTC traders are preparing for potential downside risks and expect the price to fall.