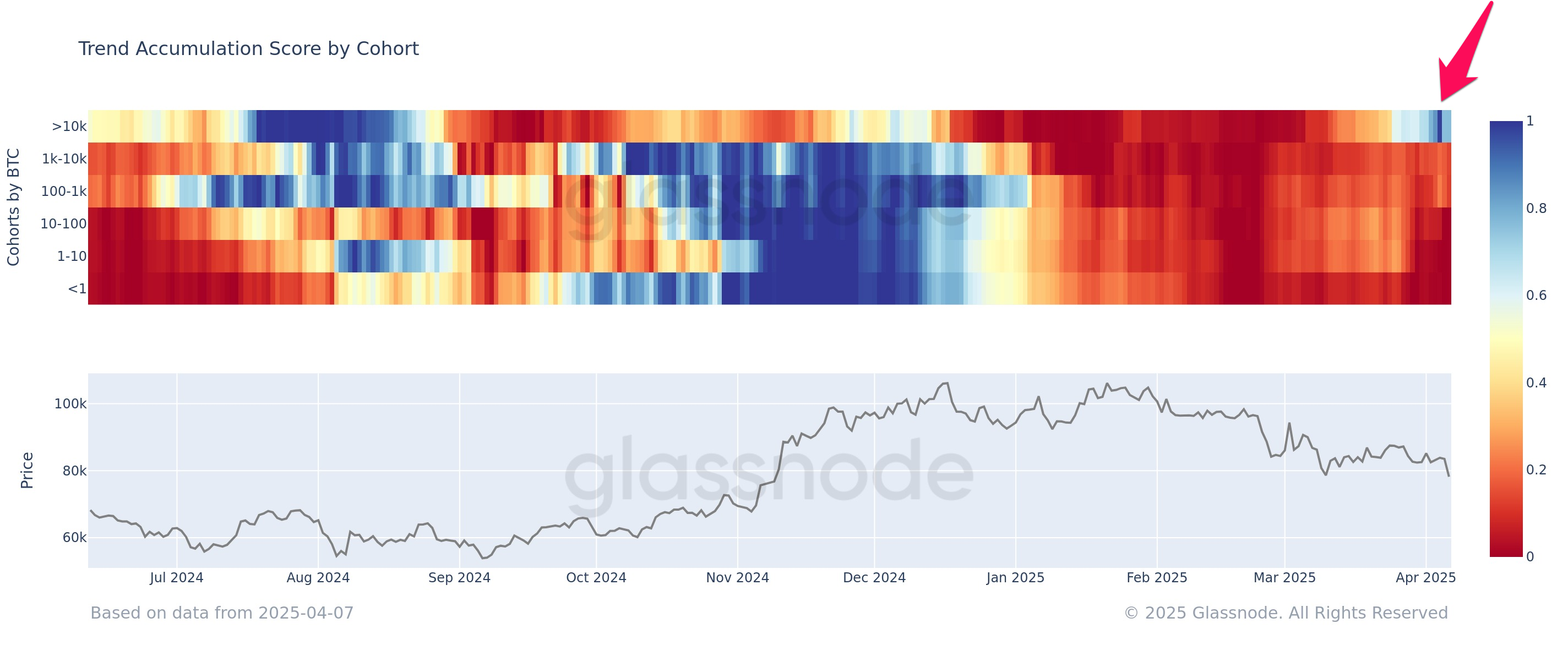

According to the cryptocurrency on-chain data analysis platform Glassnode, Bitcoin whales holding over 10,000 BTC achieved an accumulation score of approximately 1.0 at the beginning of this month, reflecting strong buying activity.

This score significantly differs from the behavior of small-scale holders who prefer distribution.

Bitcoin Whale Purchases…Why Are Small Holders Selling?

Glassnode emphasized this change in a recent X (formerly Twitter) post.

"Whales holding over 10,000 BTC briefly recorded a perfect accumulation score (~1.0) at the beginning of the month." – Glassnode

This score reflects a 15-day period of activity However, after this surge, the score slightly eased to around 0.65, suggesting a more moderate buying but still indicating continued accumulation by large holders.

Meanwhile, small Bitcoin holders with 1 to 100 BTC focused on distribution. On-chain data shows this group significantly increased selling activity, with the accumulation score dropping between 0.1 and 0.2.

"This difference shows that big players are still accumulating while small holders are selling. Market sentiment remains divided." – A user mentioned on X.

The behavioral difference between large between and small holders indicates market sentiment variations. Whales expect long-term Bitcoin growth, while small holders might be more cautious or reactive, liquidating positions in preparation for potential market declines.

These contrasting strategies emerged amid heightened geopolitical tensions and trade war concerns. Some analysts believe Bitcoin will increase its attractiveness as a hedge. Industry expert Will Clemente recently assessed these broader implications.

"From a distance, Bitcoin is planting seeds for global accumulation as a hedge against de-globalization and ge, not just monetary supply. Such allocation won't happen overnight, but this is why Bitcoin was created." – – Clemente mentioned.

Despite long-term optimism, macroeconomic conditions significantly impacted BTC, driving it below $80,000. Nevertheless, according to BeInCrypto data, Bitcoin showed a slight 5.0% increase over the past day, trading at $79,454 454 at at the time of writing.

Notably, the price decline caused substantial unrealized losses for public companies holding Bitcoin. Many companies now have values lower than acquisition costs. In fact,,, has halted Bitcoin purchases facing amid market uncertainty.

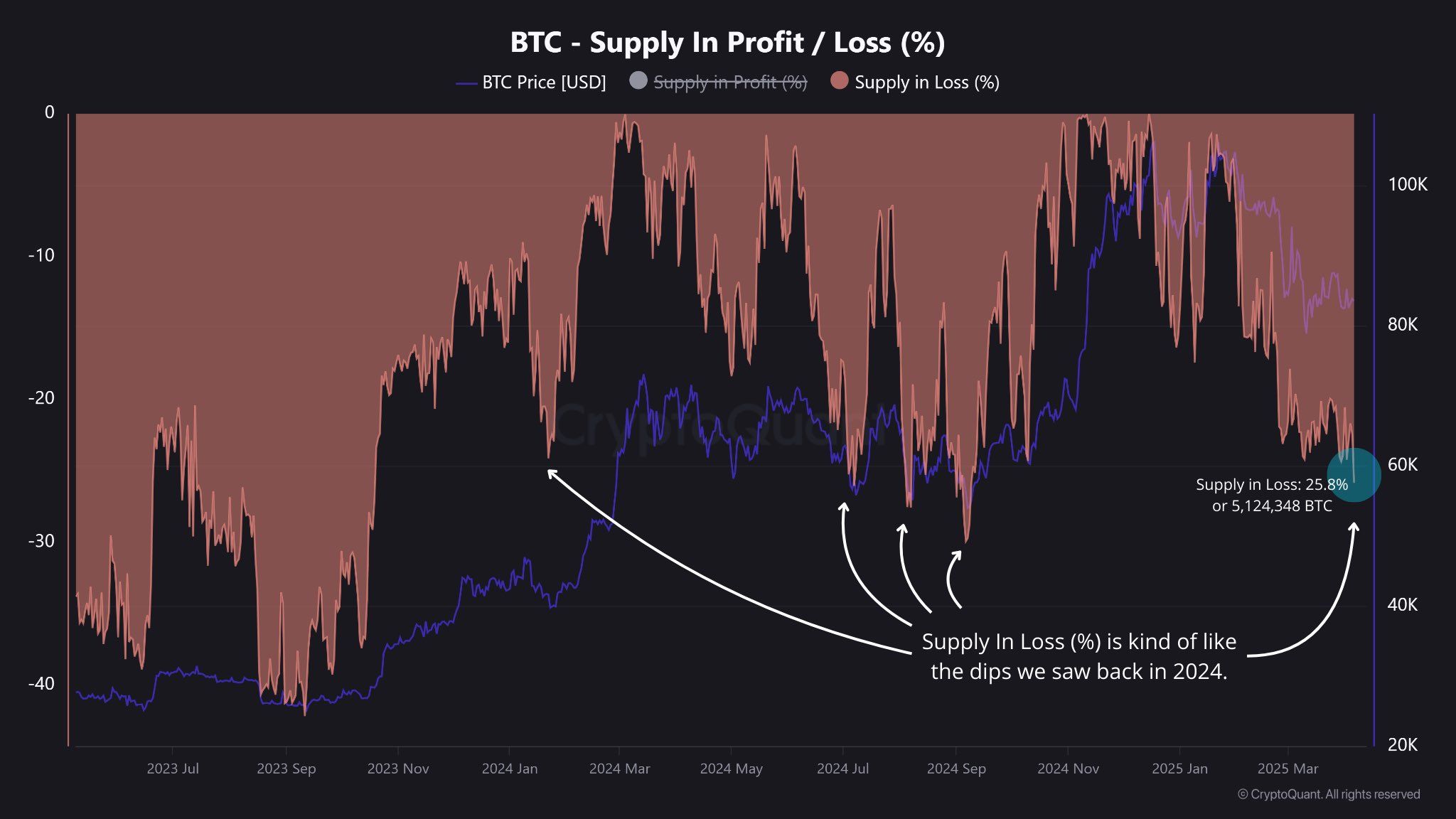

Additionally, according to cryptocurrency on-chain platform CryptoQuant, 25.8% of total Bitcoin supply is in a loss state.

"This might look like a warning, but it's not unprecedented." – Mentioned in the post.

CryptoQuant added that similar situations occurred throughout 2A significant amount of Bitcoin was held in a loss state. For example, in January 2024, 24.1% of circulating Bitcoin was in a loss state. By September,, that figure figure to 29.9%.